- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6874

Top Dividend Stocks For January 2025

Reviewed by Simply Wall St

As global markets experience a boost from easing U.S. inflation and strong bank earnings, major indices like the S&P 500 and Dow Jones have seen significant gains, reflecting investor optimism. Amidst this backdrop of economic recovery and fluctuating sector performances, dividend stocks continue to attract attention for their potential to provide steady income streams in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

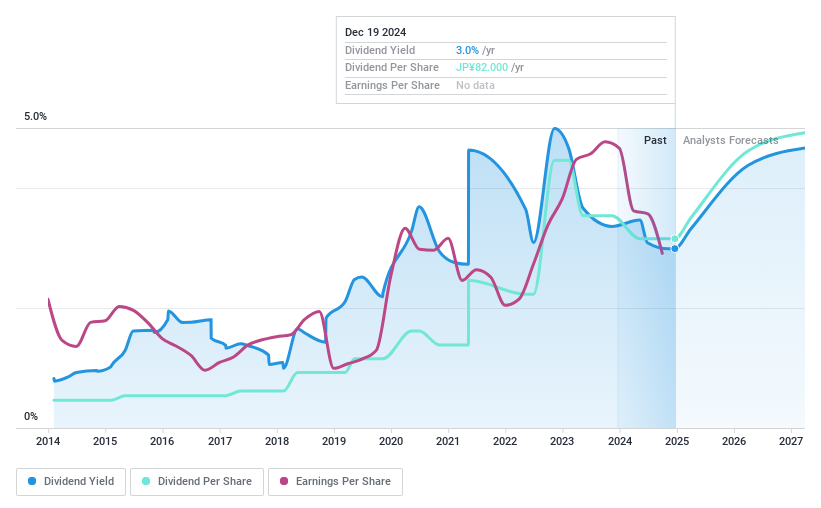

Teikoku Electric Mfg.Co.Ltd (TSE:6333)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teikoku Electric Mfg.Co., Ltd. manufactures and sells electrical equipment and general machinery, with a market cap of ¥47.95 billion.

Operations: Teikoku Electric Mfg. Co., Ltd.'s revenue primarily comes from its Pump Business, which generates ¥27.49 billion, and its Electronic Components Business, contributing ¥1.55 billion.

Dividend Yield: 3%

Teikoku Electric Mfg. Co., Ltd.'s recent share buyback program, completed in December 2024, aimed at enhancing shareholder returns and capital efficiency by repurchasing 5.68% of its shares for ¥2.48 billion. While the dividend yield is below Japan's top payers at 3.01%, dividends are covered by earnings and cash flows with payout ratios of 62.3% and 59.2%, respectively, despite a history of volatility over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of Teikoku Electric Mfg.Co.Ltd.

- Our valuation report here indicates Teikoku Electric Mfg.Co.Ltd may be overvalued.

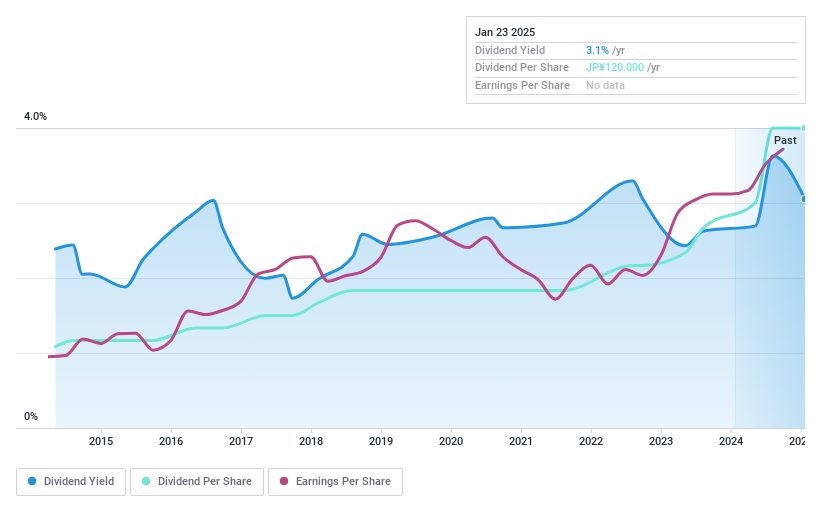

Kyoritsu Electric (TSE:6874)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kyoritsu Electric Corporation specializes in providing systems and testing and measuring instruments, with a market cap of ¥15.81 billion.

Operations: Kyoritsu Electric Corporation's revenue is primarily derived from its Intelligent FA System Business, contributing ¥14.10 billion, and the IT Control/Scientific Measurement Business, which accounts for ¥21.63 billion.

Dividend Yield: 3.1%

Kyoritsu Electric's dividend payments are well-supported, with a payout ratio of 19.4% and a cash payout ratio of 23.2%, indicating strong coverage by both earnings and cash flows. Over the past decade, dividends have been stable and consistently growing, although the yield at 3.05% is below Japan's top quartile payers. The stock trades significantly below its estimated fair value, suggesting potential for capital appreciation alongside its reliable dividend history.

- Take a closer look at Kyoritsu Electric's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Kyoritsu Electric shares in the market.

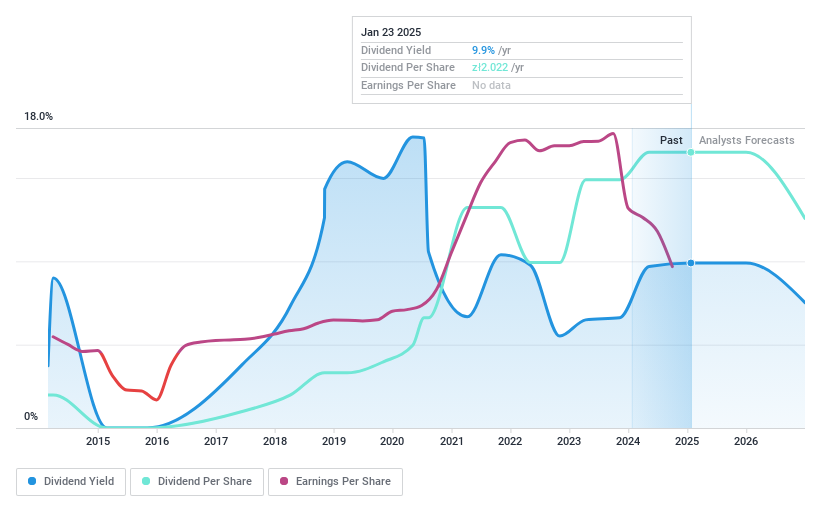

ASBISc Enterprises (WSE:ASB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ASBISc Enterprises Plc, along with its subsidiaries, distributes information and communications technology and Internet-of-Things products, solutions, and services across Europe, the Middle East and Africa, as well as internationally; it has a market cap of PLN1.13 billion.

Operations: ASBISc Enterprises Plc's revenue primarily comes from its role as a distributor of IT products, generating $2.97 billion.

Dividend Yield: 9.9%

ASBISc Enterprises offers a high dividend yield of 9.9%, placing it in the top 25% of Polish market payers, though its dividend history is volatile. The payout ratios—52.7% from earnings and 50.6% from cash flows—indicate dividends are currently sustainable despite recent declines in net income and profit margins, which fell to 1.1%. Trading at a discount to fair value, ASBISc's financial position is weakened by high debt levels.

- Get an in-depth perspective on ASBISc Enterprises' performance by reading our dividend report here.

- Upon reviewing our latest valuation report, ASBISc Enterprises' share price might be too pessimistic.

Next Steps

- Click this link to deep-dive into the 1983 companies within our Top Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kyoritsu Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6874

Kyoritsu Electric

Provides various systems, testing and measuring instruments, etc.

Flawless balance sheet with solid track record and pays a dividend.