- Poland

- /

- Telecom Services and Carriers

- /

- WSE:OPL

Orange Polska (WSE:OPL) Ticks All The Boxes When It Comes To Earnings Growth

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Orange Polska (WSE:OPL). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for Orange Polska

Orange Polska's Improving Profits

In the last three years Orange Polska's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. It's good to see that Orange Polska's EPS has grown from zł0.55 to zł0.62 over twelve months. That's a 13% gain; respectable growth in the broader scheme of things.

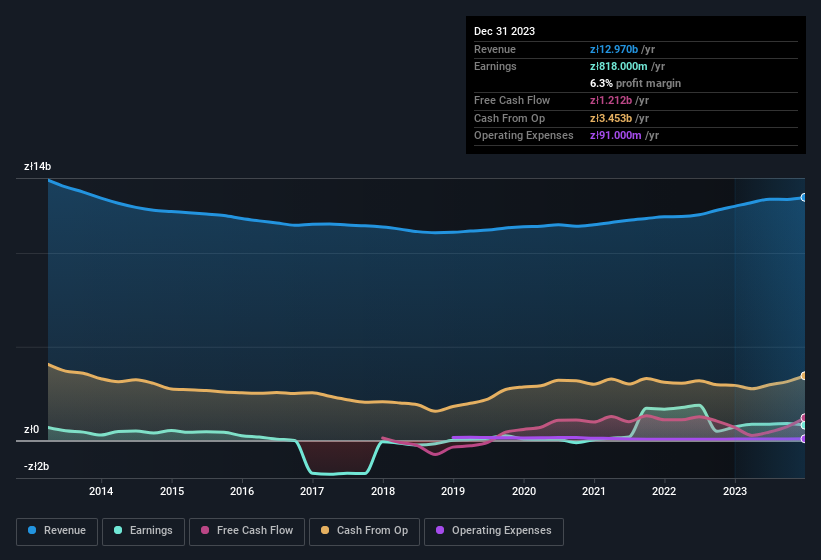

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Orange Polska maintained stable EBIT margins over the last year, all while growing revenue 3.9% to zł13b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Orange Polska's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Orange Polska Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between zł7.9b and zł25b, like Orange Polska, the median CEO pay is around zł3.0m.

Orange Polska offered total compensation worth zł1.6m to its CEO in the year to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is Orange Polska Worth Keeping An Eye On?

One important encouraging feature of Orange Polska is that it is growing profits. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. All things considered, Orange Polska is definitely worth taking a deeper dive into. Even so, be aware that Orange Polska is showing 1 warning sign in our investment analysis , you should know about...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Polish companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:OPL

Orange Polska

Provides telecommunications services for individuals, small and large businesses, and corporations in Poland.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives