- Norway

- /

- Energy Services

- /

- OB:BWO

Exploring Undiscovered Gems With Potential In December 2024

Reviewed by Simply Wall St

As we approach December 2024, the global market landscape is marked by cautious sentiment following the Federal Reserve's recent rate cuts and a backdrop of political uncertainty with looming government shutdown fears in the U.S. The S&P 600 for small-cap stocks has been particularly affected, experiencing broad-based losses amid these developments. In such an environment, identifying undiscovered gems requires a focus on companies that demonstrate resilience and adaptability to navigate economic shifts while maintaining strong fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ABG Sundal Collier Holding | 18.07% | 0.55% | -4.76% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Aktieselskabet Schouw (CPSE:SCHO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Aktieselskabet Schouw & Co. is an industrial conglomerate based in Denmark, with operations spanning various sectors globally, and has a market capitalization of approximately DKK 12.32 billion.

Operations: Schouw & Co. generates revenue primarily from its diversified segments, with BioMar contributing the largest share at DKK 16.57 billion, followed by GPV at DKK 9.35 billion. The company also sees significant contributions from HydraSpecma and Fibertex Nonwovens, with revenues of DKK 2.97 billion and DKK 2.25 billion respectively.

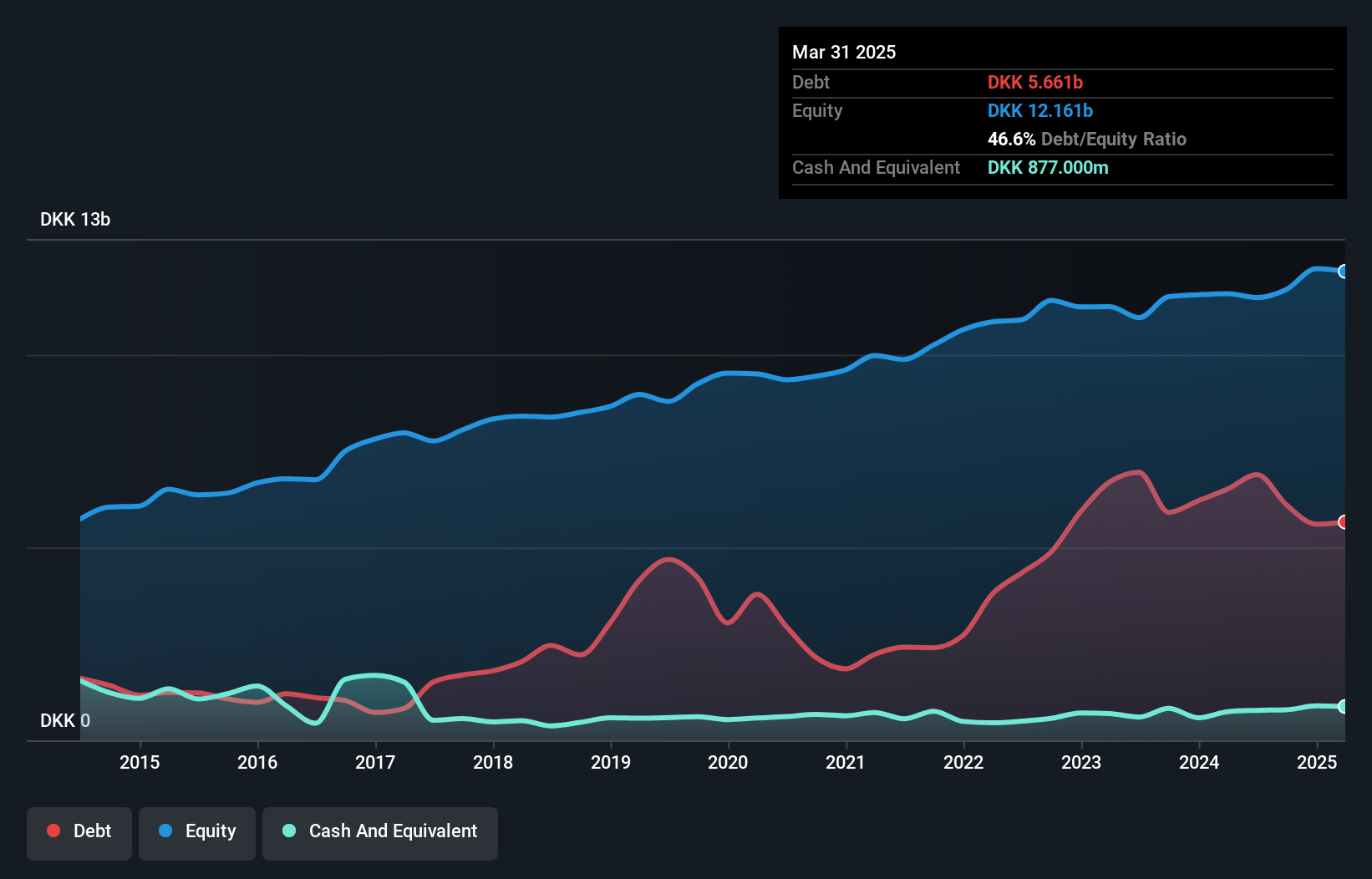

Aktieselskabet Schouw, a notable player in its industry, has shown mixed performance recently. Over the past five years, earnings grew by 0.6% annually, with the debt to equity ratio rising from 45.5% to 52.2%, indicating increased leverage. Despite trading at 27.8% below estimated fair value and having high-quality earnings, its net debt to equity ratio of 45.4% is high by industry standards. Recent results reveal a dip in Q3 sales to DKK 9,543 million from DKK 10,515 million last year and net income of DKK 340 million compared to DKK 400 million previously; however, nine-month figures show an increase in net income from DKK 716 million to DKK 730 million.

- Navigate through the intricacies of Aktieselskabet Schouw with our comprehensive health report here.

Understand Aktieselskabet Schouw's track record by examining our Past report.

BW Offshore (OB:BWO)

Simply Wall St Value Rating: ★★★★★☆

Overview: BW Offshore Limited specializes in engineering offshore production solutions across various regions, including the Americas, Europe, Africa, Asia, and the Pacific, with a market capitalization of NOK5.10 billion.

Operations: BW Offshore generates revenue primarily through the engineering of offshore production solutions. The company's net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

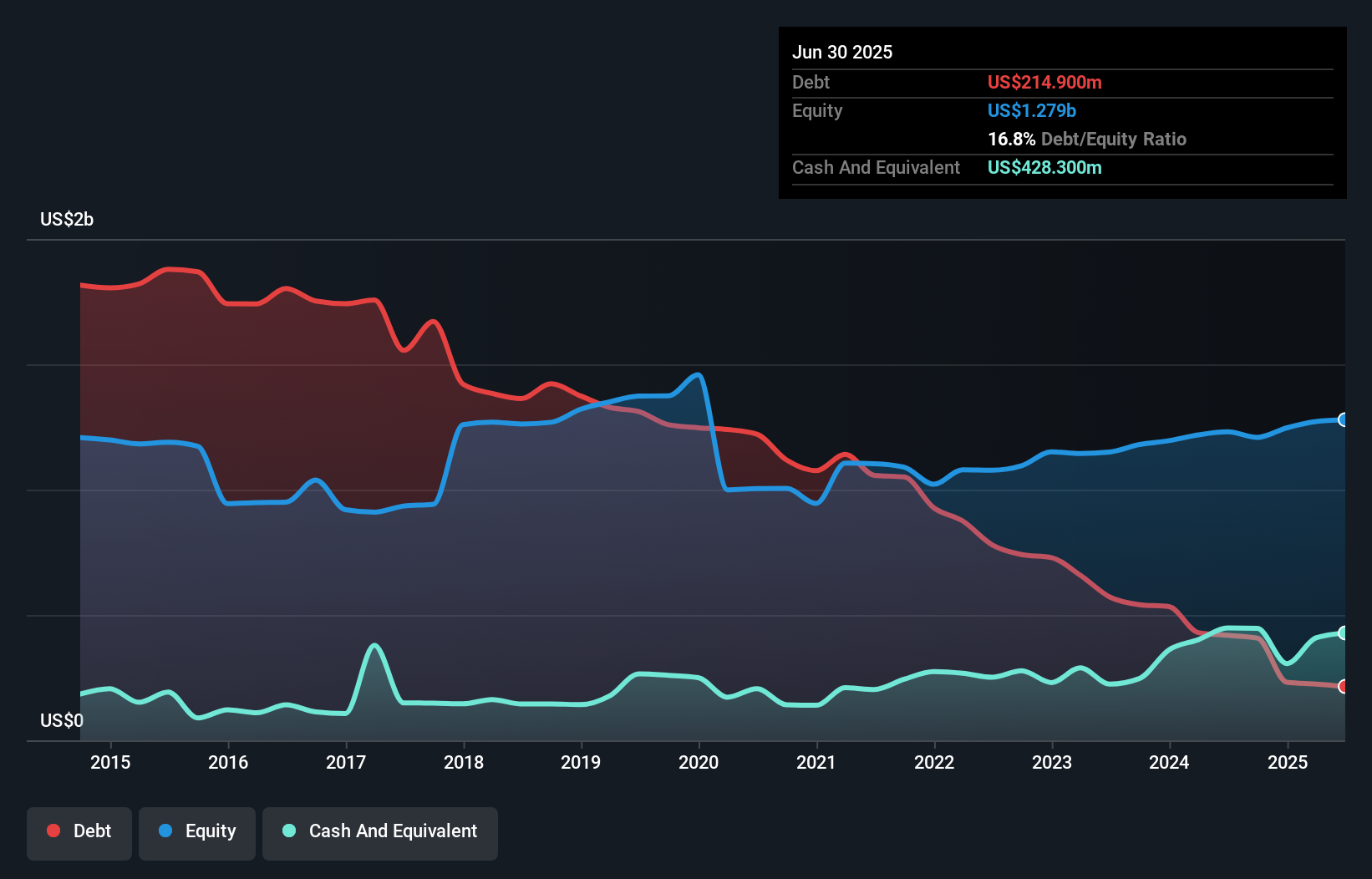

BW Offshore, a nimble player in the energy sector, has shown resilience with earnings growth of 19% last year, outpacing the industry average. The company appears to be trading at an attractive value, estimated at 91.5% below its fair value. Over five years, it has significantly improved its financial health by reducing its debt-to-equity ratio from 91.6% to 33.7%. Despite recent quarterly sales dipping to US$150.9 million and net income dropping to US$13.7 million compared to a year ago, BW Offshore maintains strong interest coverage with EBIT covering interest payments 5.6 times over and continues rewarding shareholders with dividends of US$0.0625 per share.

- Take a closer look at BW Offshore's potential here in our health report.

Review our historical performance report to gain insights into BW Offshore's's past performance.

Vercom (WSE:VRC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Vercom S.A. develops cloud communications platforms and has a market cap of PLN2.77 billion.

Operations: Vercom generates revenue primarily from its CPaaS segment, which contributed PLN462.07 million.

