Malteries Franco-Belges Société Anonyme And 2 Other Undiscovered Gems In Europe

Reviewed by Simply Wall St

As European markets navigate a landscape of mixed economic signals, with the pan-European STOXX Europe 600 Index ending roughly flat and notable variances in major stock indexes, investors are increasingly on the lookout for unique opportunities amidst these fluctuations. In this context, identifying stocks that demonstrate resilience and potential growth becomes crucial, particularly those that can capitalize on regional economic trends or have strong fundamentals despite broader market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Malteries Franco-Belges Société Anonyme (ENXTPA:MALT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Malteries Franco-Belges Société Anonyme is involved in the production and sale of malt mainly for brewers both in France and internationally, with a market capitalization of €431.51 million.

Operations: Malteries Franco-Belges generates revenue from its malt factory, amounting to €140.20 million.

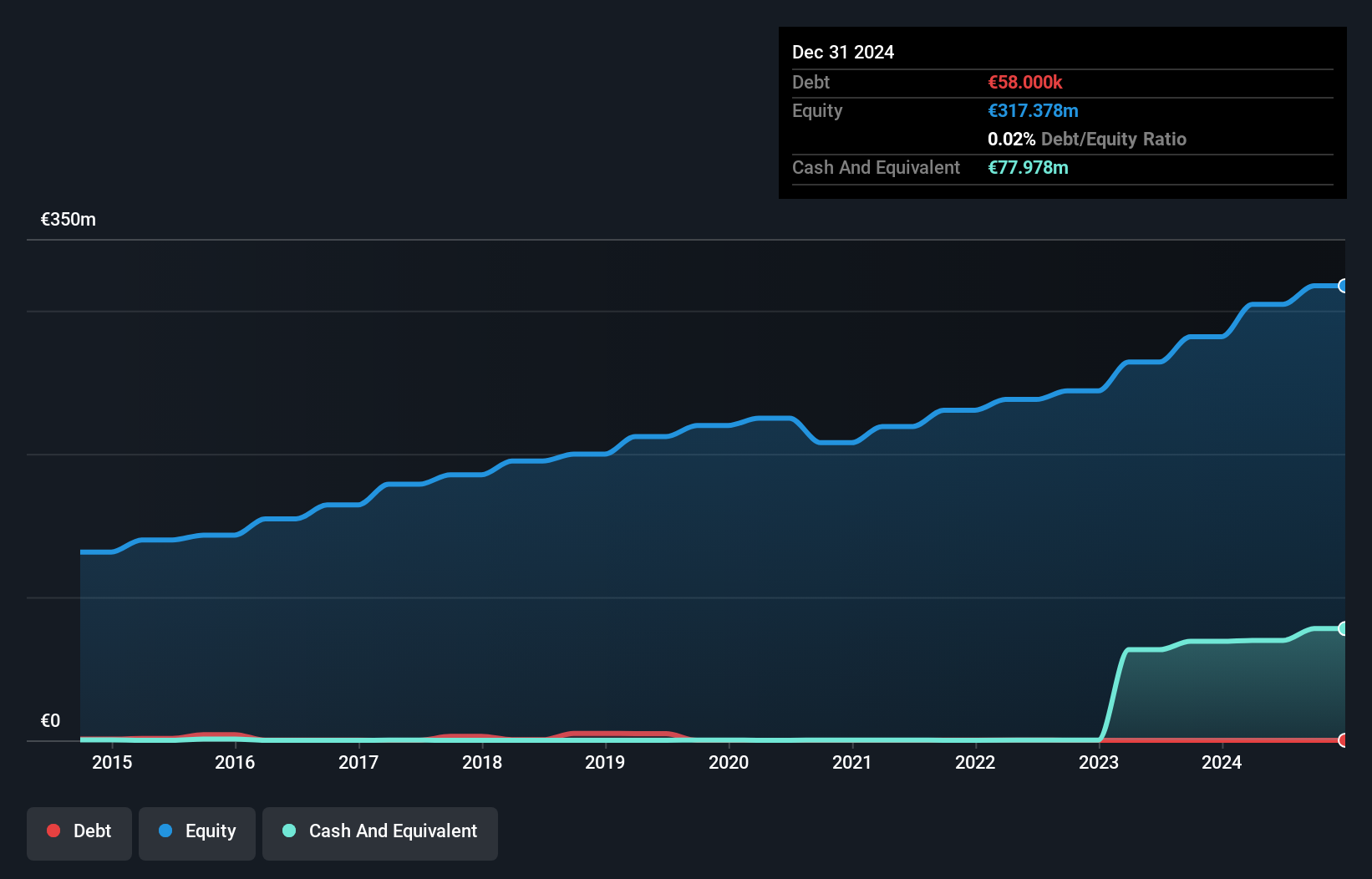

Malteries Franco-Belges Société Anonyme, with its niche in the malt industry, stands out for having more cash than total debt, indicating a strong financial footing. Over the past year, earnings rose by 12.4%, surpassing the broader food industry's -0.2% growth rate. The company seems to be trading at an attractive valuation, currently 33% below estimated fair value. Despite a slight increase in its debt-to-equity ratio from 0.01% to 0.02% over five years, it remains low and manageable. With high-quality earnings and sufficient interest coverage, MALT appears well-positioned within its sector for potential growth opportunities.

- Click here to discover the nuances of Malteries Franco-Belges Société Anonyme with our detailed analytical health report.

Understand Malteries Franco-Belges Société Anonyme's track record by examining our Past report.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG is a company that supplies medical consumer goods both in Switzerland and internationally, with a market capitalization of CHF334.58 million.

Operations: The company's revenue streams are primarily derived from Infection Management (CHF58.87 million), Wound Care (CHF44.04 million), and Incontinence Management (CHF33.92 million).

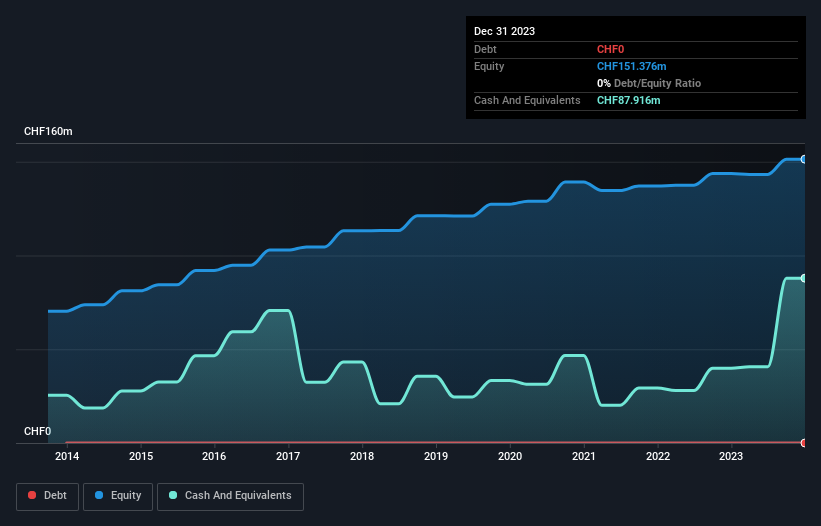

IVF Hartmann, a player in the medical equipment sector, stands out with its robust financial health and impressive growth trajectory. With earnings surging 34% over the past year, it has outpaced industry peers. The company boasts high-quality earnings and operates without debt, a rarity that eliminates concerns about interest coverage. IVF Hartmann's price-to-earnings ratio of 17.2x is attractively below the Swiss market average of 20.4x, suggesting potential undervaluation. Free cash flow remains positive at CHF 23.60 million as of September 2024, reinforcing its solid cash position and indicating flexibility for future investments or acquisitions.

- Click to explore a detailed breakdown of our findings in IVF Hartmann Holding's health report.

Gain insights into IVF Hartmann Holding's past trends and performance with our Past report.

Comp (WSE:CMP)

Simply Wall St Value Rating: ★★★★★★

Overview: Comp S.A. is a Polish technology company specializing in IT and network security services and solutions, with a market cap of PLN1.06 billion.

Operations: Comp S.A. generates revenue primarily from its IT and Retail segments, with the IT segment contributing PLN560.81 million and the Retail segment adding PLN355.95 million. The company's financial performance is reflected in its net profit margin, which shows notable trends over recent periods.

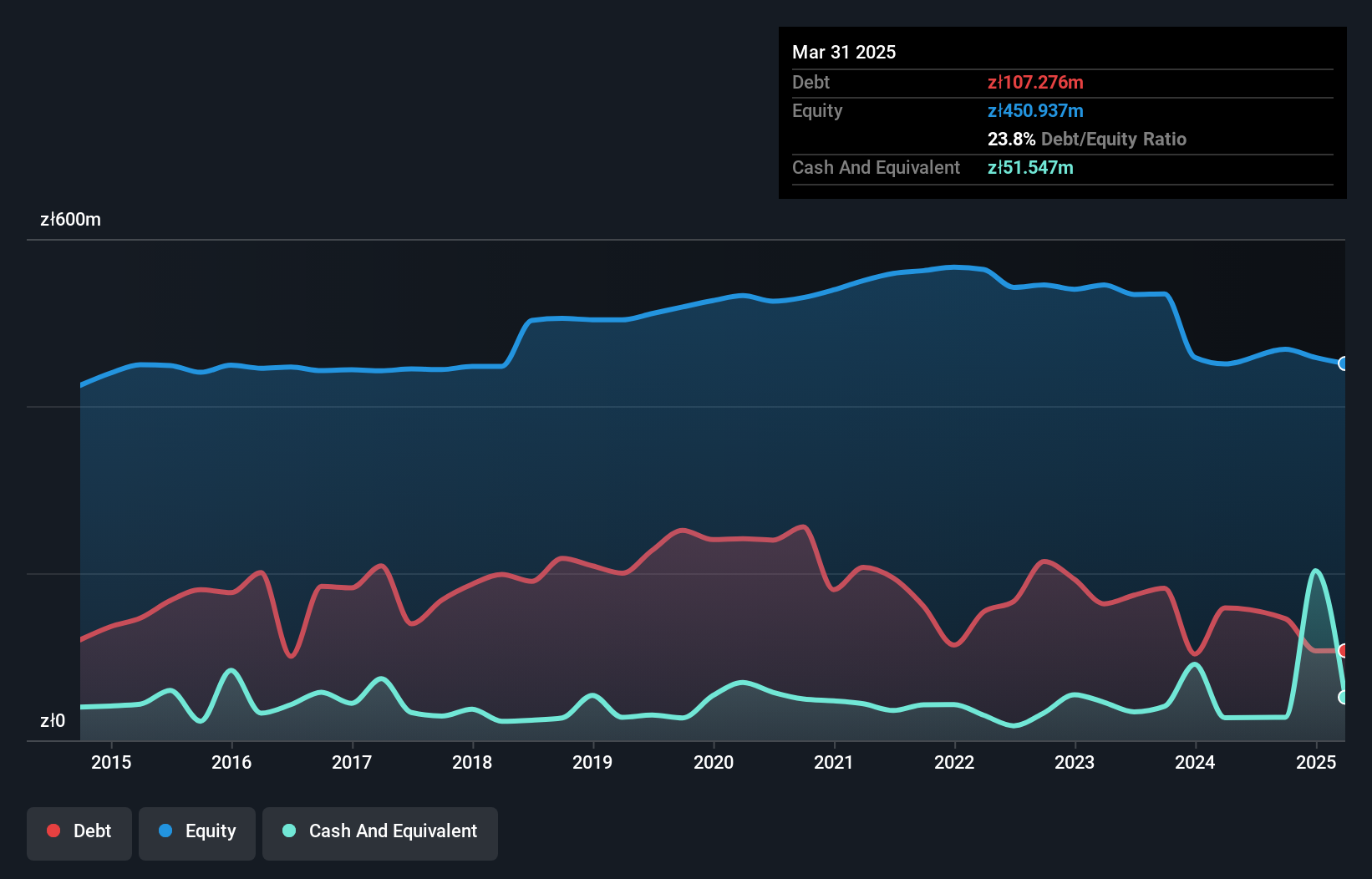

Comp S.A., a promising player in the European market, has shown noteworthy financial resilience. Its debt to equity ratio impressively decreased from 45.3% to 23.8% over five years, indicating solid financial management. Earnings have consistently grown at 5.4% annually, although last year's growth of 24.7% lagged behind the IT industry's robust 34.7%. Trading at a value below its estimated fair price by about PLN15 million suggests potential upside for investors seeking value opportunities in smaller firms like this one with high-quality earnings and satisfactory net debt levels of just 12.4%. Recent earnings reports reveal revenue rose to PLN168 million, with net income climbing to PLN13 million from the previous year’s figures, reflecting steady progress and profitability despite industry challenges.

- Get an in-depth perspective on Comp's performance by reading our health report here.

Evaluate Comp's historical performance by accessing our past performance report.

Where To Now?

- Navigate through the entire inventory of 320 European Undiscovered Gems With Strong Fundamentals here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CMP

Comp

A technology firm, provides IT security and network security services and solutions in Poland.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives