Mabion (WSE:MAB shareholders incur further losses as stock declines 12% this week, taking five-year losses to 85%

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Anyone who held Mabion S.A. (WSE:MAB) for five years would be nursing their metaphorical wounds since the share price dropped 85% in that time. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report. While a drop like that is definitely a body blow, money isn't as important as health and happiness.

Since Mabion has shed zł30m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Mabion

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Mabion became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 54% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

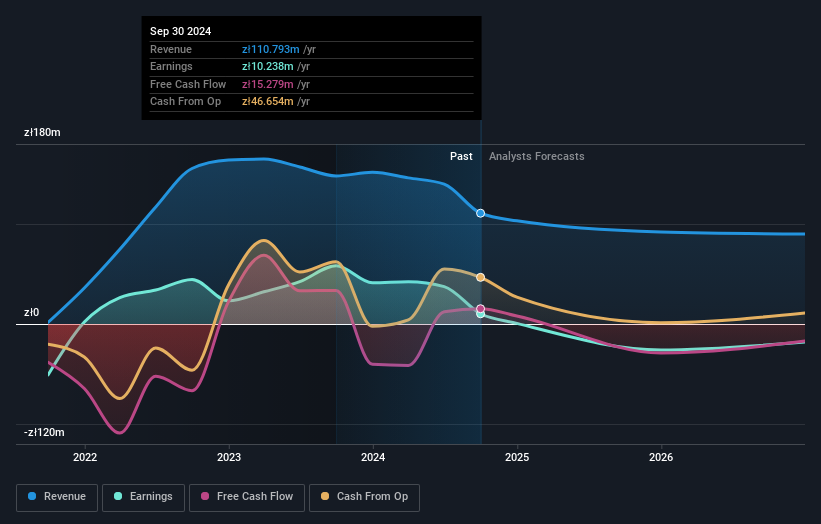

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Mabion has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on Mabion's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While the broader market gained around 13% in the last year, Mabion shareholders lost 18%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Mabion better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Mabion (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

Of course Mabion may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

If you're looking to trade Mabion, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:MAB

Mabion

A biotechnology company, engages in the development of various biotech drugs based on monoclonal antibody technology in Poland.

Flawless balance sheet and fair value.