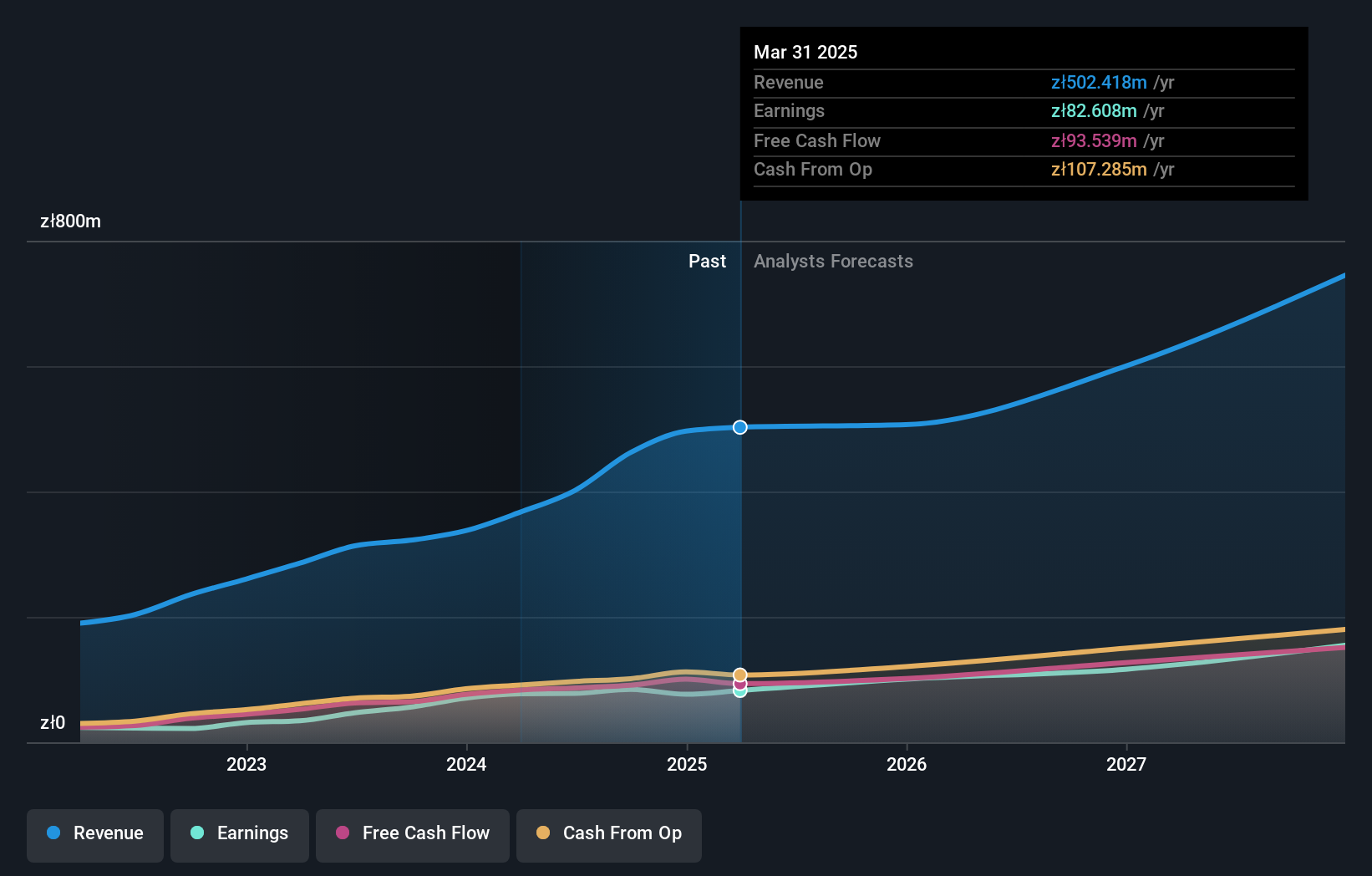

Vercom, a promising player in the software industry, has demonstrated impressive earnings growth of 50.3% over the past year, outpacing the industry's 15.2%. Its net debt to equity ratio stands at a satisfactory 5%, and interest payments are well covered by EBIT at 12 times. Vercom's recent earnings report shows robust performance with third-quarter sales reaching PLN 145 million from PLN 85 million last year, while net income climbed to PLN 19.4 million from PLN 13.05 million. With high-quality earnings and trading slightly below fair value, Vercom presents intriguing prospects for future growth in its sector.

- Click here and access our complete health analysis report to understand the dynamics of Vercom.

Assess Vercom's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 4618 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BW Offshore might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:BWO

BW Offshore

Engages in the engineering of offshore production solutions in the Americas, Europe, Africa, Asia, and the Pacific.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives