As global markets navigate a mix of moderate gains and economic uncertainties, with consumer confidence and manufacturing showing signs of decline, investors are increasingly looking for stability in their portfolios. In such an environment, dividend stocks can offer a reliable income stream, providing potential resilience against market volatility while contributing to long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

Click here to see the full list of 1940 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally with a market cap of AED9.18 billion.

Operations: Dubai Investments PJSC generates revenue from three primary segments: Property (AED2.21 billion), Manufacturing, Contracting and Services (AED1.24 billion), and Investments (AED330.77 million).

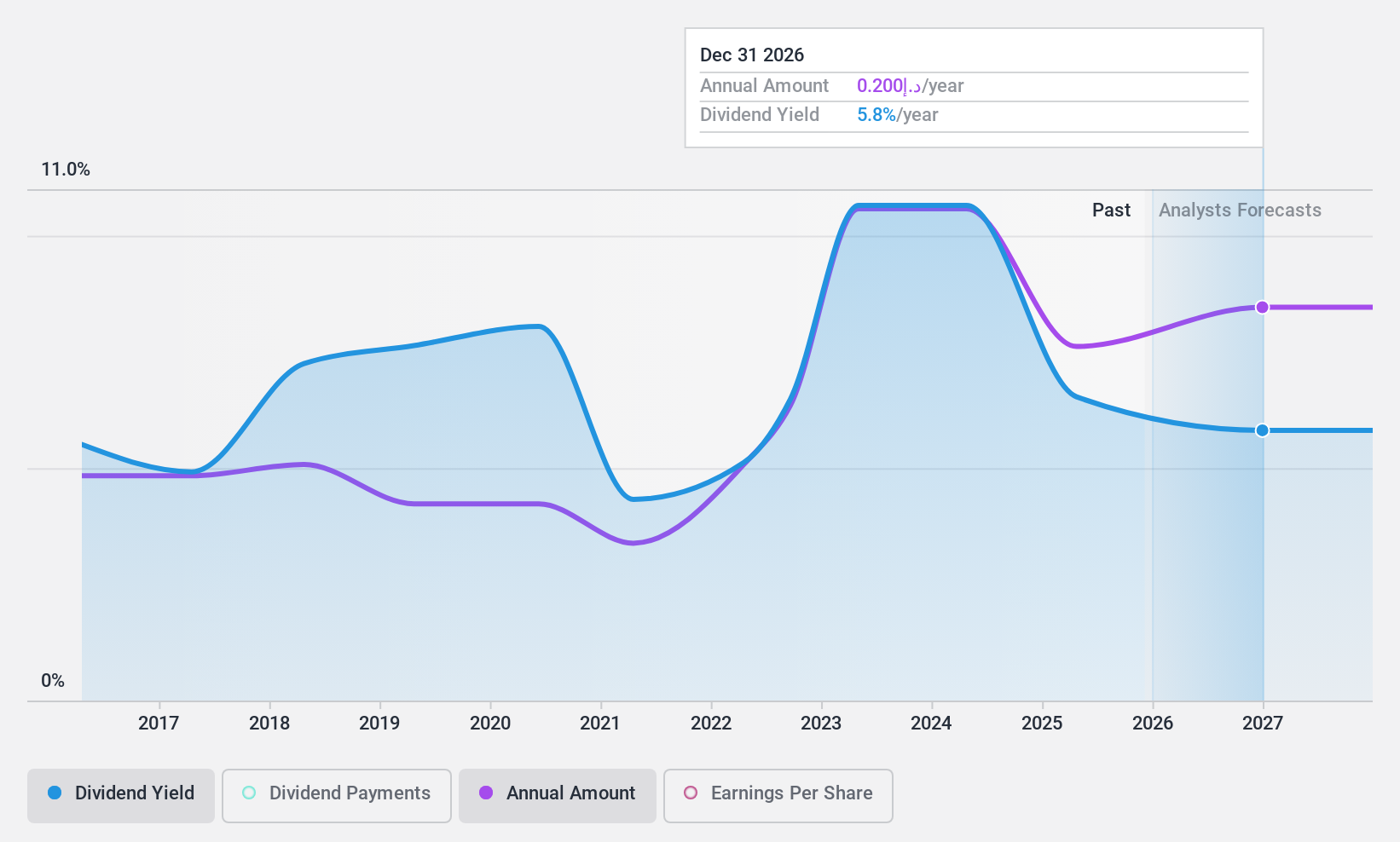

Dividend Yield: 5.8%

Dubai Investments PJSC offers a compelling value with a price-to-earnings ratio of 9.5x, below the AE market average of 13.2x. Its dividends are covered by earnings and cash flows, with payout ratios at 55.1% and 52.6%, respectively, indicating sustainability despite past volatility and unreliability in dividend payments. Recent earnings show mixed results; while third-quarter net income increased slightly to AED 241.31 million, nine-month figures reveal a decline from the previous year.

- Get an in-depth perspective on Dubai Investments PJSC's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Dubai Investments PJSC is priced higher than what may be justified by its financials.

Atea (OB:ATEA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK15.82 billion.

Operations: Atea ASA's revenue segments include Norway at NOK8.28 billion, Sweden at NOK12.44 billion, Denmark at NOK7.37 billion, Finland at NOK3.62 billion, The Baltics at NOK1.76 billion, and Group Shared Services contributing NOK9.20 billion.

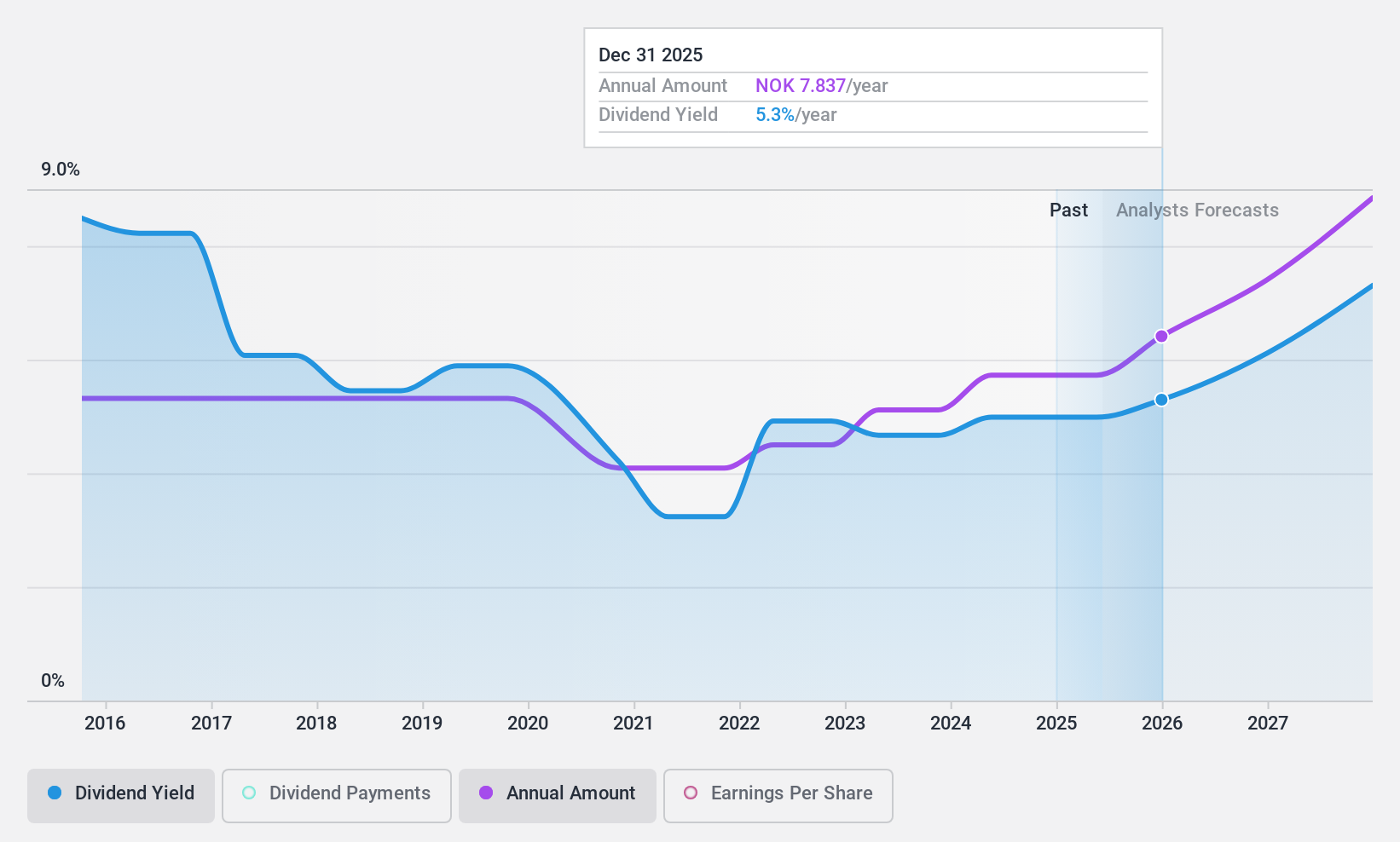

Dividend Yield: 5%

Atea ASA's dividend has grown steadily over the past decade, demonstrating reliability. However, with a payout ratio of 101.2%, dividends aren't well covered by earnings, raising sustainability concerns despite being covered by cash flows at 69.6%. The current yield of 4.95% is below the top Norwegian market payers. Recent buyback initiatives and stable earnings growth suggest potential value improvement, as shares trade at a significant discount to estimated fair value.

- Navigate through the intricacies of Atea with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Atea shares in the market.

Asseco Poland (WSE:ACP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asseco Poland S.A. is a software development and sales company operating primarily in Poland and internationally, with a market cap of PLN6.56 billion.

Operations: Asseco Poland S.A.'s revenue is primarily derived from its segments: Asseco Poland at PLN2.04 billion, Formula Systems at PLN10.75 billion, and Asseco International contributing PLN4.12 billion.

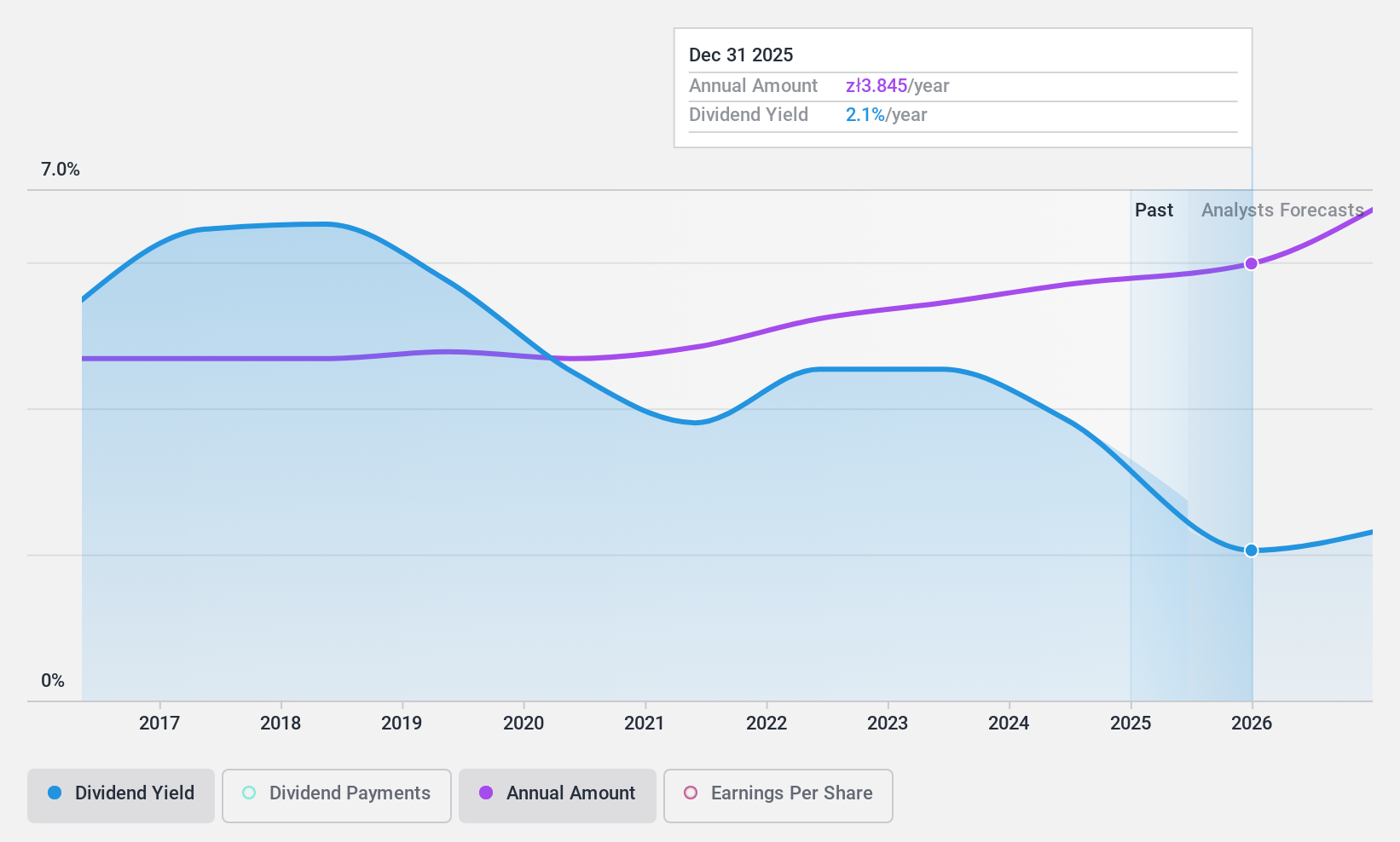

Dividend Yield: 3.8%

Asseco Poland's dividends have been stable and growing over the past decade, with a current yield of 3.8%, which is lower than the top Polish market payers. The dividend payments are well covered by earnings and cash flows, with payout ratios of 49.1% and 12%, respectively, suggesting sustainability. Recent earnings reports show an increase in net income to PLN 134 million for Q3, indicating continued financial health as shares trade below estimated fair value.

- Delve into the full analysis dividend report here for a deeper understanding of Asseco Poland.

- Our valuation report here indicates Asseco Poland may be undervalued.

Key Takeaways

- Delve into our full catalog of 1940 Top Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ACP

Asseco Poland

Develops and sells software products primarily in Poland, rest of Europe, the United States, Israel, Africa, and internationally.

Undervalued with excellent balance sheet and pays a dividend.