- Poland

- /

- Entertainment

- /

- WSE:PCF

Positive Sentiment Still Eludes PCF Group Spólka Akcyjna (WSE:PCF) Following 28% Share Price Slump

Unfortunately for some shareholders, the PCF Group Spólka Akcyjna (WSE:PCF) share price has dived 28% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

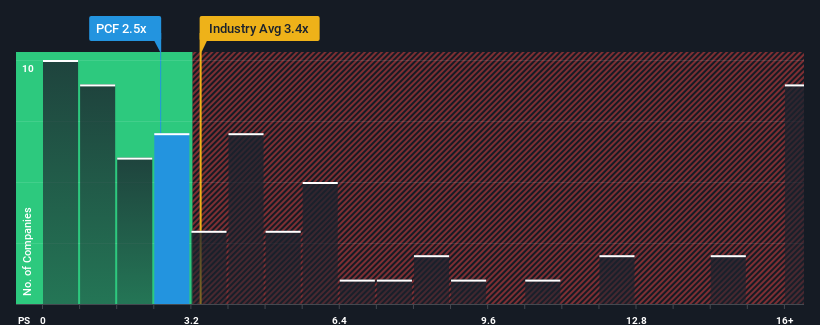

Since its price has dipped substantially, PCF Group Spólka Akcyjna's price-to-sales (or "P/S") ratio of 2.5x might make it look like a buy right now compared to the Entertainment industry in Poland, where around half of the companies have P/S ratios above 3.4x and even P/S above 8x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for PCF Group Spólka Akcyjna

What Does PCF Group Spólka Akcyjna's P/S Mean For Shareholders?

PCF Group Spólka Akcyjna could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on PCF Group Spólka Akcyjna.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as low as PCF Group Spólka Akcyjna's is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 10%. Pleasingly, revenue has also lifted 58% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 38% during the coming year according to the three analysts following the company. That would be an excellent outcome when the industry is expected to decline by 24%.

With this in mind, we find it intriguing that PCF Group Spólka Akcyjna's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What We Can Learn From PCF Group Spólka Akcyjna's P/S?

PCF Group Spólka Akcyjna's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that PCF Group Spólka Akcyjna currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for PCF Group Spólka Akcyjna with six simple checks on some of these key factors.

If you're unsure about the strength of PCF Group Spólka Akcyjna's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:PCF

PCF Group Spólka Akcyjna

Engages in the development and production of video games in Poland and internationally.

High growth potential with mediocre balance sheet.