As global markets navigate a landscape marked by record highs in U.S. indexes and geopolitical uncertainties, investors are increasingly seeking stable income sources amid fluctuating economic signals. In this context, dividend stocks like Sonae SGPS offer potential appeal by providing regular income streams, which can be particularly attractive during periods of economic volatility and market adjustments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.31% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.40% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.89% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Sonae SGPS (ENXTLS:SON)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Sonae SGPS operates in retail, financial services, technology, shopping centers, and telecommunications sectors with a market cap of €1.81 billion.

Operations: Sonae SGPS generates revenue from its key segments, including Sierra (€140.24 million), Worten (€1.36 billion), and Sonae MC (Including Maxmat and Sonae RP) (€7.19 billion).

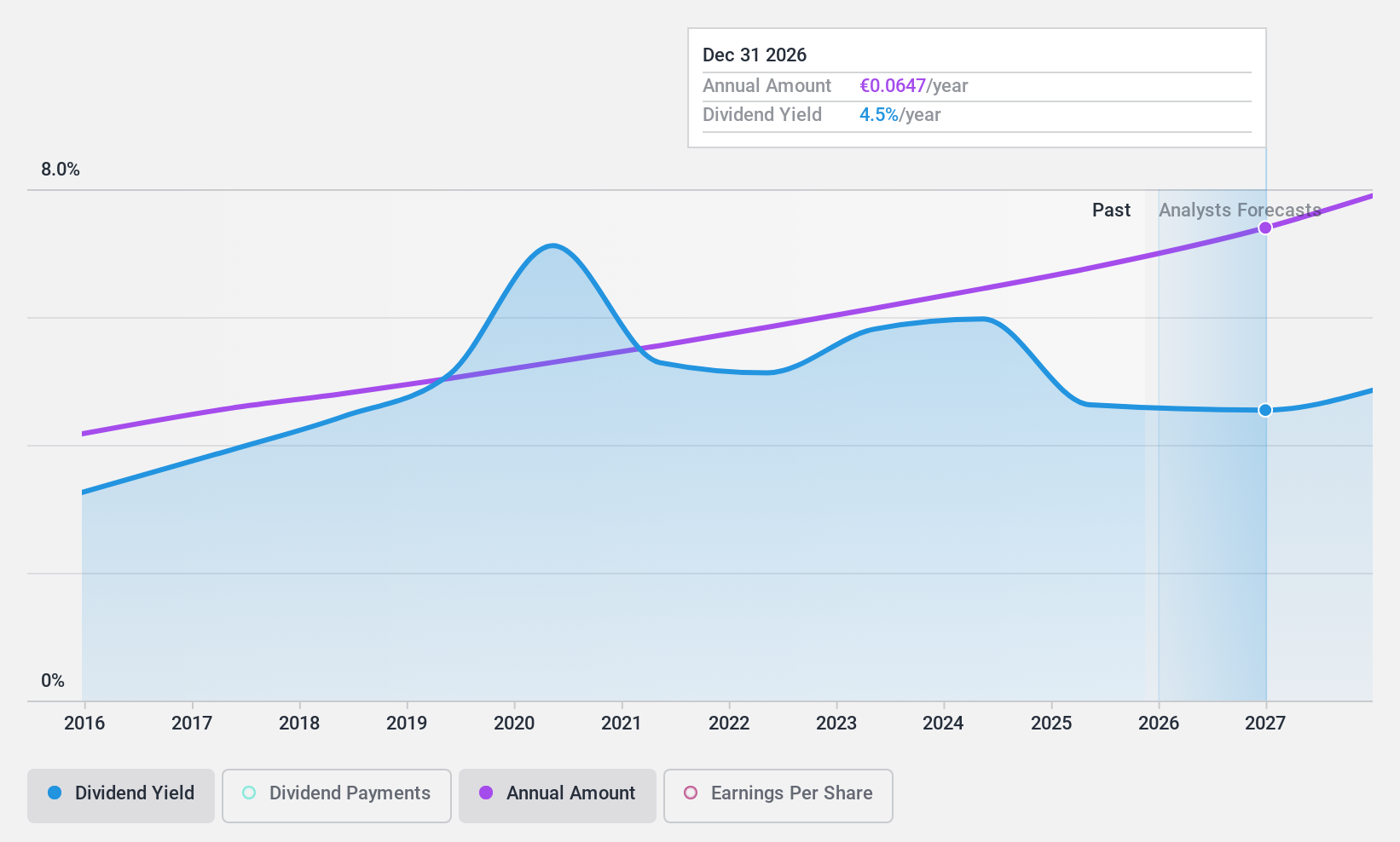

Dividend Yield: 6%

Sonae SGPS offers a reliable dividend yield of 6.01%, supported by a low payout ratio of 29.3% and cash payout ratio of 27.8%, indicating sustainability from both earnings and cash flows. Despite recent earnings growth, future earnings are expected to decline by an average of 8.3% annually over the next three years, though revenue is forecasted to grow at 4.86%. The company trades at a favorable price-to-earnings ratio of 4.7x compared to the Portuguese market's average, enhancing its relative value appeal for dividend investors seeking stability with some growth potential in revenue streams.

- Click to explore a detailed breakdown of our findings in Sonae SGPS' dividend report.

- In light of our recent valuation report, it seems possible that Sonae SGPS is trading behind its estimated value.

Amano (TSE:6436)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amano Corporation operates in the time information, parking, environmental, and cleaning systems sectors both in Japan and internationally, with a market cap of ¥303.48 billion.

