- Poland

- /

- Metals and Mining

- /

- WSE:KGH

Some Confidence Is Lacking In KGHM Polska Miedz S.A.'s (WSE:KGH) P/S

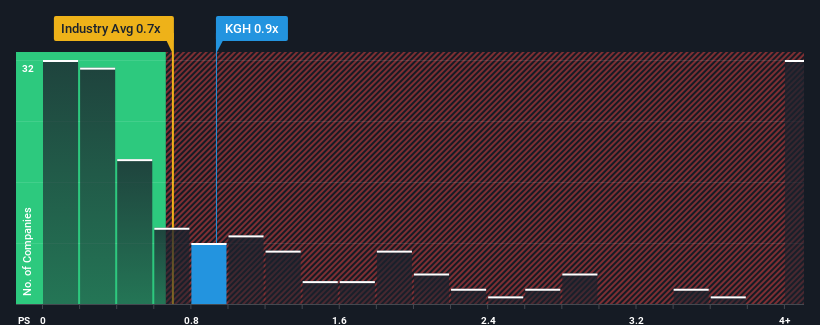

KGHM Polska Miedz S.A.'s (WSE:KGH) price-to-sales (or "P/S") ratio of 0.9x may not look like an appealing investment opportunity when you consider close to half the companies in the Metals and Mining industry in Poland have P/S ratios below 0.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for KGHM Polska Miedz

What Does KGHM Polska Miedz's Recent Performance Look Like?

With only a limited decrease in revenue compared to most other companies of late, KGHM Polska Miedz has been doing relatively well. The P/S ratio is probably high because investors think this comparatively better revenue performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price, especially if revenue continues to dissolve.

Want the full picture on analyst estimates for the company? Then our free report on KGHM Polska Miedz will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For KGHM Polska Miedz?

KGHM Polska Miedz's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.5%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 22% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 3.8% per year as estimated by the ten analysts watching the company. With the industry predicted to deliver 3.9% growth per year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that KGHM Polska Miedz's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does KGHM Polska Miedz's P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Given KGHM Polska Miedz's future revenue forecasts are in line with the wider industry, the fact that it trades at an elevated P/S is somewhat surprising. Right now we are uncomfortable with the relatively high share price as the predicted future revenues aren't likely to support such positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for KGHM Polska Miedz with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of KGHM Polska Miedz's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if KGHM Polska Miedz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:KGH

KGHM Polska Miedz

Engages in the production and sale of copper, precious metals, and non-ferrous metals in Poland and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives