Here's Why We're Watching Pure Biologics Spólka Akcyjna's (WSE:PUR) Cash Burn Situation

Just because a business does not make any money, does not mean that the stock will go down. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

Given this risk, we thought we'd take a look at whether Pure Biologics Spólka Akcyjna (WSE:PUR) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Pure Biologics Spólka Akcyjna

How Long Is Pure Biologics Spólka Akcyjna's Cash Runway?

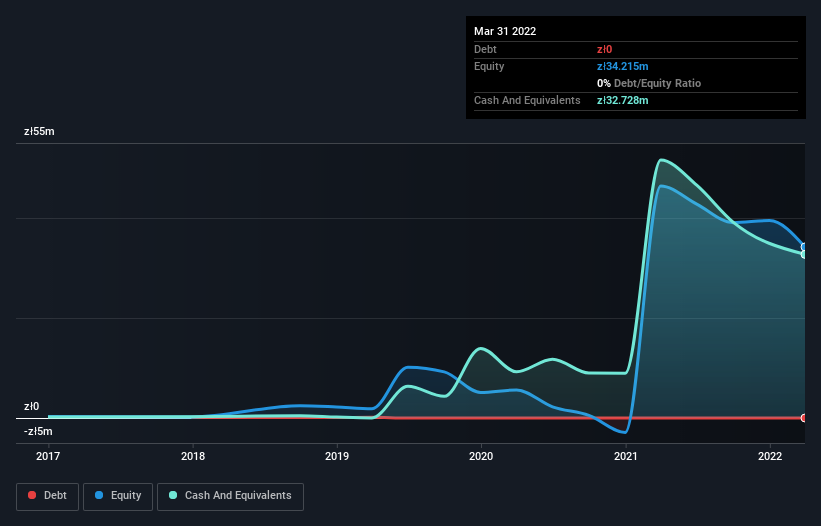

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. When Pure Biologics Spólka Akcyjna last reported its balance sheet in September 2022, it had zero debt and cash worth zł16m. Importantly, its cash burn was zł21m over the trailing twelve months. So it had a cash runway of approximately 9 months from September 2022. That's quite a short cash runway, indicating the company must either reduce its annual cash burn or replenish its cash. The image below shows how its cash balance has been changing over the last few years.

How Is Pure Biologics Spólka Akcyjna's Cash Burn Changing Over Time?

Whilst it's great to see that Pure Biologics Spólka Akcyjna has already begun generating revenue from operations, last year it only produced zł744k, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. With the cash burn rate up 13% in the last year, it seems that the company is ratcheting up investment in the business over time. That's not necessarily a bad thing, but investors should be mindful of the fact that will shorten the cash runway. Admittedly, we're a bit cautious of Pure Biologics Spólka Akcyjna due to its lack of significant operating revenues. So we'd generally prefer stocks from this list of stocks that have analysts forecasting growth.

How Easily Can Pure Biologics Spólka Akcyjna Raise Cash?

Since its cash burn is moving in the wrong direction, Pure Biologics Spólka Akcyjna shareholders may wish to think ahead to when the company may need to raise more cash. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

Pure Biologics Spólka Akcyjna's cash burn of zł21m is about 22% of its zł95m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About Pure Biologics Spólka Akcyjna's Cash Burn?

We must admit that we don't think Pure Biologics Spólka Akcyjna is in a very strong position, when it comes to its cash burn. While its cash burn relative to its market cap wasn't too bad, its cash runway does leave us rather nervous. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Pure Biologics Spólka Akcyjna (3 shouldn't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

If you're looking to trade Pure Biologics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PUR

Pure Biologics

A biopharmaceutical company, engages in the research and development of biological drugs and non-systematic therapies in the field of immuno-oncology, autoimmunology, and rare neurological diseases.

Medium-low with weak fundamentals.