- China

- /

- Electronic Equipment and Components

- /

- SZSE:002658

3 Stocks Estimated To Be Undervalued By Up To 49.5% Presenting A Unique Opportunity

Reviewed by Simply Wall St

As global markets show signs of resilience, with U.S. indexes nearing record highs and positive sentiment driven by strong labor market data, investors are increasingly on the lookout for opportunities that may be undervalued amidst the broader economic optimism. In such an environment, identifying stocks that are perceived to be undervalued can present a unique opportunity for investors seeking potential value plays in a landscape characterized by broad-based gains and cautious optimism about future interest rate cuts.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.97 | CN¥55.80 | 49.9% |

| BMC Medical (SZSE:301367) | CN¥68.90 | CN¥137.11 | 49.7% |

| SeSa (BIT:SES) | €75.10 | €149.67 | 49.8% |

| Tongqinglou Catering (SHSE:605108) | CN¥21.87 | CN¥43.59 | 49.8% |

| Winking Studios (Catalist:WKS) | SGD0.27 | SGD0.54 | 49.6% |

| CS Wind (KOSE:A112610) | ₩41050.00 | ₩81386.71 | 49.6% |

| Intermedical Care and Lab Hospital (SET:IMH) | THB4.94 | THB9.87 | 50% |

| Cavotec (OM:CCC) | SEK17.55 | SEK35.07 | 50% |

| Snap (NYSE:SNAP) | US$11.42 | US$22.72 | 49.7% |

| Cellnex Telecom (BME:CLNX) | €32.54 | €64.59 | 49.6% |

Let's review some notable picks from our screened stocks.

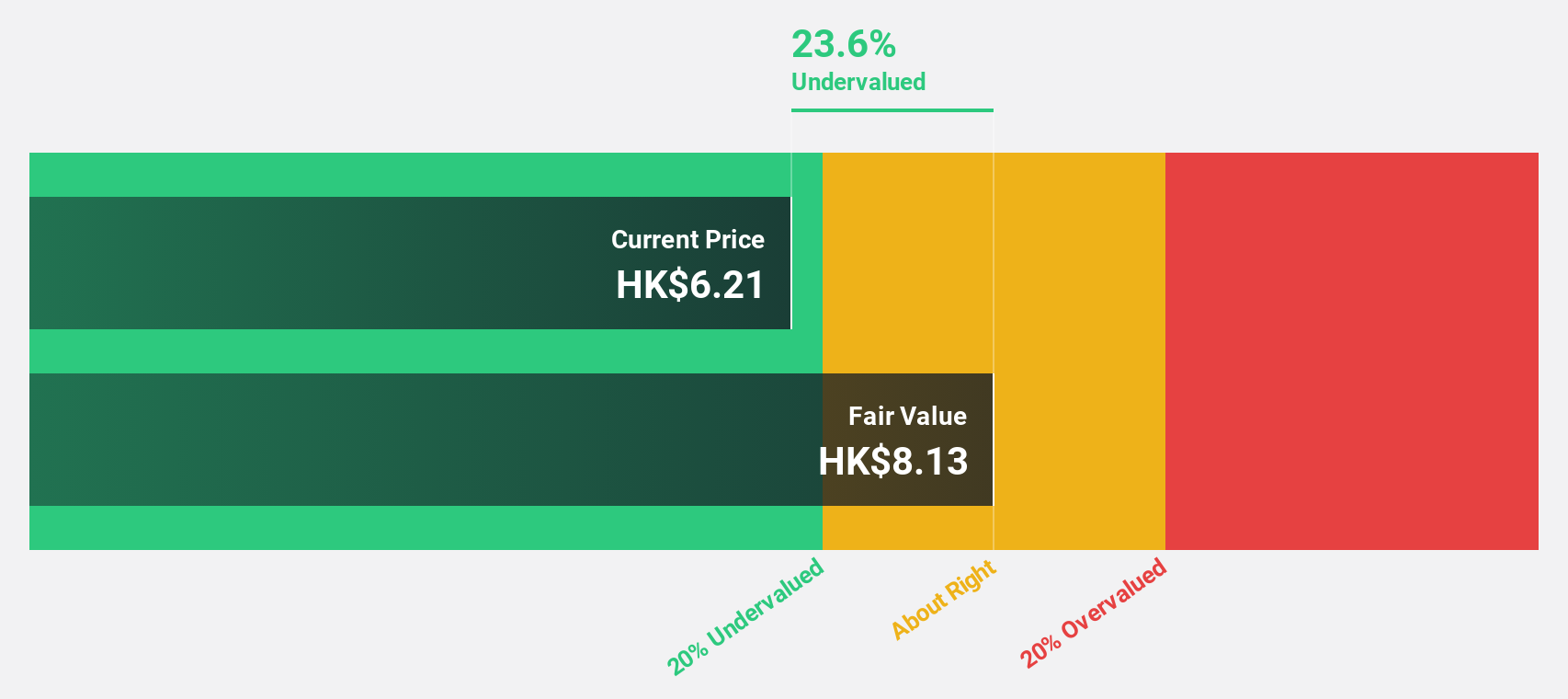

Plover Bay Technologies (SEHK:1523)

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market cap of HK$5.66 billion.

Operations: The company's revenue is primarily derived from sales of SD-WAN routers with mobile first connectivity ($59.87 million), fixed first connectivity ($15.19 million), and software licenses along with warranty and support services ($31.86 million).

Estimated Discount To Fair Value: 49.4%

Plover Bay Technologies appears undervalued, trading at HK$5.09, significantly below its estimated fair value of HK$10.06. The company's earnings have grown by 41.4% over the past year and are forecast to grow 17.3% annually, outpacing the Hong Kong market's growth rate of 11.6%. Recent guidance indicates a net profit increase exceeding last year's US$28.1 million by no less than 10%, driven by strong SD-WAN router sales and improved margins.

- In light of our recent growth report, it seems possible that Plover Bay Technologies' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Plover Bay Technologies.

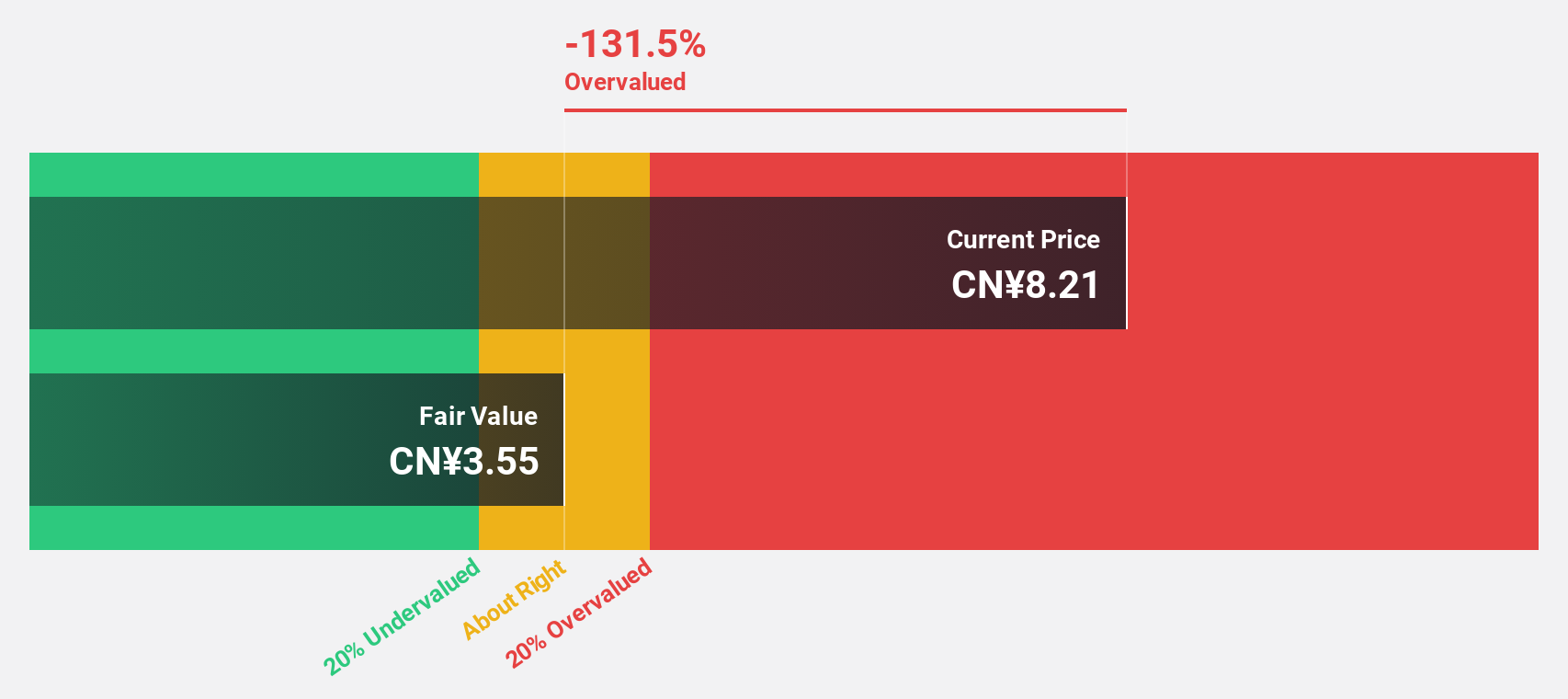

Beijing SDL TechnologyLtd (SZSE:002658)

Overview: Beijing SDL Technology Co., Ltd. develops and sells environmental monitoring products in China, with a market cap of CN¥4.49 billion.

Operations: Beijing SDL Technology Co., Ltd.'s revenue is primarily derived from its development and sale of environmental monitoring products in China.

Estimated Discount To Fair Value: 49.5%

Beijing SDL Technology Ltd. trades at CNY 7.91, considerably below its estimated fair value of CNY 15.65, suggesting it is undervalued based on cash flows. Despite a decline in recent earnings, with net income dropping to CNY 75.85 million from CNY 122.28 million year-on-year, forecasts indicate significant annual earnings growth of over 27% and revenue growth surpassing the Chinese market average at 16.5%, highlighting potential for recovery and value realization.

