Investors Appear Satisfied With Comp S.A.'s (WSE:CMP) Prospects As Shares Rocket 27%

Despite an already strong run, Comp S.A. (WSE:CMP) shares have been powering on, with a gain of 27% in the last thirty days. The annual gain comes to 182% following the latest surge, making investors sit up and take notice.

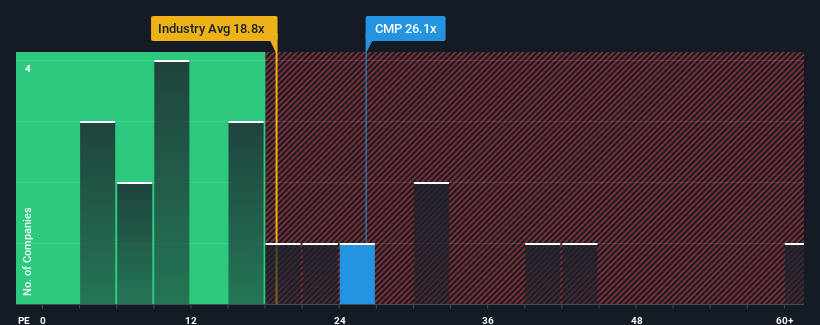

After such a large jump in price, Comp may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 26.1x, since almost half of all companies in Poland have P/E ratios under 12x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Comp has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Comp

What Are Growth Metrics Telling Us About The High P/E?

Comp's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 27%. However, this wasn't enough as the latest three year period has seen a very unpleasant 11% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the two analysts covering the company suggest earnings should grow by 39% per year over the next three years. That's shaping up to be materially higher than the 10% per annum growth forecast for the broader market.

In light of this, it's understandable that Comp's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Comp's P/E is flying high just like its stock has during the last month. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Comp's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Comp with six simple checks.

Of course, you might also be able to find a better stock than Comp. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CMP

Comp

A technology firm, provides IT security and network security services and solutions in Poland.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026