Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that KGHM Polska Miedz S.A. (WSE:KGH) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for KGHM Polska Miedz

What Is KGHM Polska Miedz's Debt?

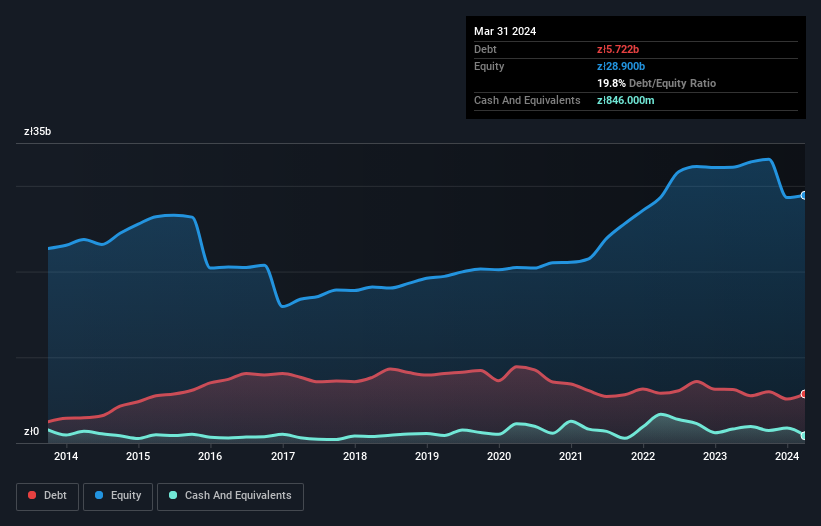

You can click the graphic below for the historical numbers, but it shows that KGHM Polska Miedz had zł5.72b of debt in March 2024, down from zł6.25b, one year before. However, it also had zł846.0m in cash, and so its net debt is zł4.88b.

How Strong Is KGHM Polska Miedz's Balance Sheet?

The latest balance sheet data shows that KGHM Polska Miedz had liabilities of zł10.7b due within a year, and liabilities of zł11.5b falling due after that. On the other hand, it had cash of zł846.0m and zł2.25b worth of receivables due within a year. So it has liabilities totalling zł19.1b more than its cash and near-term receivables, combined.

This is a mountain of leverage relative to its market capitalization of zł29.6b. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

We'd say that KGHM Polska Miedz's moderate net debt to EBITDA ratio ( being 1.6), indicates prudence when it comes to debt. And its commanding EBIT of 1k times its interest expense, implies the debt load is as light as a peacock feather. It is just as well that KGHM Polska Miedz's load is not too heavy, because its EBIT was down 69% over the last year. When it comes to paying off debt, falling earnings are no more useful than sugary sodas are for your health. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine KGHM Polska Miedz's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, KGHM Polska Miedz recorded negative free cash flow, in total. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

On the face of it, KGHM Polska Miedz's conversion of EBIT to free cash flow left us tentative about the stock, and its EBIT growth rate was no more enticing than the one empty restaurant on the busiest night of the year. But on the bright side, its interest cover is a good sign, and makes us more optimistic. Overall, we think it's fair to say that KGHM Polska Miedz has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. Even though KGHM Polska Miedz lost money on the bottom line, its positive EBIT suggests the business itself has potential. So you might want to check out how earnings have been trending over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if KGHM Polska Miedz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:KGH

KGHM Polska Miedz

Engages in the production and sale of copper, precious metals, and non-ferrous metals in Poland and internationally.

Flawless balance sheet and good value.