- Our growth report here indicates Beijing SDL TechnologyLtd may be poised for an improving outlook.

- Navigate through the intricacies of Beijing SDL TechnologyLtd with our comprehensive financial health report here.

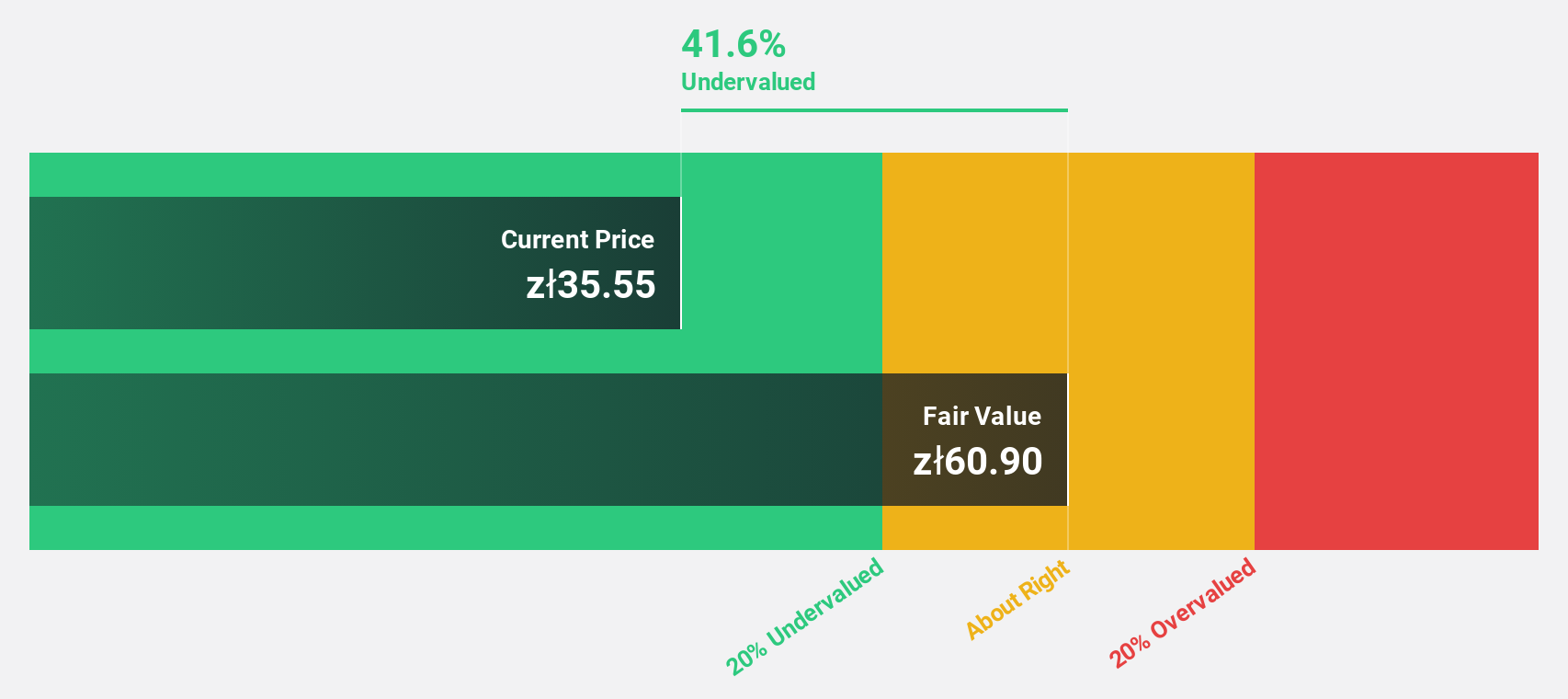

Allegro.eu (WSE:ALE)

Overview: Allegro.eu S.A. operates a leading commerce platform for consumers in Poland and internationally, with a market cap of PLN30.45 billion.

Operations: The company's revenue segments include PLN1.83 billion from Mall and PLN136.14 million from Allegro International.

Estimated Discount To Fair Value: 28.7%

Allegro.eu, with a current price of PLN 28.82, trades below its estimated fair value of PLN 40.42, indicating potential undervaluation based on cash flows. Recent earnings showed mixed results; Q3 net income declined to PLN 193.1 million from PLN 241.7 million year-on-year, yet nine-month figures improved significantly. Forecasts predict annual earnings growth of over 27%, outpacing the Polish market's average and offering prospects for value appreciation despite slower revenue growth at 10.3%.

- Our earnings growth report unveils the potential for significant increases in Allegro.eu's future results.

- Unlock comprehensive insights into our analysis of Allegro.eu stock in this financial health report.

Turning Ideas Into Actions

- Investigate our full lineup of 914 Undervalued Stocks Based On Cash Flows right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing SDL TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002658

Beijing SDL TechnologyLtd

Develops and sells environmental monitoring equipment and solutions in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives