- Poland

- /

- Basic Materials

- /

- WSE:RPC

It's A Story Of Risk Vs Reward With Zaklady Magnezytowe ROPCZYCE S.A. (WSE:RPC)

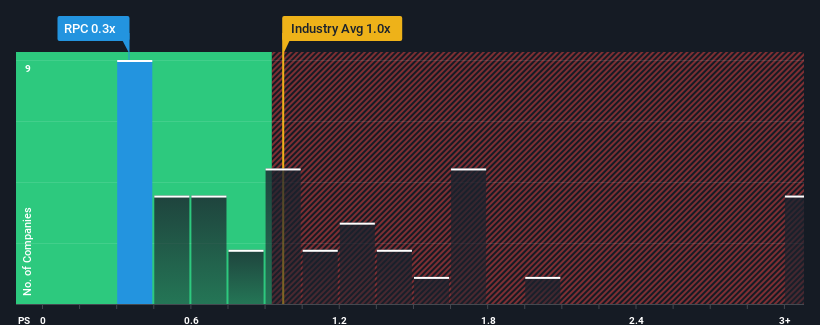

When you see that almost half of the companies in the Basic Materials industry in Poland have price-to-sales ratios (or "P/S") above 1x, Zaklady Magnezytowe ROPCZYCE S.A. (WSE:RPC) looks to be giving off some buy signals with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Zaklady Magnezytowe ROPCZYCE

How Has Zaklady Magnezytowe ROPCZYCE Performed Recently?

For example, consider that Zaklady Magnezytowe ROPCZYCE's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Zaklady Magnezytowe ROPCZYCE, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Zaklady Magnezytowe ROPCZYCE?

In order to justify its P/S ratio, Zaklady Magnezytowe ROPCZYCE would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 26% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.0% shows it's noticeably more attractive.

In light of this, it's peculiar that Zaklady Magnezytowe ROPCZYCE's P/S sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Zaklady Magnezytowe ROPCZYCE's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Zaklady Magnezytowe ROPCZYCE currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for Zaklady Magnezytowe ROPCZYCE (1 is a bit unpleasant!) that you should be aware of.

If these risks are making you reconsider your opinion on Zaklady Magnezytowe ROPCZYCE, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zaklady Magnezytowe ROPCZYCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:RPC

Zaklady Magnezytowe ROPCZYCE

Manufactures and sells basic and aluminosilicate refractory materials in Poland and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives