- Poland

- /

- Telecom Services and Carriers

- /

- WSE:CPS

Cyfrowy Polsat (WSE:CPS) sheds zł569m, company earnings and investor returns have been trending downwards for past five years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Cyfrowy Polsat S.A. (WSE:CPS) shareholders for doubting their decision to hold, with the stock down 53% over a half decade. Even worse, it's down 14% in about a month, which isn't fun at all.

If the past week is anything to go by, investor sentiment for Cyfrowy Polsat isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

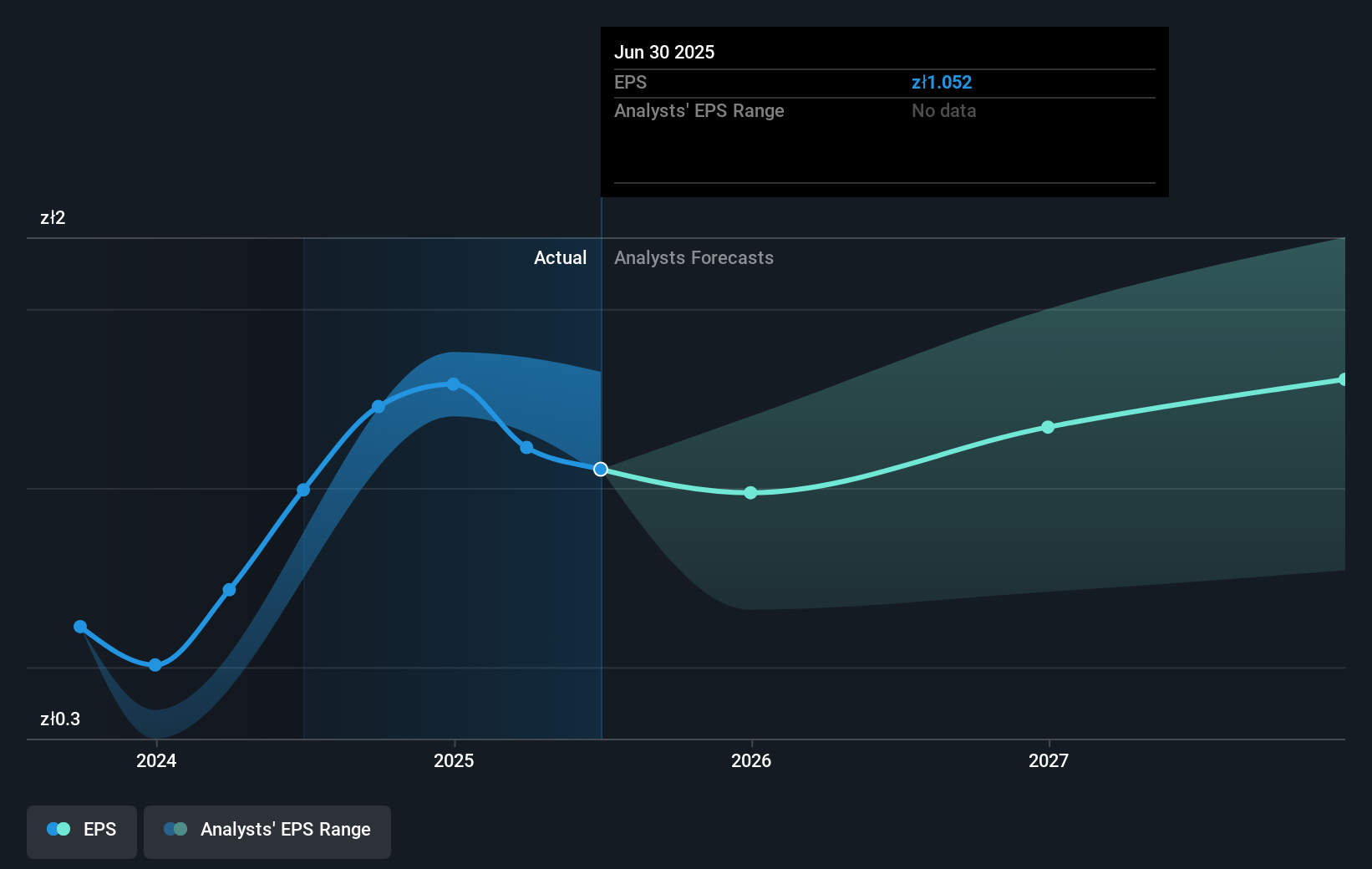

Looking back five years, both Cyfrowy Polsat's share price and EPS declined; the latter at a rate of 11% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 14% per year, over the period. So it seems the market was too confident about the business, in the past.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It might be well worthwhile taking a look at our free report on Cyfrowy Polsat's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Cyfrowy Polsat's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Cyfrowy Polsat shareholders, and that cash payout explains why its total shareholder loss of 49%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Cyfrowy Polsat shareholders are up 1.2% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 8% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 1 warning sign for Cyfrowy Polsat you should be aware of.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CPS

Cyfrowy Polsat

Provides digital satellite platform and terrestrial television (TV), and telecommunication services primarily in Poland.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Community Narratives