Operations: Amano Corporation's revenue is primarily derived from its Time Information System Business, which contributes ¥129.36 billion, and its Environment-Related Systems Business, which adds ¥37.57 billion.

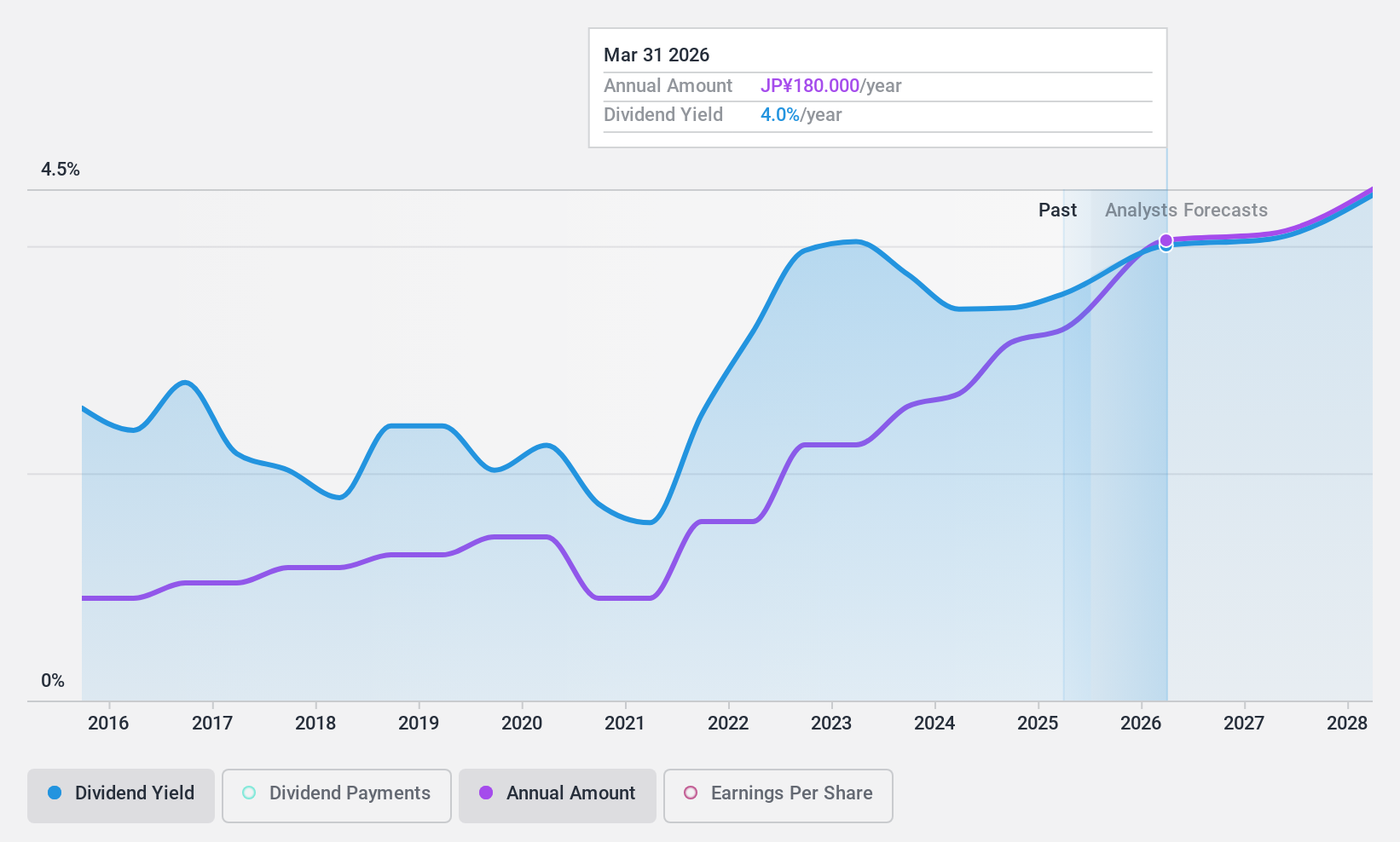

Dividend Yield: 3.4%

Amano's dividend payments have been volatile over the past decade, with annual drops exceeding 20%, yet they have shown growth. The payout ratio of 70.4% and cash payout ratio of 53.3% suggest dividends are covered by earnings and cash flows, though not top-tier in yield at 3.41%. Despite an unstable track record, recent earnings growth of 12.2% may support future dividends if sustained amidst announced upcoming financial disclosures.

- Get an in-depth perspective on Amano's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Amano is priced higher than what may be justified by its financials.

Schloss Wachenheim (XTRA:SWA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG produces and distributes sparkling and semi-sparkling wine products in Europe and internationally, with a market cap of €117.22 million.

Operations: Schloss Wachenheim AG generates revenue of €441.21 million from its Alcoholic Beverages segment.

Dividend Yield: 4.1%

Schloss Wachenheim's dividend payments have grown steadily over the past decade, though a high cash payout ratio of 106.6% indicates they are not well covered by free cash flows. Despite this, dividends remain stable with a reasonable payout ratio of 64.8%, suggesting coverage by earnings. Recent financial results show decreased net income, potentially impacting future payouts. Trading below estimated fair value, its yield of 4.05% is lower than top-tier German market payers at 4.81%.

- Click here and access our complete dividend analysis report to understand the dynamics of Schloss Wachenheim.

- Our expertly prepared valuation report Schloss Wachenheim implies its share price may be lower than expected.

Key Takeaways

- Click through to start exploring the rest of the 1967 Top Dividend Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SWA

Schloss Wachenheim

Produces and distributes sparkling and semi-sparkling wine products in Europe and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives