- Poland

- /

- Renewable Energy

- /

- WSE:FIG

Figene Capital Spólka Akcyjna (WSE:FIG shareholders incur further losses as stock declines 27% this week, taking three-year losses to 74%

As every investor would know, not every swing hits the sweet spot. But you have a problem if you face massive losses more than once in a while. So spare a thought for the long term shareholders of Figene Capital Spólka Akcyjna (WSE:FIG); the share price is down a whopping 74% in the last three years. That would be a disturbing experience. And over the last year the share price fell 71%, so we doubt many shareholders are delighted. The falls have accelerated recently, with the share price down 57% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

After losing 27% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

View our latest analysis for Figene Capital Spólka Akcyjna

Figene Capital Spólka Akcyjna wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last three years, Figene Capital Spólka Akcyjna saw its revenue grow by 92% per year, compound. That is faster than most pre-profit companies. So on the face of it we're really surprised to see the share price down 20% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. Unless the balance sheet is strong, the company might have to raise capital.

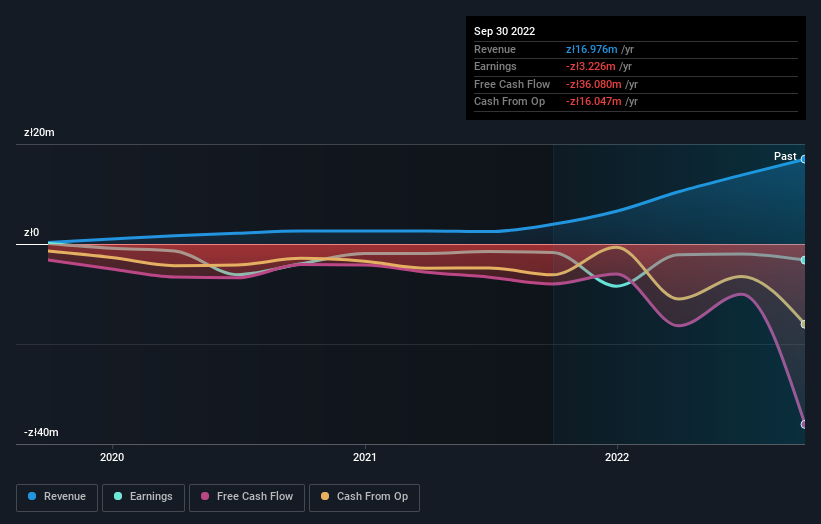

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Figene Capital Spólka Akcyjna's financial health with this free report on its balance sheet.

A Different Perspective

We regret to report that Figene Capital Spólka Akcyjna shareholders are down 71% for the year. Unfortunately, that's worse than the broader market decline of 16%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 6%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Figene Capital Spólka Akcyjna better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Figene Capital Spólka Akcyjna (at least 3 which are concerning) , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:FIG

Slight with worrying balance sheet.

Market Insights

Community Narratives