- Poland

- /

- Entertainment

- /

- WSE:CDR

Exploring 3 High Growth Tech Stocks In Europe

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index recently edged higher, buoyed by easing trade tensions and slowing inflation in major economies, investor sentiment remains cautiously optimistic about the region's economic prospects. In this environment, identifying high growth tech stocks involves looking for companies that can leverage technological advancements and maintain robust growth trajectories despite broader market uncertainties.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.85% | 45.05% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| Yubico | 20.18% | 30.36% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 26.03% | 43.09% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

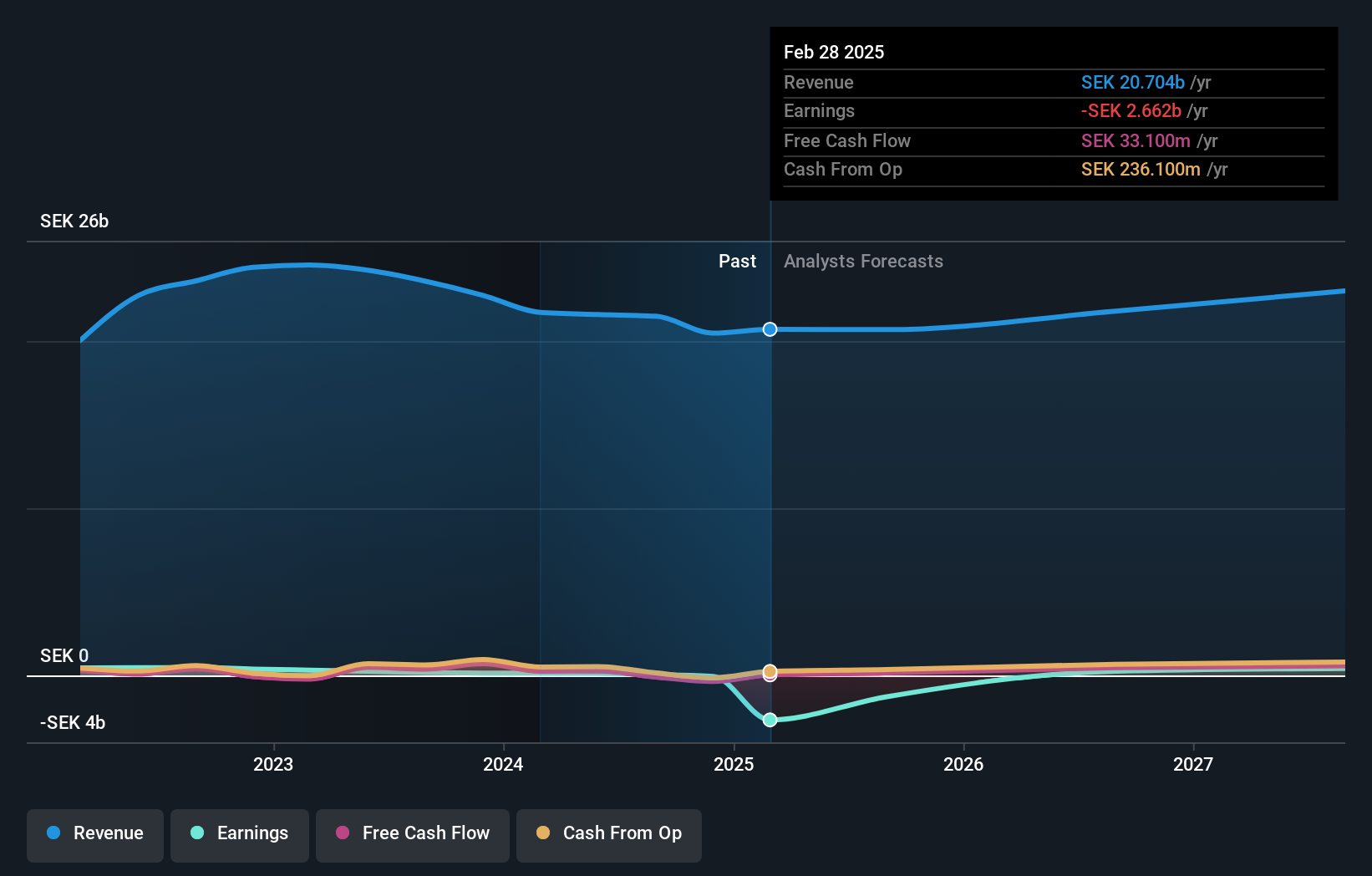

Dustin Group (OM:DUST)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Dustin Group AB (publ) operates as an online provider of IT products and services across the Nordic and Benelux regions, with a market cap of approximately SEK2.71 billion.

Operations: The company generates revenue primarily through its LCP segment, which accounts for SEK14.86 billion. Segment adjustments contribute SEK5.85 billion to the overall financial structure.

Dustin Group's recent strategic maneuvers, including a substantial rights issue raising SEK 1.27 billion, signal a robust approach to solidifying its financial base amidst challenging market conditions evidenced by a net loss of SEK 2.53 billion in Q2 2025. Despite these hurdles, the company is poised for recovery with an expected annual earnings growth of 116.07%. This forecast aligns with the broader aim to transition towards profitability within three years, surpassing average market projections. Moreover, Dustin's commitment to innovation and adaptation in its service offerings could catalyze its long-term success in the competitive tech landscape of Europe.

- Navigate through the intricacies of Dustin Group with our comprehensive health report here.

Evaluate Dustin Group's historical performance by accessing our past performance report.

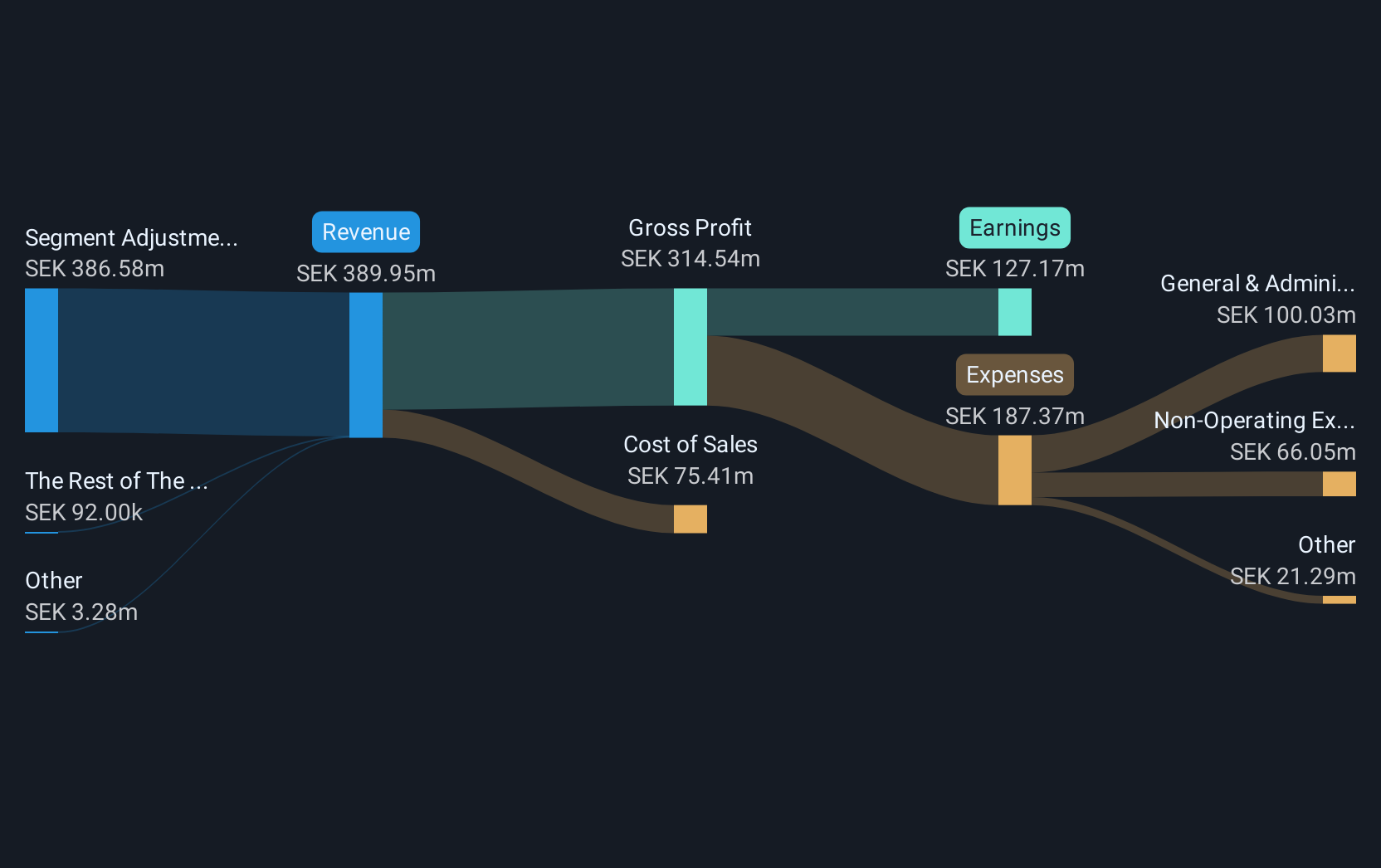

Intellego Technologies (OM:INT)

Simply Wall St Growth Rating: ★★★★★★

Overview: Intellego Technologies AB, with a market cap of SEK2.46 billion, manufactures and sells colorimetric ultraviolet indicators in Sweden.

Operations: The company focuses on producing and distributing colorimetric ultraviolet indicators within Sweden. It operates with a market capitalization of SEK2.46 billion, highlighting its significant presence in the niche market for UV indicators.

Intellego Technologies AB has demonstrated remarkable growth, with a revenue surge of 30.8% annually and earnings growth outpacing the industry at 61.1% over the past year. This performance is notably superior to the broader electronic sector’s decline of 11%. The company's commitment to R&D is reflected in its substantial investment, aligning with its strategic initiatives like the recent expansion deal worth up to $1.4 billion over five years with Shanghai Zhongyou Medical High-Tech Co., Ltd., enhancing its footprint in Asian healthcare markets. This collaboration not only bolsters Intellego’s market position but also underscores its innovative approach in healthcare technology, potentially setting new standards in medical equipment efficacy and safety across multiple countries.

- Click here to discover the nuances of Intellego Technologies with our detailed analytical health report.

Explore historical data to track Intellego Technologies' performance over time in our Past section.

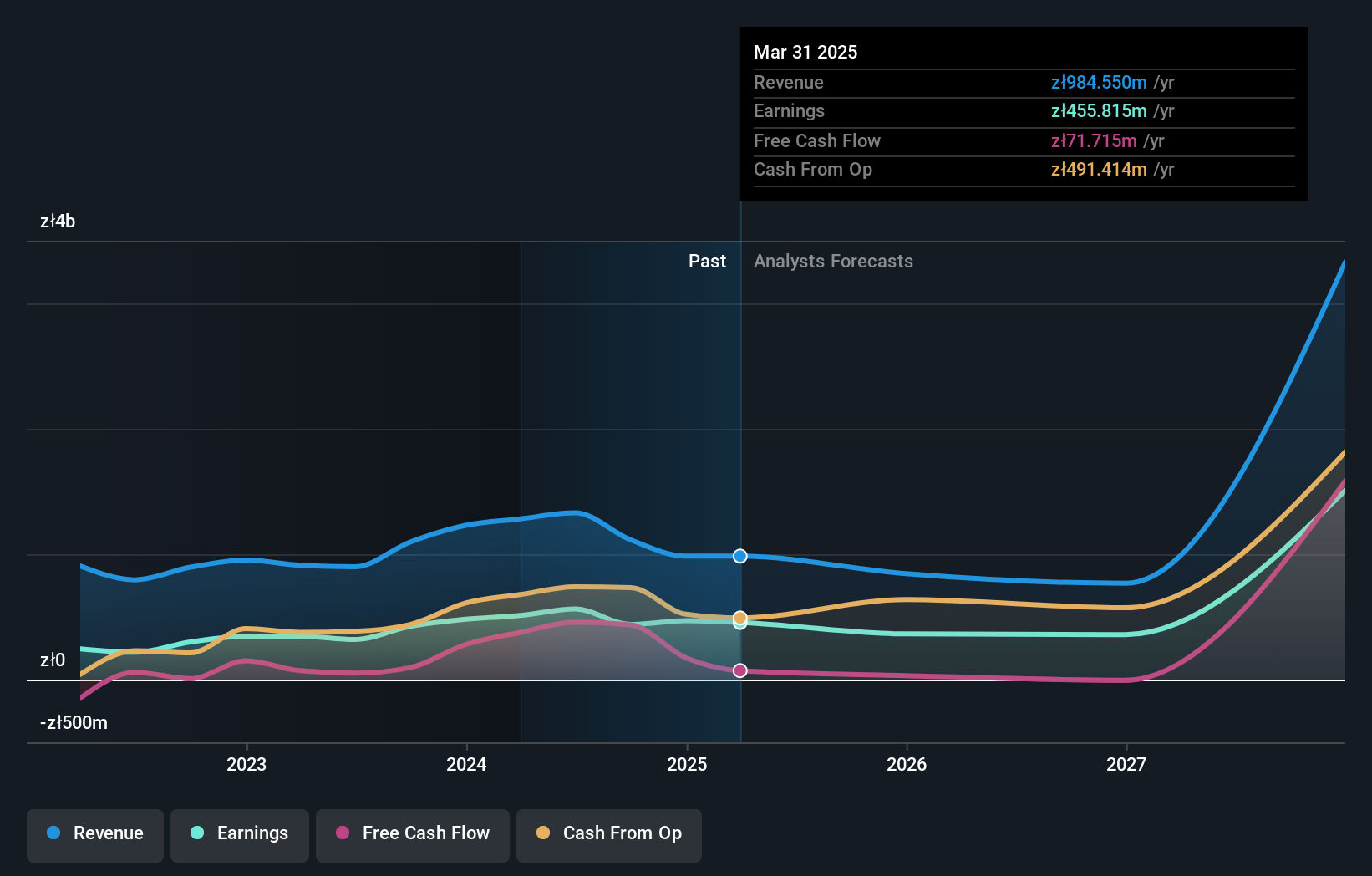

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CD Projekt S.A., with a market cap of PLN22.13 billion, is involved in the development, publishing, and digital distribution of video games for personal computers and consoles through its subsidiaries in Poland.

Operations: The company generates revenue primarily through its CD PROJEKT RED segment, contributing PLN795.50 million, and the GOG.Com platform, adding PLN203.79 million. The focus is on video game development and digital distribution for PCs and consoles in Poland.

CD Projekt, amidst a challenging market, demonstrates robust growth with projected annual revenue and earnings increases of 36.7% and 51.2%, respectively, significantly outpacing the Polish market's averages of 4.7% and 13.3%. Despite a slight year-over-year dip in net income from PLN 100.06 million to PLN 86 million in Q1 2025, the company maintains strong free cash flow and high-quality earnings characterized by substantial non-cash components. This financial health is underpinned by strategic R&D investments that not only fuel innovation but also enhance its competitive edge in the gaming industry—an area where continuous technological advancements are critical for sustaining growth and capturing consumer interest globally.

- Delve into the full analysis health report here for a deeper understanding of CD Projekt.

Understand CD Projekt's track record by examining our Past report.

Taking Advantage

- Take a closer look at our European High Growth Tech and AI Stocks list of 226 companies by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:CDR

CD Projekt

Together its subsidiaries, engages in the development, publishing, and digital distribution of video games for personal computers and video game consoles in Poland.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives