- Poland

- /

- Real Estate

- /

- WSE:EFK

Korporacja Gospodarcza efekt (WSE:EFK) Use Of Debt Could Be Considered Risky

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Korporacja Gospodarcza efekt S.A. (WSE:EFK) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Korporacja Gospodarcza efekt

What Is Korporacja Gospodarcza efekt's Net Debt?

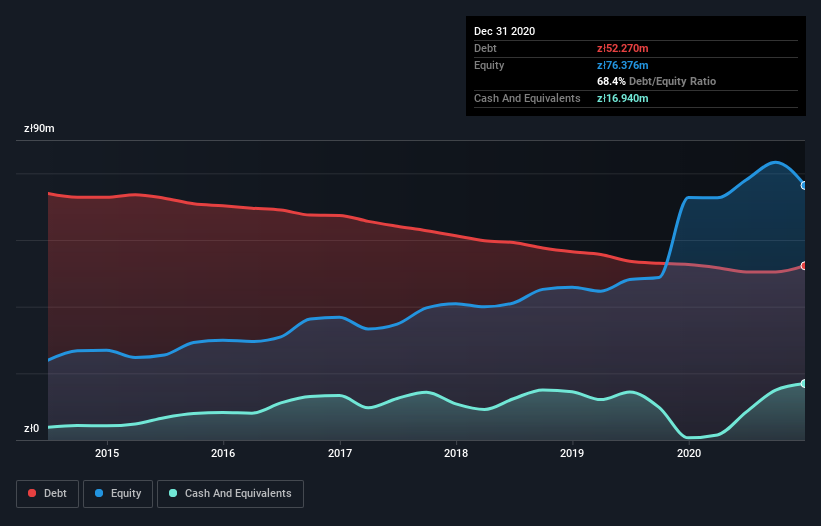

As you can see below, Korporacja Gospodarcza efekt had zł52.2m of debt, at December 2020, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of zł16.9m, its net debt is less, at about zł35.3m.

How Healthy Is Korporacja Gospodarcza efekt's Balance Sheet?

We can see from the most recent balance sheet that Korporacja Gospodarcza efekt had liabilities of zł24.1m falling due within a year, and liabilities of zł54.6m due beyond that. Offsetting this, it had zł16.9m in cash and zł11.9m in receivables that were due within 12 months. So its liabilities total zł49.9m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's zł38.0m market capitalization, you might well be inclined to review the balance sheet intently. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 1.1 times and a disturbingly high net debt to EBITDA ratio of 7.5 hit our confidence in Korporacja Gospodarcza efekt like a one-two punch to the gut. The debt burden here is substantial. Even worse, Korporacja Gospodarcza efekt saw its EBIT tank 56% over the last 12 months. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Korporacja Gospodarcza efekt will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Korporacja Gospodarcza efekt generated free cash flow amounting to a very robust 96% of its EBIT, more than we'd expect. That positions it well to pay down debt if desirable to do so.

Our View

To be frank both Korporacja Gospodarcza efekt's interest cover and its track record of (not) growing its EBIT make us rather uncomfortable with its debt levels. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Overall, it seems to us that Korporacja Gospodarcza efekt's balance sheet is really quite a risk to the business. So we're almost as wary of this stock as a hungry kitten is about falling into its owner's fish pond: once bitten, twice shy, as they say. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Korporacja Gospodarcza efekt (1 is significant!) that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Korporacja Gospodarcza efekt, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Korporacja Gospodarcza efekt might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:EFK

Korporacja Gospodarcza efekt

Engages in the provision of rental and tenancy services for premises and commercial stands.

Good value with acceptable track record.