- China

- /

- Electronic Equipment and Components

- /

- SHSE:688600

High Growth Tech Stocks To Watch In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results and the Federal Reserve's rate cut, optimism has driven major indices like the Russell 2000 and S&P 500 to impressive gains, though small-cap stocks still lag behind their record highs. In this environment of potential regulatory changes and economic shifts, identifying high-growth tech stocks involves looking for companies with robust innovation capabilities and adaptability to evolving market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.61% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Anhui Wanyi Science and TechnologyLtd (SHSE:688600)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Anhui Wanyi Science and Technology Co., Ltd. (ticker: SHSE:688600) is engaged in the development and production of advanced technology solutions, with a market capitalization of CN¥2.06 billion.

Operations: Anhui Wanyi focuses on creating advanced technology solutions, contributing to its market presence. The company's revenue model and cost structure details are not specified in the available data, limiting further insights into specific financial trends or segment contributions.

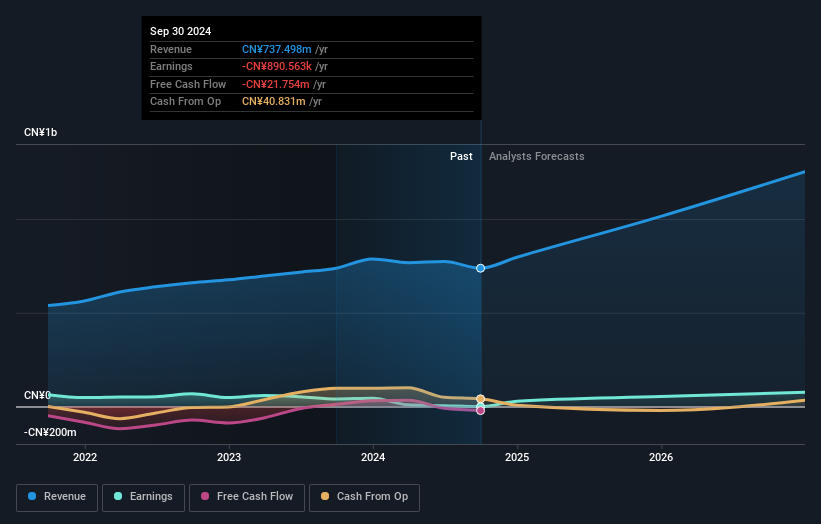

Anhui Wanyi Science and Technology Co., Ltd. faces challenges with a recent net loss of CNY 26.68 million, contrasting sharply with the previous year's net income of CNY 18.02 million. Despite these setbacks, the company's projected revenue growth at 23.9% annually outpaces the Chinese market forecast of 13.9%. This suggests potential for recovery and scaling, especially as they aim to transition into profitability within three years, expecting earnings to surge by approximately 78.2% per year. Furthermore, their commitment to innovation is underscored by substantial R&D investments which are crucial for maintaining competitiveness in the fast-evolving tech landscape.

- Unlock comprehensive insights into our analysis of Anhui Wanyi Science and TechnologyLtd stock in this health report.

Learn about Anhui Wanyi Science and TechnologyLtd's historical performance.

Nan Ya Printed Circuit Board (TWSE:8046)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nan Ya Printed Circuit Board Corporation manufactures and sells printed circuit boards (PCBs) in Taiwan, the United States, Mainland China, Korea, and internationally, with a market cap of NT$83.68 billion.

Operations: Nan Ya PCB focuses on producing and distributing printed circuit boards across several major markets, including Taiwan, the United States, Mainland China, and Korea. The company operates with a market capitalization of NT$83.68 billion.

Nan Ya Printed Circuit Board has faced significant challenges recently, as evidenced by a sharp decline in net income to TWD 58.89 million from TWD 1,075.64 million year-over-year for the third quarter of 2024. Despite these setbacks, the company's future looks promising with an expected earnings growth of 97.5% per annum. This robust projection is notably higher than Taiwan's market average of 20.1%, highlighting its potential resilience and adaptability in the tech sector. Moreover, their commitment to R&D is evident from their strategic focus on innovation to stay competitive amidst evolving industry demands.

Vercom (WSE:VRC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.59 billion.

Operations: The company generates revenue primarily through its CPaaS segment, which reported PLN401.89 million. Focused on cloud communications platforms, it leverages technology to facilitate communication services for businesses.

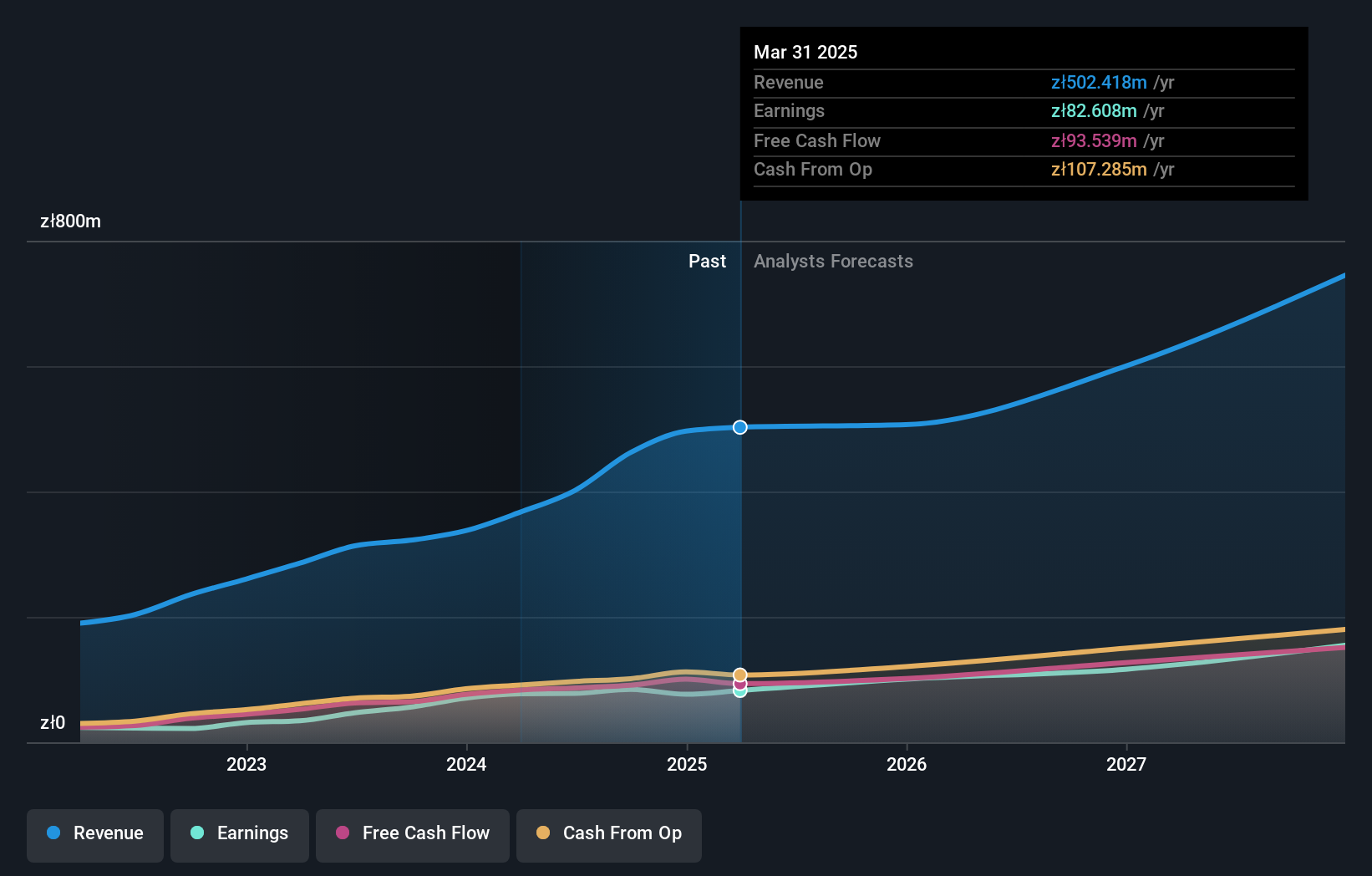

Vercom S.A. has demonstrated robust growth, with earnings surging by 65.6% over the past year, significantly outpacing the software industry's average of 0.8%. This performance is underpinned by a strategic emphasis on R&D, which is evident from its allocation of resources—ensuring Vercom stays ahead in innovation within a competitive market landscape. Looking ahead, the company's revenue is projected to grow at an annual rate of 13.5%, faster than Poland's market average of 4.2%, while earnings are expected to increase by 17.3% annually, also surpassing local market expectations (14.6%). These figures reflect not only Vercom’s current financial health but also its potential to sustain growth through continuous technological advancements and effective market positioning.

- Take a closer look at Vercom's potential here in our health report.

Examine Vercom's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Access the full spectrum of 1281 High Growth Tech and AI Stocks by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688600

Anhui Wanyi Science and TechnologyLtd

AnHui Wanyi Science and Technology Co.,Ltd.

High growth potential with excellent balance sheet.