- Poland

- /

- Metals and Mining

- /

- WSE:KGH

Those who invested in KGHM Polska Miedz (WSE:KGH) five years ago are up 41%

While KGHM Polska Miedz S.A. (WSE:KGH) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 20% in the last quarter. On the bright side the share price is up over the last half decade. In that time, it is up 33%, which isn't bad, but is below the market return of 57%.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

Check out our latest analysis for KGHM Polska Miedz

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

KGHM Polska Miedz's earnings per share are down 27% per year, despite strong share price performance over five years. The impact of extraordinary items on earnings, in the last year, partially explain the diversion.

Essentially, it doesn't seem likely that investors are focused on EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

The modest 1.2% dividend yield is unlikely to be propping up the share price. In contrast revenue growth of 9.8% per year is probably viewed as evidence that KGHM Polska Miedz is growing, a real positive. In that case, the company may be sacrificing current earnings per share to drive growth.

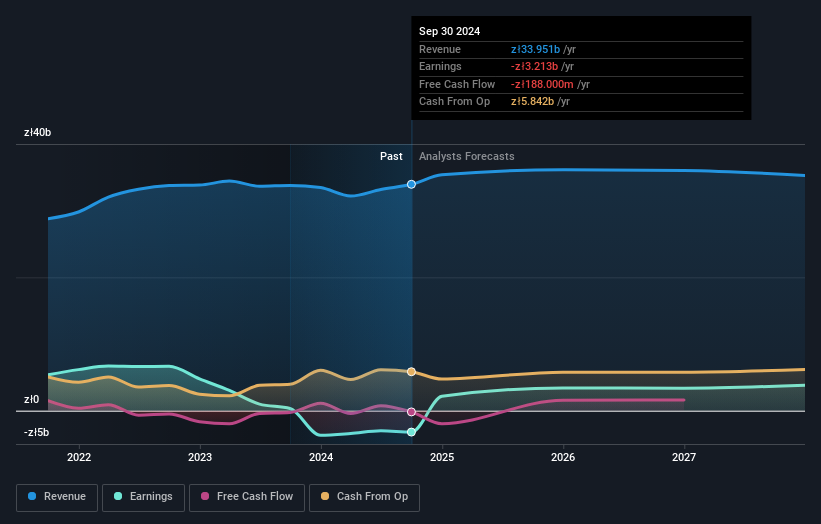

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

KGHM Polska Miedz is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think KGHM Polska Miedz will earn in the future (free analyst consensus estimates)

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of KGHM Polska Miedz, it has a TSR of 41% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

KGHM Polska Miedz provided a TSR of 9.7% over the last twelve months. But that return falls short of the market. The silver lining is that the gain was actually better than the average annual return of 7% per year over five year. This suggests the company might be improving over time. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Polish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if KGHM Polska Miedz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:KGH

KGHM Polska Miedz

Engages in the production and sale of copper, precious metals, and non-ferrous metals in Poland and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives