Is OPTeam Spólka Akcyjna (WSE:OPM) Using Too Much Debt?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies OPTeam Spólka Akcyjna (WSE:OPM) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for OPTeam Spólka Akcyjna

What Is OPTeam Spólka Akcyjna's Debt?

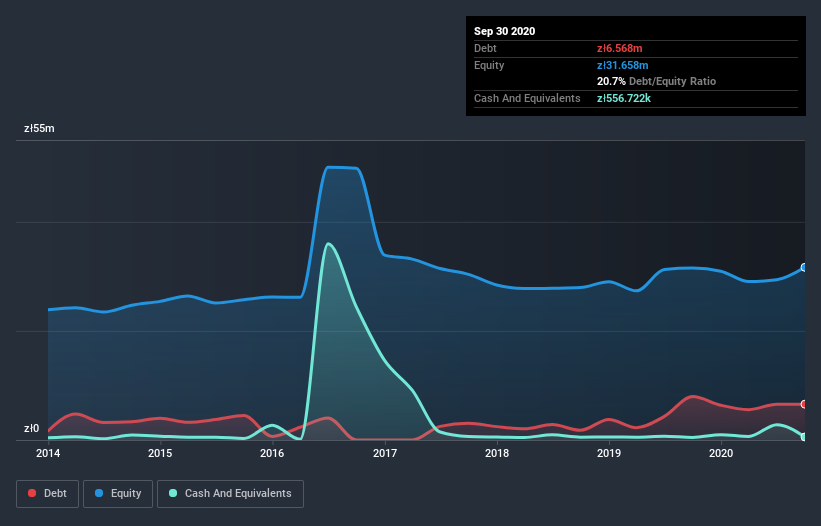

You can click the graphic below for the historical numbers, but it shows that OPTeam Spólka Akcyjna had zł6.57m of debt in September 2020, down from zł7.95m, one year before. On the flip side, it has zł556.7k in cash leading to net debt of about zł6.01m.

How Strong Is OPTeam Spólka Akcyjna's Balance Sheet?

We can see from the most recent balance sheet that OPTeam Spólka Akcyjna had liabilities of zł13.8m falling due within a year, and liabilities of zł9.62m due beyond that. Offsetting these obligations, it had cash of zł556.7k as well as receivables valued at zł13.6m due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł9.22m.

Of course, OPTeam Spólka Akcyjna has a market capitalization of zł251.9m, so these liabilities are probably manageable. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

OPTeam Spólka Akcyjna's net debt to EBITDA ratio of about 1.9 suggests only moderate use of debt. And its commanding EBIT of 11.8 times its interest expense, implies the debt load is as light as a peacock feather. Notably, OPTeam Spólka Akcyjna made a loss at the EBIT level, last year, but improved that to positive EBIT of zł2.9m in the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But it is OPTeam Spólka Akcyjna's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, OPTeam Spólka Akcyjna actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

OPTeam Spólka Akcyjna's conversion of EBIT to free cash flow suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And the good news does not stop there, as its interest cover also supports that impression! Zooming out, OPTeam Spólka Akcyjna seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that OPTeam Spólka Akcyjna is showing 5 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading OPTeam Spólka Akcyjna or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About WSE:OPM

OPTeam Spólka Akcyjna

Provides IT solutions for enterprises, universities, and public administration units in Poland.

Flawless balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026