As European markets navigate the complexities of global tensions and economic uncertainties, indices like the STOXX Europe 600 have experienced declines, reflecting broader concerns. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for investors seeking to balance risk with steady returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.97% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.48% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.80% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.90% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.37% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.12% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.83% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.53% | ★★★★★★ |

Click here to see the full list of 241 stocks from our Top European Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

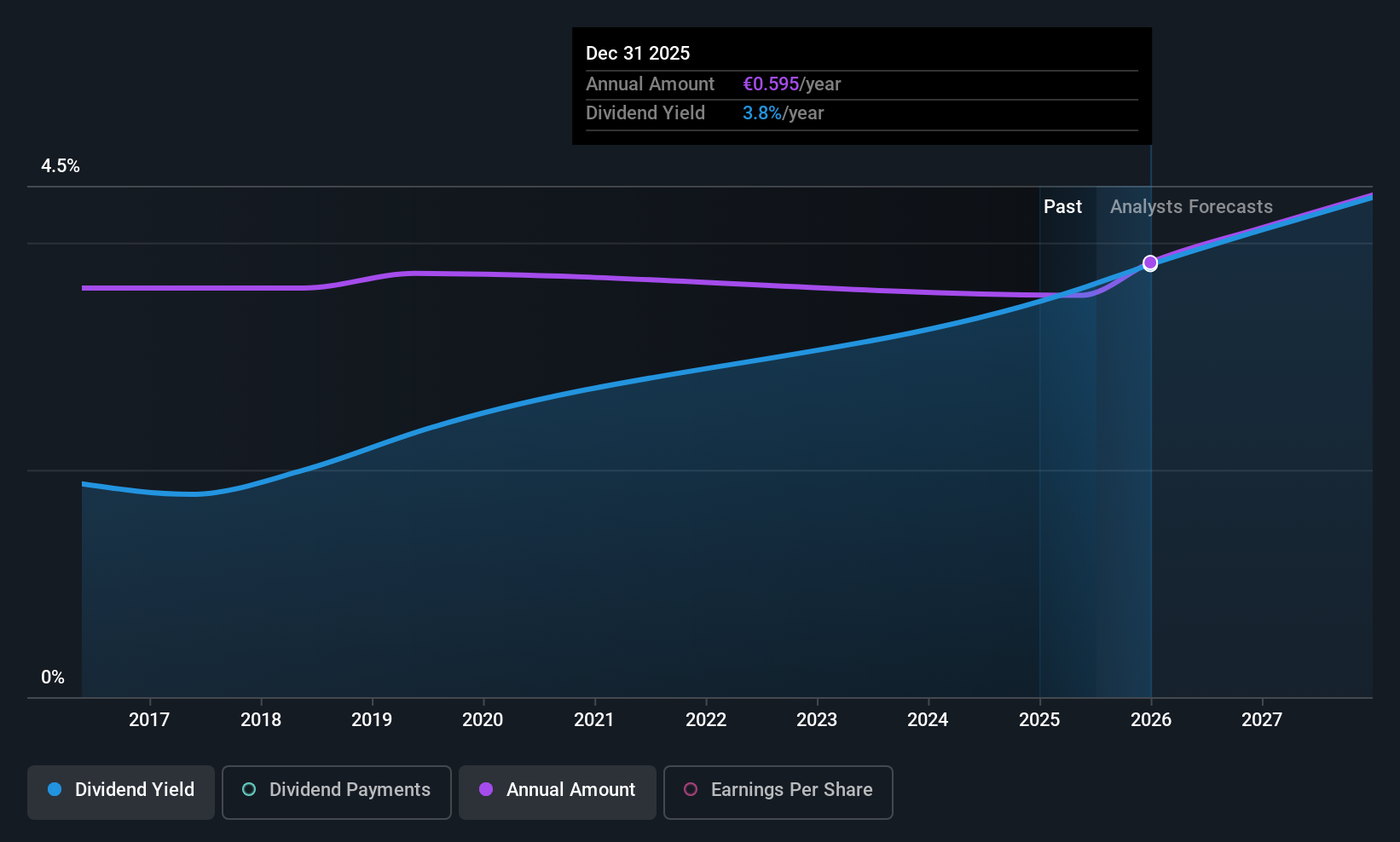

JCDecaux (ENXTPA:DEC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: JCDecaux SE is a global outdoor advertising company with a market cap of €3.24 billion.

Operations: JCDecaux SE generates revenue through its three main segments: Street Furniture (€1.99 billion), Transport (€1.39 billion), and Billboard (€546.60 million).

Dividend Yield: 3.6%

JCDecaux's dividend payments are well-covered by earnings and cash flows, with payout ratios of 45.4% and 14.5%, respectively, though the dividends have been volatile over the past decade. The stock's price-to-earnings ratio of 12.5x suggests it is undervalued compared to the French market average of 15.8x. Recent strategic partnerships, such as with Qloo for enhanced digital ad targeting, may bolster future revenue streams but do not directly impact dividend stability or yield improvements currently at a modest 3.64%.

