- Poland

- /

- Real Estate

- /

- WSE:DVL

3 European Dividend Stocks Yielding Up To 10.4%

Reviewed by Simply Wall St

As European markets experience a positive upswing, with the STOXX Europe 600 Index climbing 2.35% and major indices like Germany's DAX and the UK's FTSE 100 also seeing gains, investors are increasingly attentive to opportunities within dividend stocks. In an environment where inflation appears subdued and economic policies evolve, selecting dividend stocks that offer robust yields can be a strategic way to generate income while potentially benefiting from market growth.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.34% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.65% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.12% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.74% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.55% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.94% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.16% | ★★★★★★ |

| d'Amico International Shipping (BIT:DIS) | 9.54% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.37% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.52% | ★★★★★★ |

Click here to see the full list of 207 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

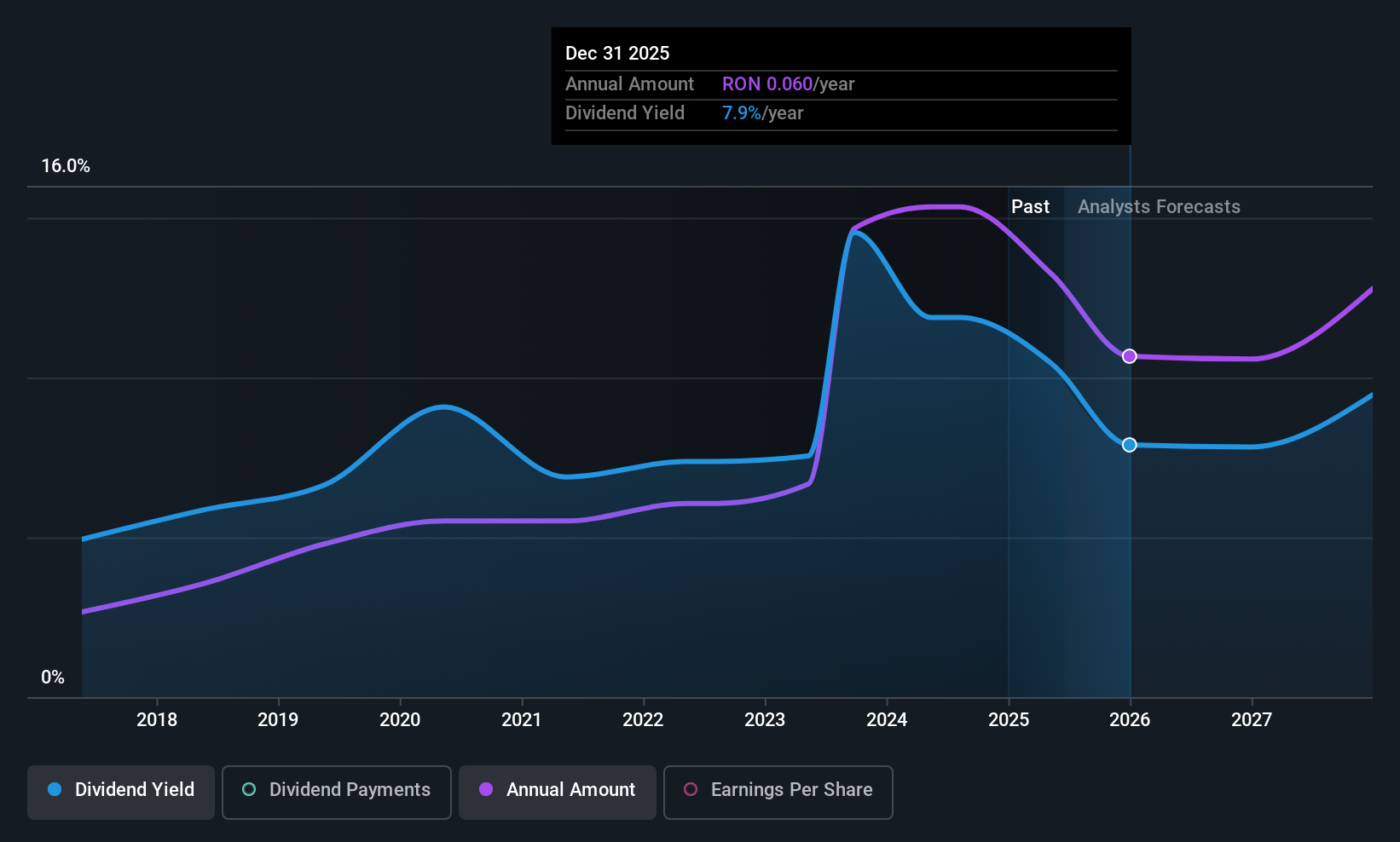

OMV Petrom (BVB:SNP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OMV Petrom S.A. is an energy company involved in the exploration and production of oil and gas in Southeastern Europe, with a market cap of RON60.44 billion.

Operations: OMV Petrom S.A.'s revenue primarily comes from its Refining and Marketing segment, generating RON24.61 billion, followed by the Gas and Power segment at RON11.73 billion, and the Exploration and Production segment contributing RON9.79 billion.

Dividend Yield: 6.6%

OMV Petrom's dividend profile reveals both strengths and weaknesses for investors. The company has approved a special dividend, indicating shareholder returns remain a priority. However, its historical dividend payments have been volatile, and the current cash payout ratio of 1116% suggests dividends are not well covered by free cash flows. Despite this, the payout ratio of 74.8% indicates earnings coverage is reasonable. Trading below estimated fair value may present an opportunity for value-seeking investors.

- Unlock comprehensive insights into our analysis of OMV Petrom stock in this dividend report.

- Our expertly prepared valuation report OMV Petrom implies its share price may be too high.

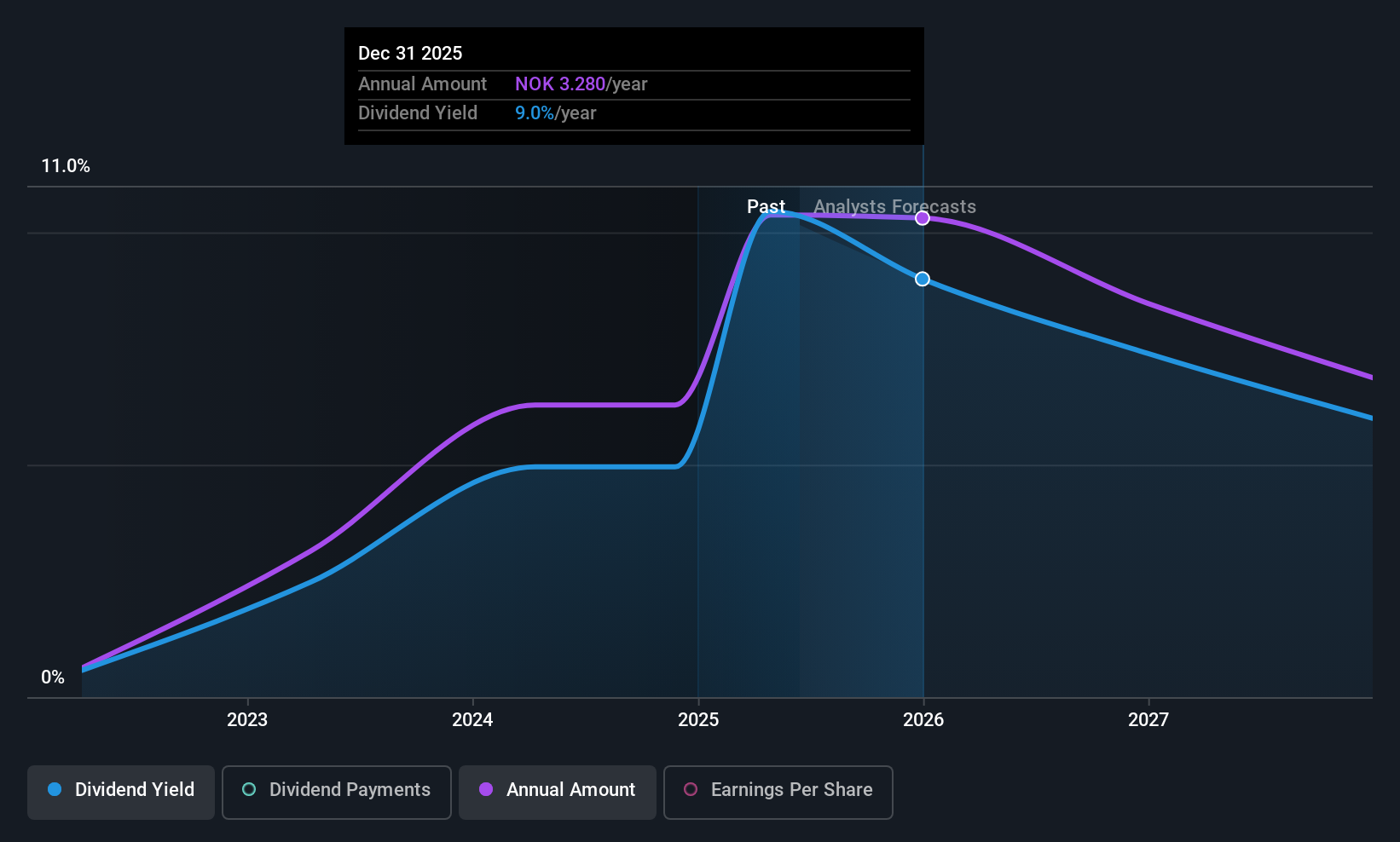

Aker Solutions (OB:AKSO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aker Solutions ASA offers solutions, products, systems, and services to the oil and gas industry across various countries including Norway, the United States, Brazil, and others with a market cap of NOK15.21 billion.

Operations: Aker Solutions ASA generates revenue primarily from its Renewables and Field Development segment, which accounts for NOK45.07 billion, followed by the Life Cycle segment contributing NOK14.93 billion.

Dividend Yield: 10.5%

Aker Solutions' dividend profile presents a mixed outlook. The company's payout ratio of 63.1% suggests dividends are covered by earnings, while the cash payout ratio of 67.5% indicates coverage by cash flows as well. However, dividend payments have been volatile and unreliable over the past decade, despite recent growth in earnings and revenues reaching NOK 16.98 billion in Q3 2025. Recent contracts with ConocoPhillips and ExxonMobil could bolster future revenue streams but do not guarantee stable dividends due to historical volatility.

- Navigate through the intricacies of Aker Solutions with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Aker Solutions' current price could be quite moderate.

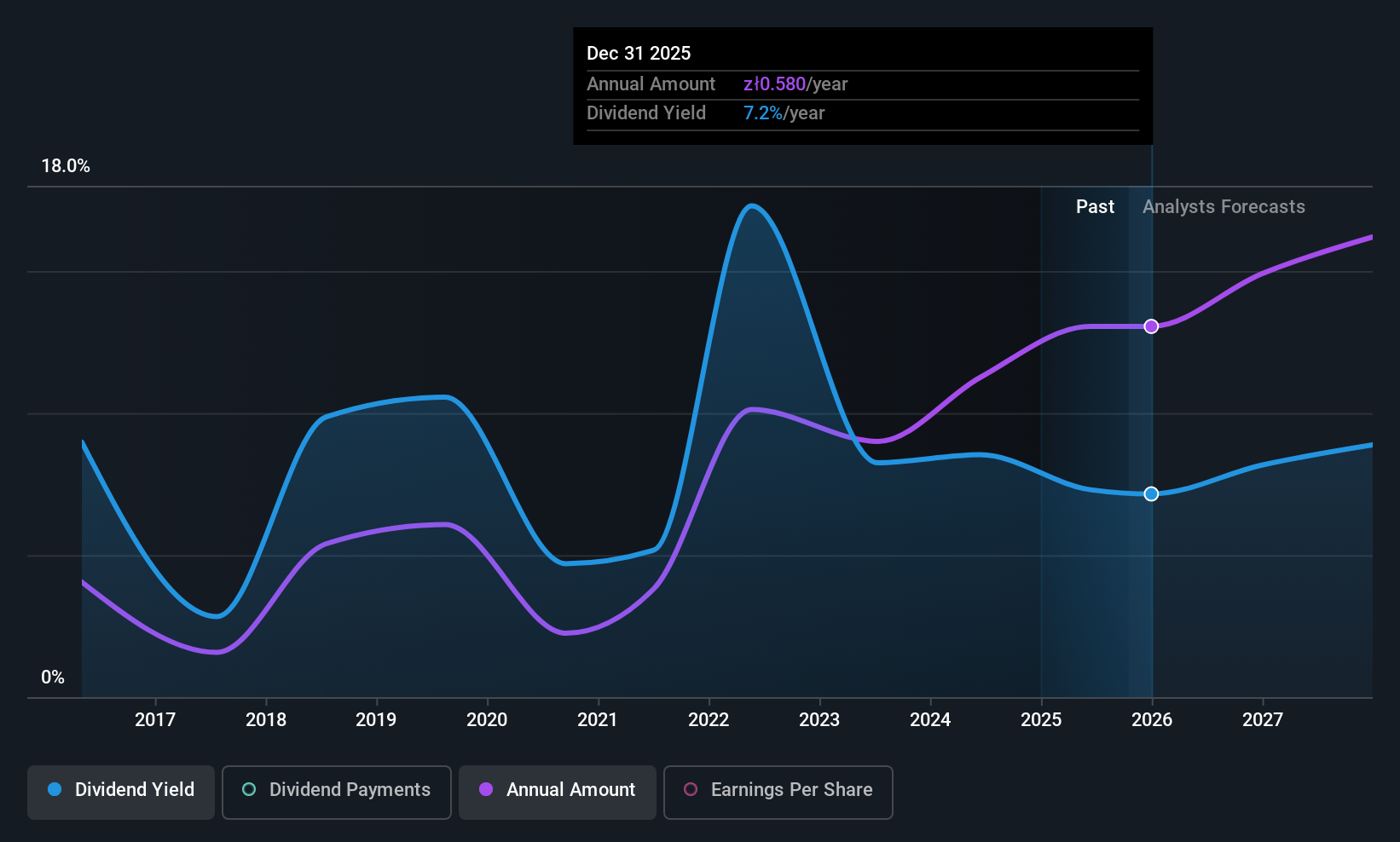

Develia (WSE:DVL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Develia S.A., with a market cap of PLN 3.81 billion, operates in the real estate sector in Poland through its subsidiaries.

Operations: Develia S.A.'s revenue segments include real estate development, property management, and leasing activities in Poland.

Dividend Yield: 7.0%

Develia's dividend payments have been unstable over the past decade, despite a reasonable payout ratio of 56.5% and cash payout ratio of 60.5%, indicating coverage by earnings and cash flows. The stock trades at a discount to its estimated fair value, with recent earnings showing strong growth; net income for Q3 2025 reached PLN 133.4 million compared to PLN 67.12 million the previous year, suggesting potential for future dividend stability if volatility is addressed.

- Delve into the full analysis dividend report here for a deeper understanding of Develia.

- In light of our recent valuation report, it seems possible that Develia is trading behind its estimated value.

Key Takeaways

- Investigate our full lineup of 207 Top European Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:DVL

Develia

Through its subsidiaries, engages in real estate business in Poland.

Undervalued with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026