- Poland

- /

- Entertainment

- /

- WSE:CDA

A Piece Of The Puzzle Missing From CDA S.A.'s (WSE:CDA) 27% Share Price Climb

Despite an already strong run, CDA S.A. (WSE:CDA) shares have been powering on, with a gain of 27% in the last thirty days. The last 30 days bring the annual gain to a very sharp 47%.

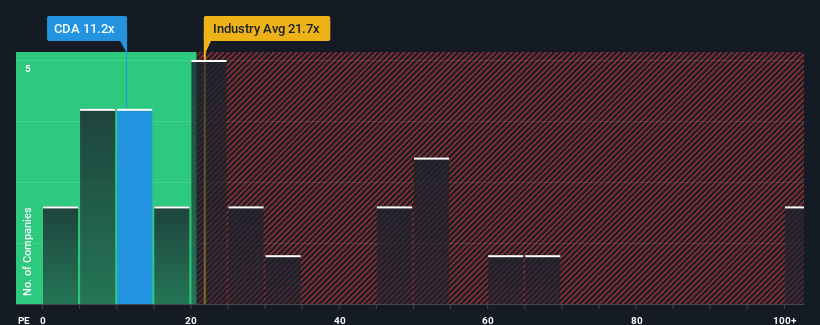

Although its price has surged higher, there still wouldn't be many who think CDA's price-to-earnings (or "P/E") ratio of 11.2x is worth a mention when the median P/E in Poland is similar at about 12x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

CDA has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for CDA

Does Growth Match The P/E?

CDA's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 27% last year. The strong recent performance means it was also able to grow EPS by 50% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 7.8% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's curious that CDA's P/E sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On CDA's P/E

CDA appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that CDA currently trades on a lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least the risk of a price drop looks to be subdued if recent medium-term earnings trends continue, but investors seem to think future earnings could see some volatility.

It is also worth noting that we have found 4 warning signs for CDA (1 is a bit concerning!) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:CDA

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives