As global markets navigate mixed performances and subdued inflation data, the technology-heavy Nasdaq Composite has faced notable challenges, particularly impacted by declines in major tech stocks. Amid this backdrop, investors are keenly observing high-growth tech stocks that demonstrate resilience and potential for significant returns. In such a dynamic market environment, identifying promising tech stocks involves looking for companies with strong fundamentals, innovative product pipelines, and robust financial health.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 22.41% | 27.42% | ★★★★★★ |

| Sarepta Therapeutics | 24.22% | 44.94% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 41.84% | 75.34% | ★★★★★★ |

| G1 Therapeutics | 27.57% | 57.75% | ★★★★★★ |

| KebNi | 34.75% | 86.11% | ★★★★★★ |

| Ascendis Pharma | 39.71% | 68.43% | ★★★★★★ |

| Adocia | 59.08% | 63.00% | ★★★★★★ |

Click here to see the full list of 1287 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

VGI (SET:VGI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: VGI Public Company Limited, along with its subsidiaries, provides advertising services in Thailand and has a market cap of approximately THB30.23 billion.

Operations: VGI generates revenue primarily from three segments: Transit (THB2.41 billion), Distribution (THB1.18 billion), and Digital Services (THB1.80 billion). The company focuses on advertising services within Thailand, leveraging its extensive network in these areas to drive income.

VGI reported a significant turnaround with Q1 2024 net income of THB 62.76 million, compared to a net loss of THB 366.45 million the previous year. Revenue increased by 9.6% to THB 1,274.52 million, reflecting strong operational performance despite market volatility. The company is expected to grow its earnings by an impressive 127.05% annually over the next three years and has been actively investing in R&D, with expenses rising to support innovative projects and future growth initiatives.

- Unlock comprehensive insights into our analysis of VGI stock in this health report.

Examine VGI's past performance report to understand how it has performed in the past.

Insyde Software (TPEX:6231)

Simply Wall St Growth Rating: ★★★★★★

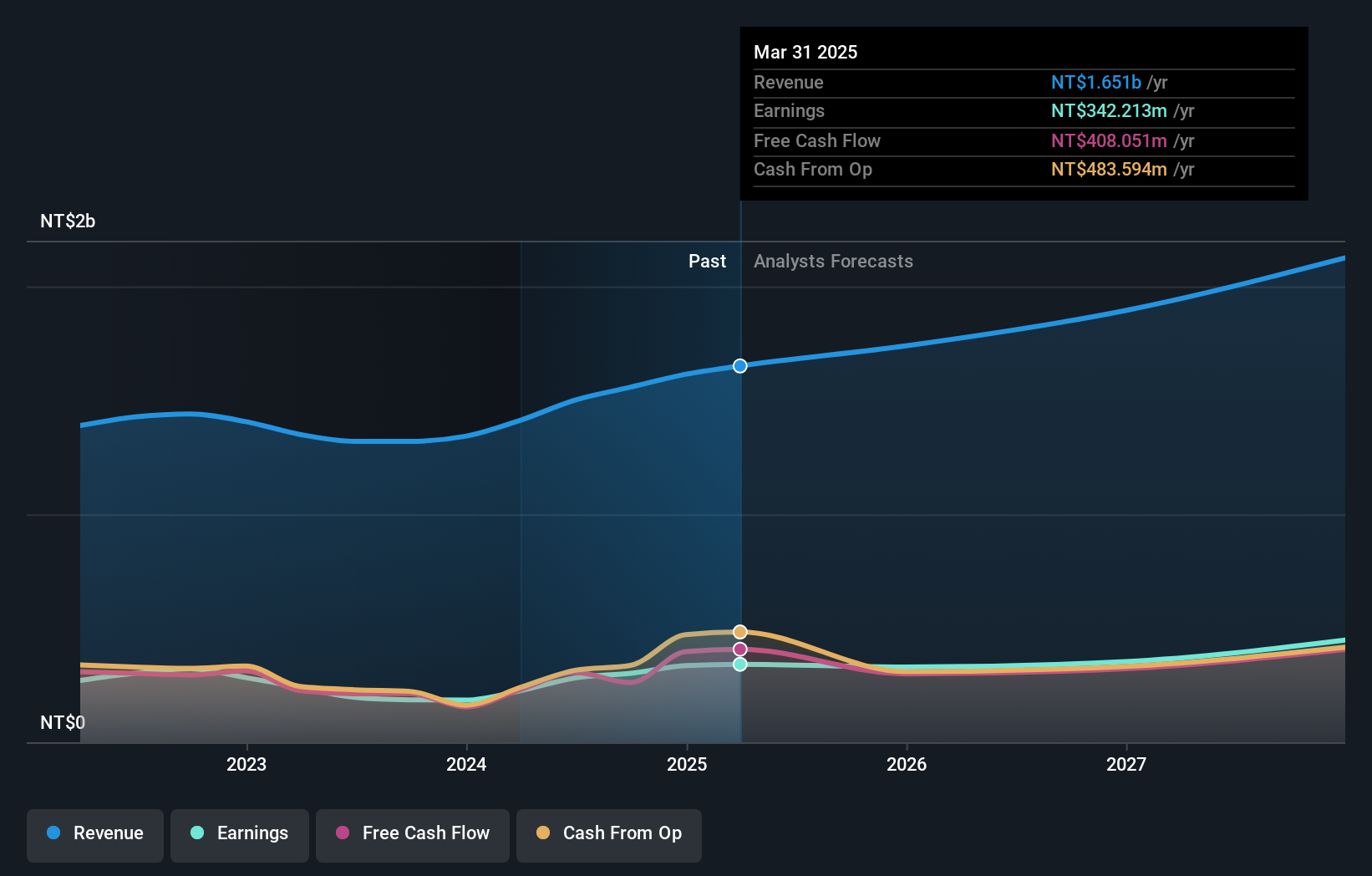

Overview: Insyde Software Corp. provides system firmware and software engineering services for companies in the mobile, desktop, server, and embedded systems industries worldwide, with a market cap of NT$23.24 billion.

Operations: Insyde Software Corp. generates revenue primarily from software and programming services, amounting to NT$1.50 billion. The company operates in the mobile, desktop, server, and embedded systems sectors globally.

Insyde Software has demonstrated robust growth, with revenue increasing by 28.23% to TWD 402.75 million in Q2 2024 compared to the previous year. Net income surged by nearly threefold, reaching TWD 84.19 million from TWD 28.09 million a year ago, reflecting strong operational performance and effective cost management. The company's R&D expenditure underscores its commitment to innovation, supporting future growth initiatives and maintaining competitive advantages in the tech sector.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.69 billion.

Operations: Vercom S.A. specializes in developing cloud communications platforms. The company generates revenue primarily through its communication services, with a notable focus on scalability and technological innovation.

Vercom's revenue growth of 13.3% annually outpaces the Polish market's 4.4%, reflecting its strong market position and innovative capabilities. The company's earnings surged by 65.6% over the past year, significantly outperforming the software industry's -3.9%. With PLN 220.47 million in sales for H1 2024 and a net income increase to PLN 34.74 million, Vercom demonstrates robust financial health and potential for continued growth driven by strategic investments in R&D and expanding client base.

- Delve into the full analysis health report here for a deeper understanding of Vercom.

Understand Vercom's track record by examining our Past report.

Seize The Opportunity

- Dive into all 1287 of the High Growth Tech and AI Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:VRC

Outstanding track record with high growth potential.