- Poland

- /

- Entertainment

- /

- WSE:OML

European Penny Stocks: 3 Promising Picks Under €70M Market Cap

Reviewed by Simply Wall St

Amid recent concerns about global growth and a stronger euro, the European markets have shown mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower. In such fluctuating market conditions, investors often look for opportunities in smaller or newer companies that might offer potential for growth. While the term "penny stocks" may seem outdated, these investments can still represent valuable prospects when they exhibit strong financials and stability.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.208 | €1.46B | ✅ 5 ⚠️ 2 View Analysis > |

| Maps (BIT:MAPS) | €3.37 | €44.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €247.45M | ✅ 2 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €3.12 | €65.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.04 | €9.65M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.46 | €394.2M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.53 | €69.39M | ✅ 1 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.095 | €289.57M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.93 | €31.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 329 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Aiforia Technologies Oyj (HLSE:AIFORIA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aiforia Technologies Oyj, along with its subsidiary Aiforia Inc., offers AI-based image analysis software for clinical, preclinical, and academic laboratories globally, serving pathologists and researchers, with a market cap of €92.29 million.

Operations: The company's revenue is primarily generated from its healthcare software segment, amounting to €2.88 million.

Market Cap: €92.29M

Aiforia Technologies Oyj, with a market cap of €92.29 million, is making strides in the AI-driven pathology sector despite being unprofitable and generating modest revenue of €2.88 million primarily from healthcare software. The company's strategic alliance with Dedalus Group aims to integrate AI into pathology workflows, addressing global demands for more efficient diagnostics amid rising cancer cases and pathologist shortages. Aiforia's recent expansion into France supports its growth ambitions in a country heavily investing in AI technologies. Financially, it has reduced its debt significantly over five years but faces challenges with less than a year of cash runway remaining.

- Get an in-depth perspective on Aiforia Technologies Oyj's performance by reading our balance sheet health report here.

- Gain insights into Aiforia Technologies Oyj's outlook and expected performance with our report on the company's earnings estimates.

Nanoform Finland Oyj (HLSE:NANOFH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nanoform Finland Oyj provides nanotechnology and drug particle engineering services to the pharma and biotech industries in Europe and the United States, with a market cap of €75.39 million.

Operations: The company generates revenue of €3.95 million from its expert services in nanotechnology and drug particle engineering.

Market Cap: €75.39M

Nanoform Finland Oyj, with a market cap of €75.39 million, is navigating the nanotechnology sector despite being unprofitable and generating modest revenue of €3.95 million from its services. The company recently secured a €5 million R&D loan from Business Finland to advance its nanoapalutamide clinical development, demonstrating strategic financial management with more cash than debt and sufficient short-term asset coverage. Nanoform's pivotal bioequivalence studies for Nanoenzalutamide aim to enhance prostate cancer treatment options, potentially unlocking significant milestone revenues post-patent expiry. However, the stock remains volatile with increasing losses over five years and no profitability forecast within three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Nanoform Finland Oyj.

- Gain insights into Nanoform Finland Oyj's future direction by reviewing our growth report.

One More Level (WSE:OML)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: One More Level S.A. is a Polish gaming company that develops video games for consoles and PCs, with a market cap of PLN143.83 million.

Operations: The company generates revenue from its Computer Graphics segment, amounting to PLN8.94 million.

Market Cap: PLN143.83M

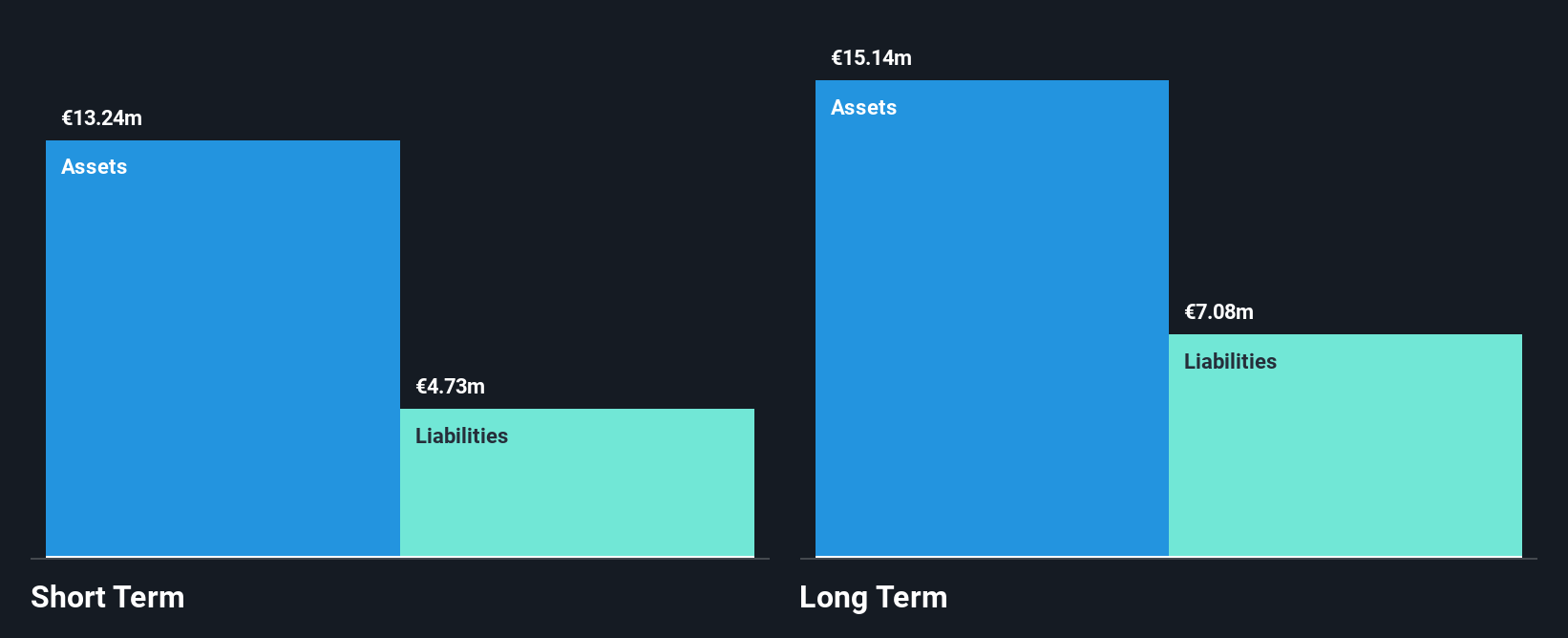

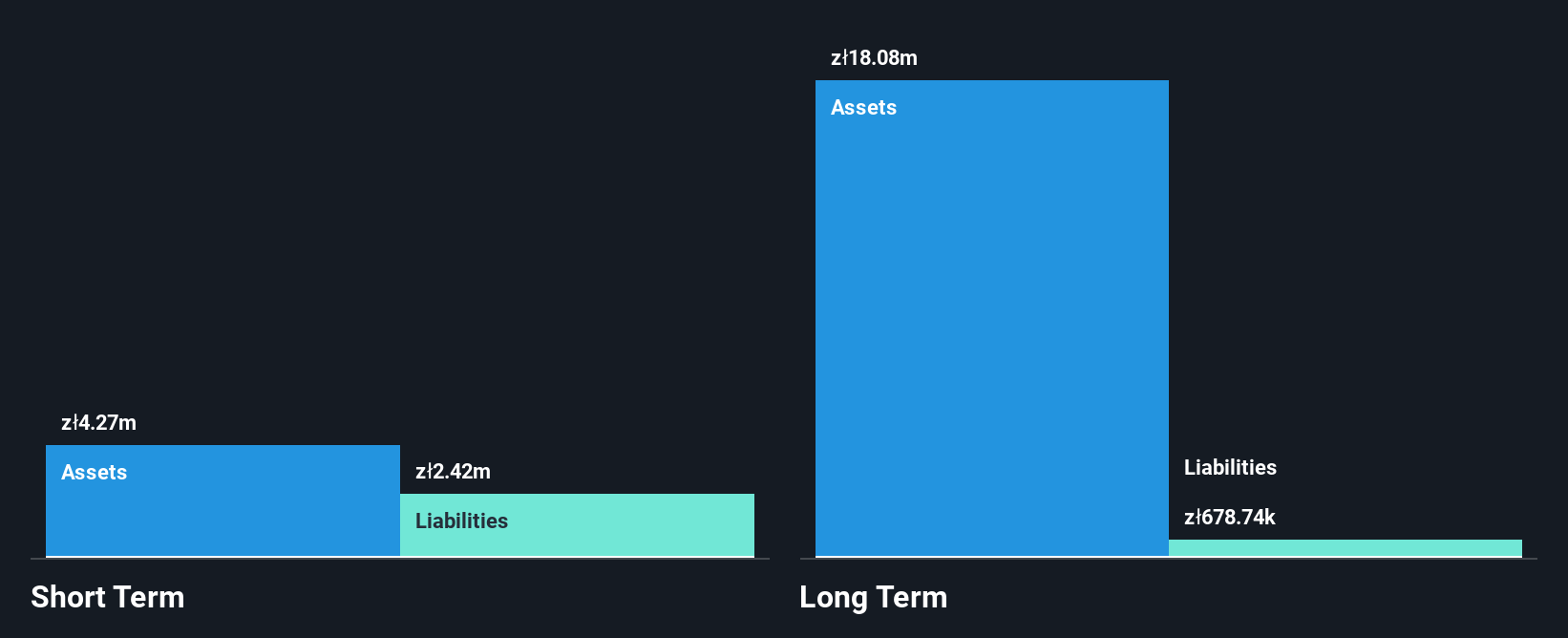

One More Level S.A., a Polish gaming company, has been navigating financial challenges with its recent earnings report showing a significant decline in revenue to PLN 0.00475 million for the first half of 2025, compared to PLN 11.41 million a year ago. Despite this, the company remains debt-free and maintains short-term asset coverage over both its short-term and long-term liabilities. While it has experienced high volatility in share price recently, it achieved profitability over the past five years with consistent earnings growth of 33.1% annually before encountering current setbacks. The board is experienced but management tenure details are insufficient for assessment.

- Jump into the full analysis health report here for a deeper understanding of One More Level.

- Gain insights into One More Level's historical outcomes by reviewing our past performance report.

Make It Happen

- Embark on your investment journey to our 329 European Penny Stocks selection here.

- Interested In Other Possibilities? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:OML

One More Level

A gaming company, develops video games for consoles and PCs in Poland.

Moderate risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.