Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Xplus S.A. (WSE:XPL) is about to go ex-dividend in just four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Meaning, you will need to purchase Xplus' shares before the 7th of July to receive the dividend, which will be paid on the 19th of July.

The upcoming dividend for Xplus will put a total of zł0.10 per share in shareholders' pockets. If you buy this business for its dividend, you should have an idea of whether Xplus's dividend is reliable and sustainable. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

View our latest analysis for Xplus

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Its dividend payout ratio is 78% of profit, which means the company is paying out a majority of its earnings. The relatively limited profit reinvestment could slow the rate of future earnings growth. It could become a concern if earnings started to decline. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. It paid out more than half (64%) of its free cash flow in the past year, which is within an average range for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see how much of its profit Xplus paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

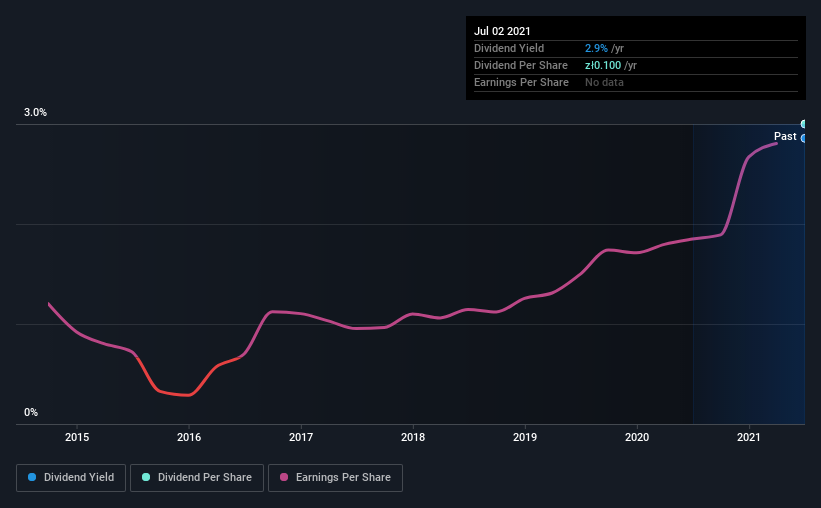

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Xplus's earnings have been skyrocketing, up 45% per annum for the past five years. Earnings per share are growing at a rapid rate, yet the company is paying out more than three-quarters of its earnings.

This is Xplus's first year of paying a dividend, so it doesn't have much of a history yet to compare to.

To Sum It Up

Has Xplus got what it takes to maintain its dividend payments? Higher earnings per share generally lead to higher dividends from dividend-paying stocks over the long run. However, we'd also note that Xplus is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. Overall, it's not a bad combination, but we feel that there are likely more attractive dividend prospects out there.

While it's tempting to invest in Xplus for the dividends alone, you should always be mindful of the risks involved. Every company has risks, and we've spotted 4 warning signs for Xplus (of which 1 is concerning!) you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Xplus, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:XPL

Flawless balance sheet with solid track record.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success