David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that KCI Spolka Akcyjna (WSE:KCI) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for KCI Spolka Akcyjna

How Much Debt Does KCI Spolka Akcyjna Carry?

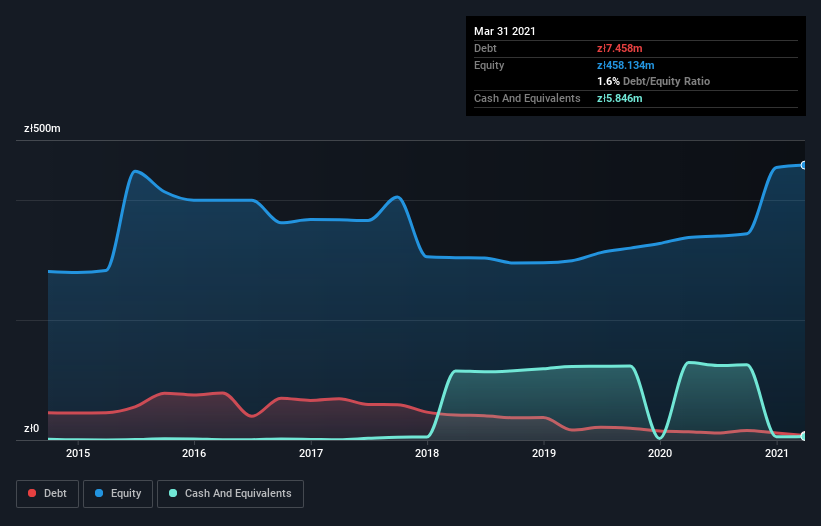

The image below, which you can click on for greater detail, shows that KCI Spolka Akcyjna had debt of zł7.46m at the end of March 2021, a reduction from zł13.9m over a year. On the flip side, it has zł5.85m in cash leading to net debt of about zł1.61m.

How Strong Is KCI Spolka Akcyjna's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that KCI Spolka Akcyjna had liabilities of zł43.4m due within 12 months and liabilities of zł48.4m due beyond that. Offsetting this, it had zł5.85m in cash and zł41.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by zł44.3m.

KCI Spolka Akcyjna has a market capitalization of zł97.1m, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With debt at a measly 0.092 times EBITDA and EBIT covering interest a whopping 14.4 times, it's clear that KCI Spolka Akcyjna is not a desperate borrower. Indeed relative to its earnings its debt load seems light as a feather. It is just as well that KCI Spolka Akcyjna's load is not too heavy, because its EBIT was down 43% over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since KCI Spolka Akcyjna will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. During the last three years, KCI Spolka Akcyjna generated free cash flow amounting to a very robust 90% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

Based on what we've seen KCI Spolka Akcyjna is not finding it easy, given its EBIT growth rate, but the other factors we considered give us cause to be optimistic. In particular, we are dazzled with its interest cover. When we consider all the elements mentioned above, it seems to us that KCI Spolka Akcyjna is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that KCI Spolka Akcyjna is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you’re looking to trade KCI Spolka Akcyjna, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade KCI Spolka Akcyjna, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KCI Spolka Akcyjna might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:KCI

KCI Spolka Akcyjna

KCI Spolka Akcyjna, formerly known as Jupiter Spolka Akcyjna, is a private equity firm specializing in real estate and media sector.

Flawless balance sheet and good value.