- Click here and access our complete dividend analysis report to understand the dynamics of JCDecaux.

- Insights from our recent valuation report point to the potential undervaluation of JCDecaux shares in the market.

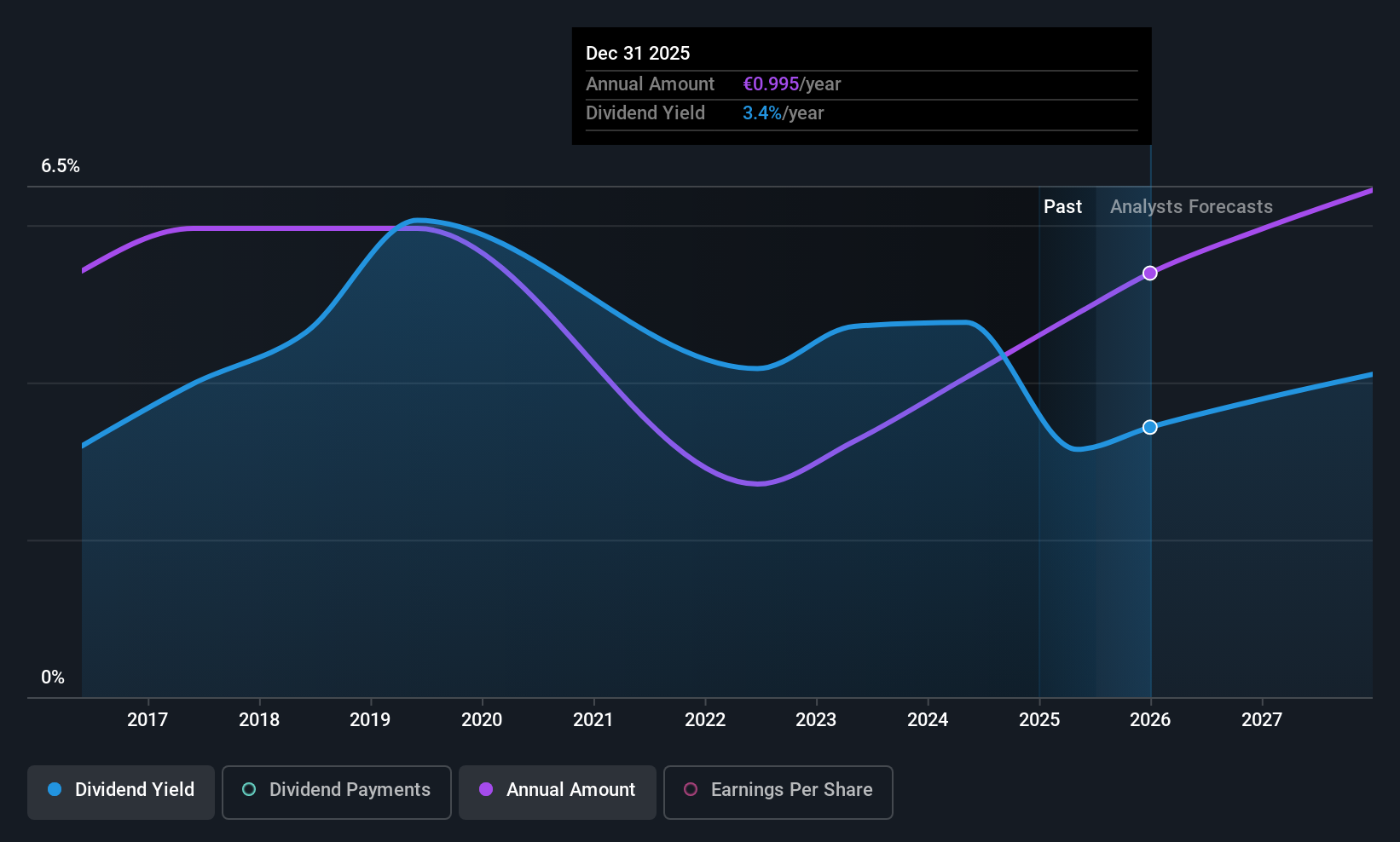

PORR (WBAG:POS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: PORR AG is a construction company with operations across multiple European countries and internationally, with a market cap of €1.07 billion.

Operations: PORR AG generates revenue from various segments including €937.96 million from Germany, €907.75 million from Poland, €745.65 million from Central and Eastern Europe (CEE), €3.13 billion from Austria and Switzerland (AT/CH), and €424.91 million from Infrastructure International projects.

Dividend Yield: 3.2%

PORR AG's dividend yield of €0.90 per share remains below the top tier in Austria, though recent increases signal potential growth. Despite a volatile dividend history over the past decade, current dividends are well-covered by earnings and cash flows, with payout ratios at 38.5% and 62.7%, respectively. The stock trades at a significant discount to its fair value estimate, but recent earnings have shown a decline in net income to €0.665 million for Q1 2025, impacting overall financial stability.

- Get an in-depth perspective on PORR's performance by reading our dividend report here.

