Cloud Technologies S.A. (WSE:CLD) Looks Interesting, And It's About To Pay A Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Cloud Technologies S.A. (WSE:CLD) is about to trade ex-dividend in the next three days. Typically, the ex-dividend date is two business days before the record date, which is the date on which a company determines the shareholders eligible to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Therefore, if you purchase Cloud Technologies' shares on or after the 18th of June, you won't be eligible to receive the dividend, when it is paid on the 27th of June.

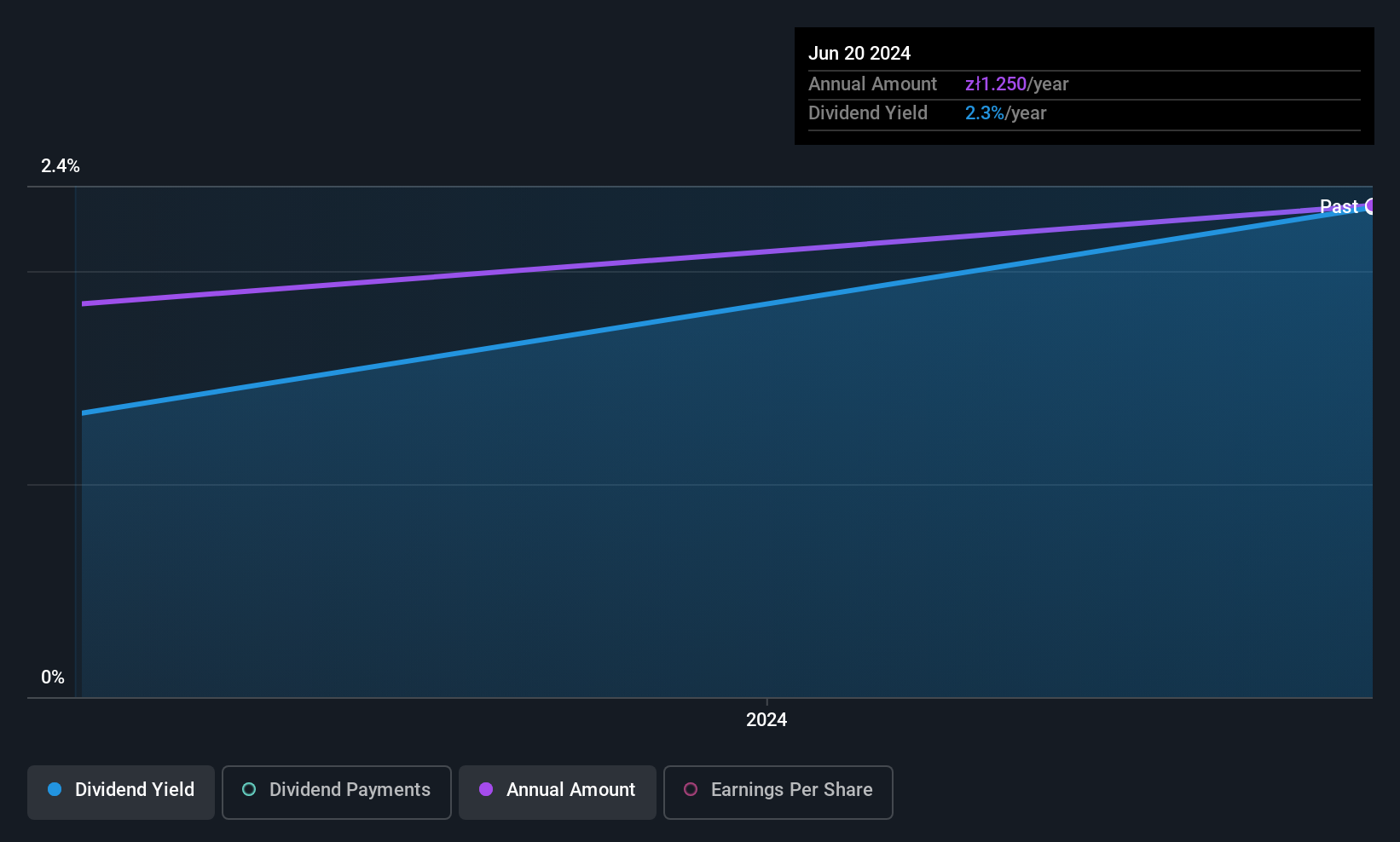

The company's next dividend payment will be zł1.25 per share. Last year, in total, the company distributed zł1.25 to shareholders. Based on the last year's worth of payments, Cloud Technologies stock has a trailing yield of around 2.7% on the current share price of zł45.50. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Cloud Technologies paid out 53% of its earnings to investors last year, a normal payout level for most businesses. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It distributed 32% of its free cash flow as dividends, a comfortable payout level for most companies.

It's positive to see that Cloud Technologies's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

See our latest analysis for Cloud Technologies

Click here to see how much of its profit Cloud Technologies paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. That's why it's comforting to see Cloud Technologies's earnings have been skyrocketing, up 33% per annum for the past five years. Management appears to be striking a nice balance between reinvesting for growth and paying dividends to shareholders. Earnings per share have been growing quickly and in combination with some reinvestment and a middling payout ratio, the stock may have decent dividend prospects going forwards.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last two years, Cloud Technologies has lifted its dividend by approximately 12% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

To Sum It Up

Is Cloud Technologies worth buying for its dividend? We like Cloud Technologies's growing earnings per share and the fact that - while its payout ratio is around average - it paid out a lower percentage of its cash flow. It's a promising combination that should mark this company worthy of closer attention.

In light of that, while Cloud Technologies has an appealing dividend, it's worth knowing the risks involved with this stock. Every company has risks, and we've spotted 2 warning signs for Cloud Technologies you should know about.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CLD

Cloud Technologies

Engages in the big data marketing and data monetization businesses.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Duolingo: Billion Dollar Business Hiding in Plain Sight

Kyocera: The Hidden AI Enabler

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks