A Piece Of The Puzzle Missing From Text S.A.'s (WSE:TXT) Share Price

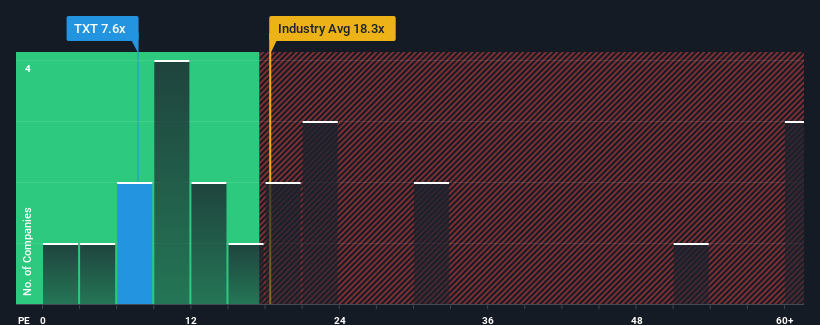

With a price-to-earnings (or "P/E") ratio of 7.6x Text S.A. (WSE:TXT) may be sending bullish signals at the moment, given that almost half of all companies in Poland have P/E ratios greater than 13x and even P/E's higher than 28x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Text hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for Text

Is There Any Growth For Text?

In order to justify its P/E ratio, Text would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 4.6% decrease to the company's bottom line. Even so, admirably EPS has lifted 43% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 5.3% per year during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to expand by 4.7% each year, which is not materially different.

In light of this, it's peculiar that Text's P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Text currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Having said that, be aware Text is showing 2 warning signs in our investment analysis, and 1 of those can't be ignored.

If these risks are making you reconsider your opinion on Text, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Text might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:TXT

Text

Develops and distributes online text communication software for businesses worldwide.

Very undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026