- According our valuation report, there's an indication that PORR's share price might be on the cheaper side.

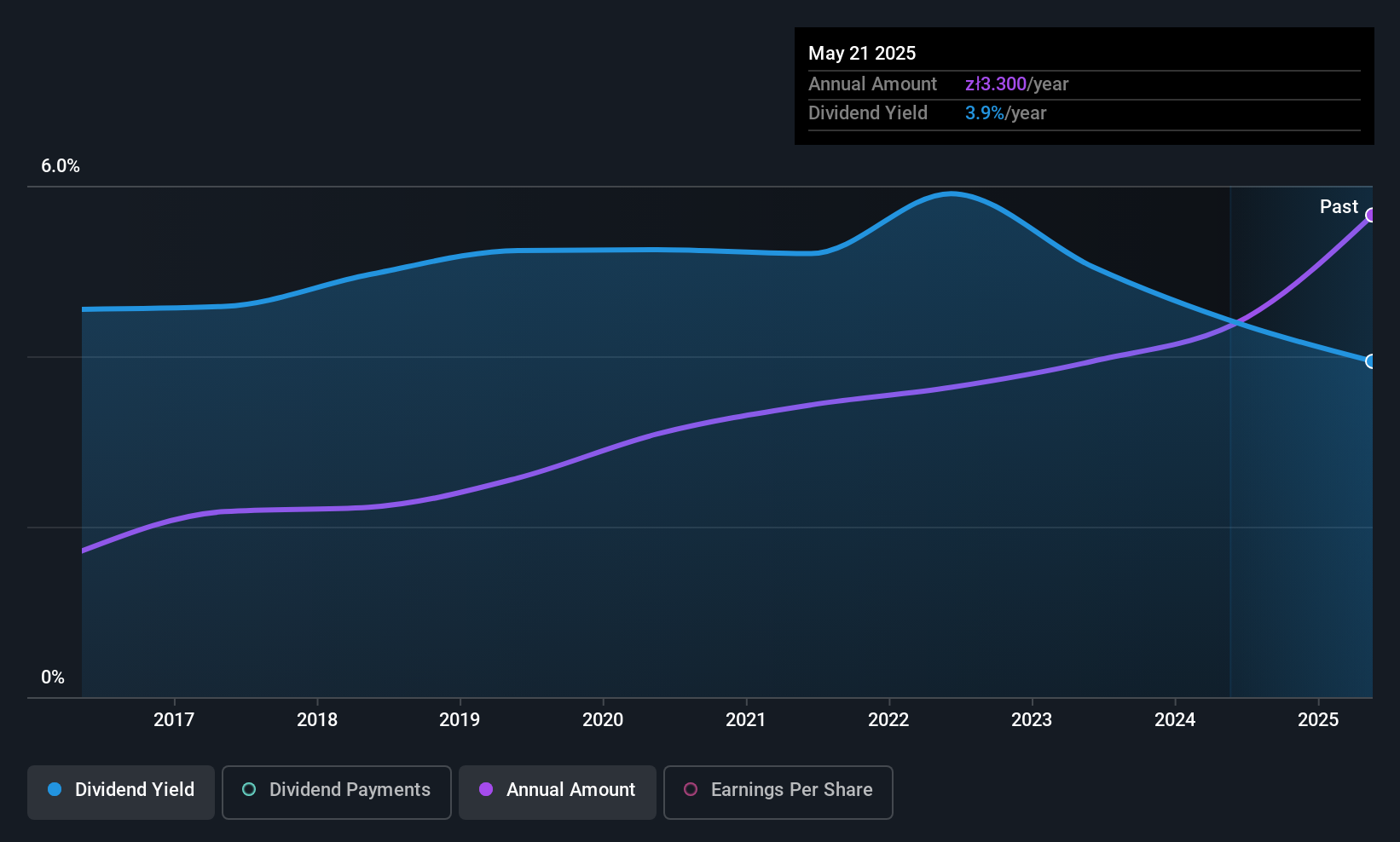

Asseco Business Solutions (WSE:ABS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Asseco Business Solutions S.A. designs and develops enterprise software solutions in Poland and internationally, with a market cap of PLN2.76 billion.

Operations: Asseco Business Solutions S.A. generates revenue primarily from its ERP (Enterprise Resource Planning) Segment, amounting to PLN417.51 million.

Dividend Yield: 3.9%

Asseco Business Solutions offers a dividend yield of 3.95%, which is lower than the top 25% of Polish dividend payers. Despite stable and growing dividends over the past decade, with a high payout ratio of 91.5%, current earnings do not fully cover these payments, raising sustainability concerns. Recent Q1 2025 results show improved sales at PLN 108.08 million and net income at PLN 28.41 million, indicating potential for future growth in profitability and cash flow coverage.

- Unlock comprehensive insights into our analysis of Asseco Business Solutions stock in this dividend report.

- According our valuation report, there's an indication that Asseco Business Solutions' share price might be on the expensive side.

Taking Advantage

- Dive into all 241 of the Top European Dividend Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:DEC

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives