EDITEL Polska S.A. (WSE:EDL) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

EDITEL Polska S.A. (WSE:EDL) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 16% share price drop.

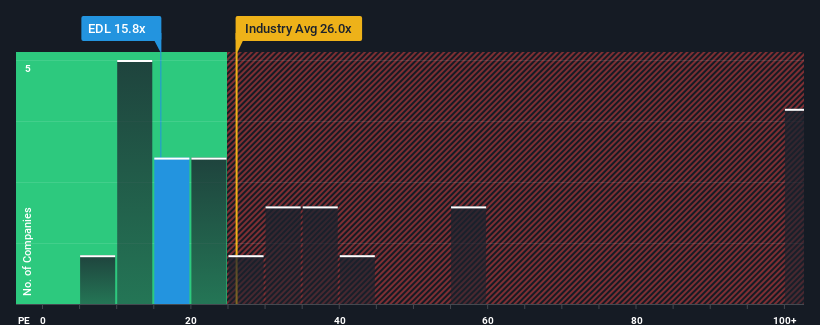

Even after such a large drop in price, EDITEL Polska's price-to-earnings (or "P/E") ratio of 15.8x might still make it look like a sell right now compared to the market in Poland, where around half of the companies have P/E ratios below 12x and even P/E's below 6x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For instance, EDITEL Polska's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for EDITEL Polska

What Are Growth Metrics Telling Us About The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as EDITEL Polska's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 13% in total. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 10% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that EDITEL Polska is trading at a P/E higher than the market. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On EDITEL Polska's P/E

There's still some solid strength behind EDITEL Polska's P/E, if not its share price lately. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that EDITEL Polska currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 4 warning signs for EDITEL Polska (of which 3 can't be ignored!) you should know about.

If you're unsure about the strength of EDITEL Polska's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if EDITEL Polska might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:EDL

EDITEL Polska

Provides electronic data interchange (EDI) solutions worldwide.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives