Grupa Azoty Zaklady Chemiczne Police (WSE:PCE) Share Prices Have Dropped 48% In The Last Five Years

While it may not be enough for some shareholders, we think it is good to see the Grupa Azoty Zaklady Chemiczne Police S.A. (WSE:PCE) share price up 14% in a single quarter. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 48% in that half decade.

Check out our latest analysis for Grupa Azoty Zaklady Chemiczne Police

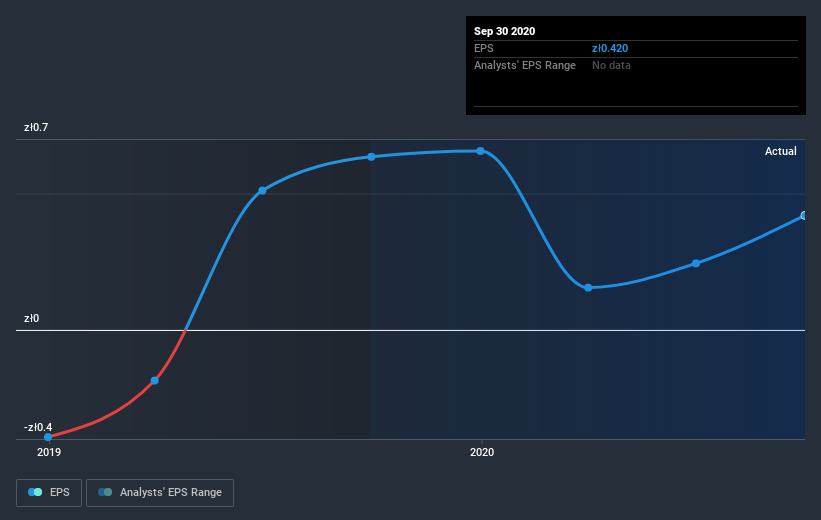

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Grupa Azoty Zaklady Chemiczne Police's earnings per share (EPS) dropped by 25% each year. The share price decline of 12% per year isn't as bad as the EPS decline. The relatively muted share price reaction might be because the market expects the business to turn around.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Grupa Azoty Zaklady Chemiczne Police's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

We've already covered Grupa Azoty Zaklady Chemiczne Police's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Grupa Azoty Zaklady Chemiczne Police's TSR of was a loss of 37% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Grupa Azoty Zaklady Chemiczne Police shareholders have received a total shareholder return of 25% over one year. Notably the five-year annualised TSR loss of 6% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Grupa Azoty Zaklady Chemiczne Police better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Grupa Azoty Zaklady Chemiczne Police you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on PL exchanges.

If you decide to trade Grupa Azoty Zaklady Chemiczne Police, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:PCE

Grupa Azoty Zaklady Chemiczne Police

Grupa Azoty Zaklady Chemiczne Police S.A.

Good value with mediocre balance sheet.