Undiscovered Gems With Potential On None Exchange December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and looming political uncertainties, smaller-cap indexes have faced significant challenges, underperforming their larger counterparts. Despite this backdrop, the search for undiscovered gems in the small-cap sector remains compelling as these stocks often offer unique growth potential that can thrive even amid broader market volatility. Identifying such opportunities requires a keen understanding of market dynamics and an eye for companies with strong fundamentals that may not yet be fully appreciated by the wider market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| PBA Holdings Bhd | 1.86% | 7.41% | 40.17% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Pure Cycle | 5.31% | -4.44% | -5.74% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Societatea Energetica Electrica (BVB:EL)

Simply Wall St Value Rating: ★★★★☆☆

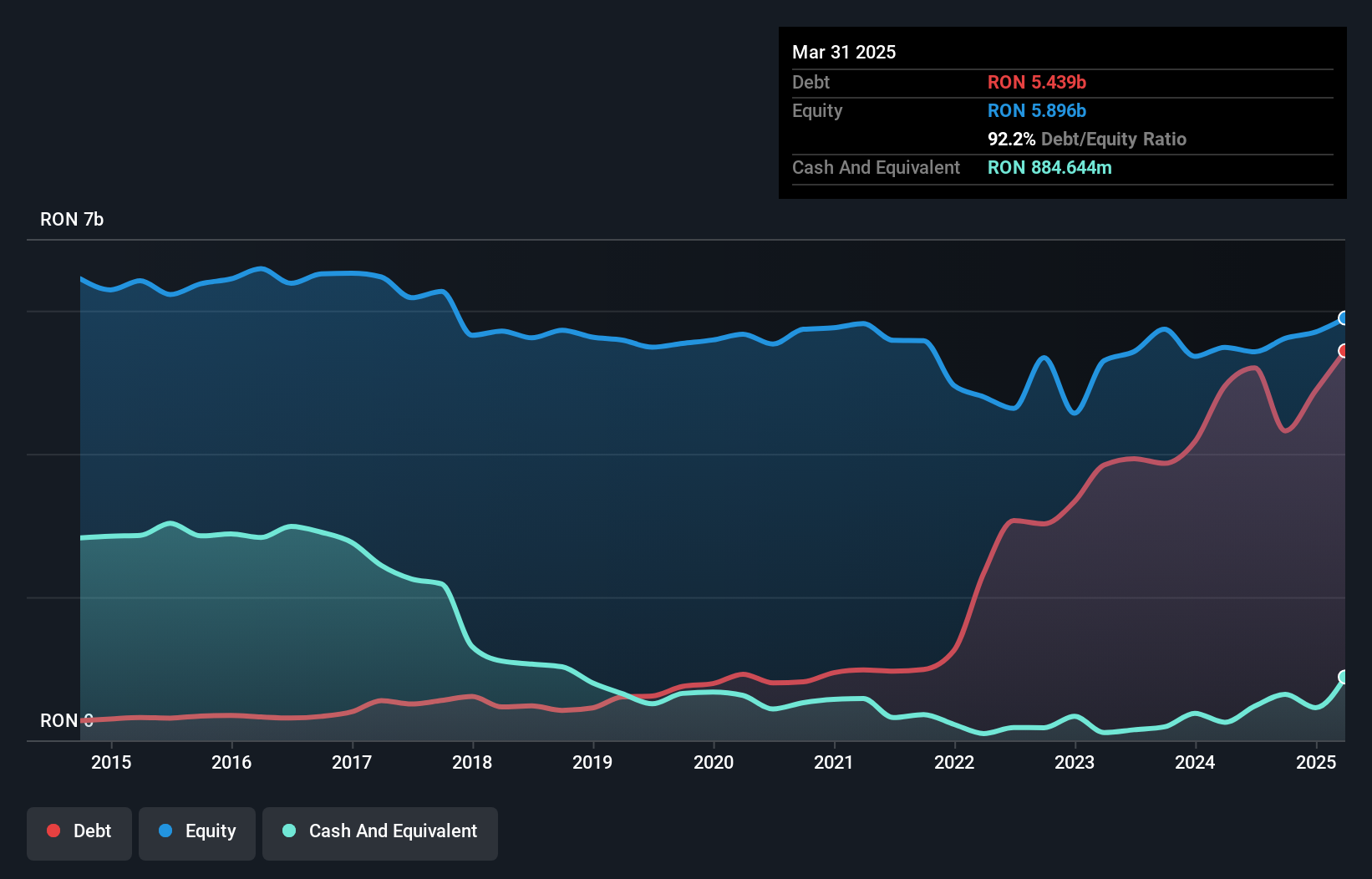

Overview: Societatea Energetica Electrica S.A. operates in Romania, focusing on the construction, operation, and maintenance of electricity distribution networks, with a market capitalization of RON4.35 billion.

Operations: Electrica generates revenue primarily from electricity and natural gas supply (RON9.86 billion) and electricity distribution (RON4.82 billion), with additional income from external electricity network maintenance (RON130.35 million).

Electrica, a notable player in Romania's energy sector, recently became profitable and is trading at 12.6% below its estimated fair value. Despite a high net debt to equity ratio of 65.6%, the company's interest payments are well covered by EBIT with a coverage of 3.4x, indicating solid financial management amidst industry challenges. Recent strategic moves include the formation of Electrica Esyasoft Smart Solutions S.A., focusing on smart grid technologies, which aligns with their innovative growth trajectory. However, sales and net income have dipped compared to last year, highlighting areas for potential improvement in operational efficiency and market positioning.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

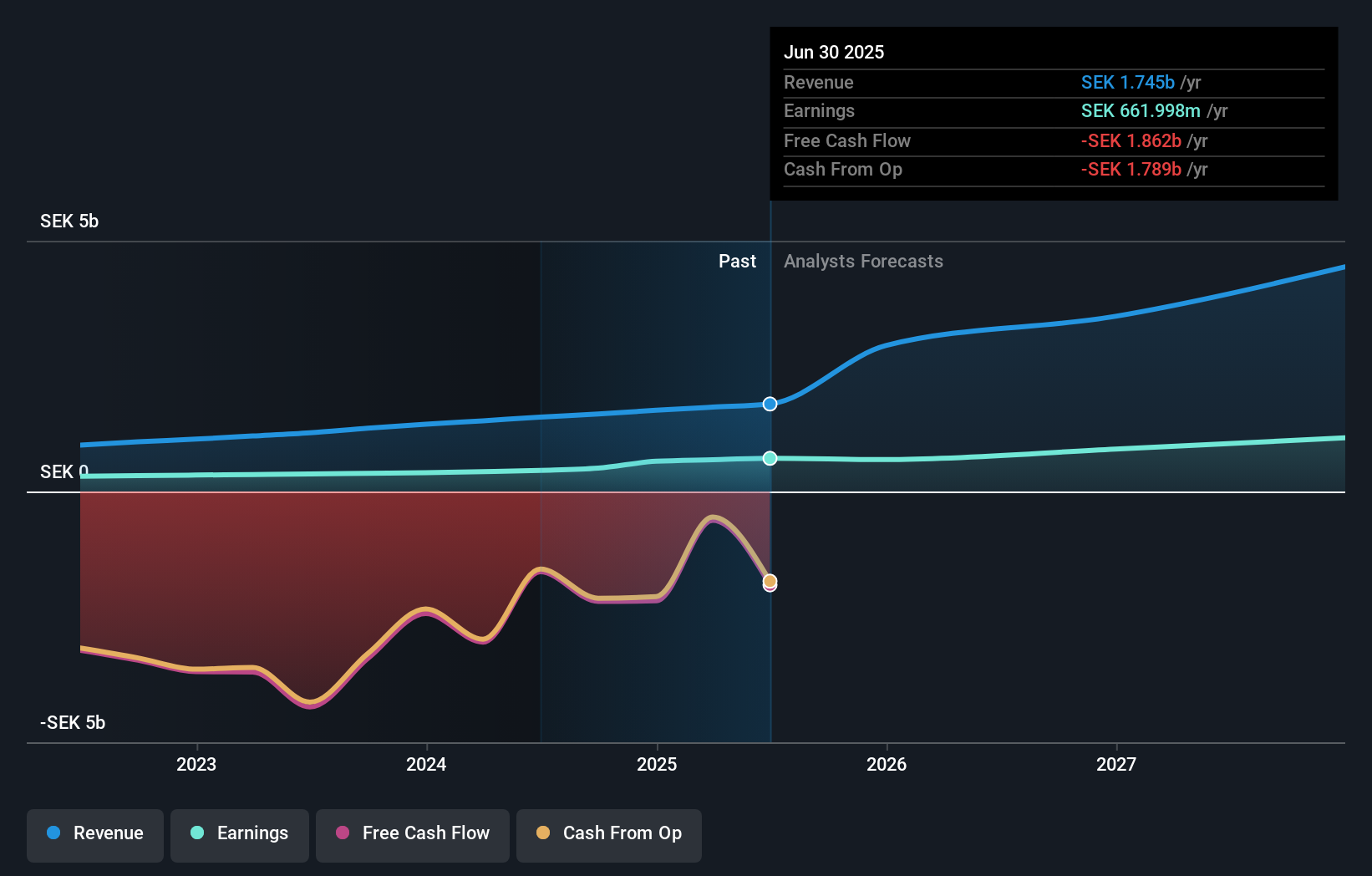

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK7.89 billion.

Operations: TF Bank generates revenue primarily through its credit cards, consumer lending, and e-commerce solutions segments, with consumer lending contributing SEK602.16 million and credit cards SEK563.14 million.

TF Bank, a smaller player in the financial sector, is trading at 39% below its estimated fair value. It boasts a strong earnings growth of 28.1% over the past year, outpacing the industry average of 0.2%. With total assets of SEK25.3 billion and total loans amounting to SEK20.3 billion, it relies heavily on low-risk customer deposits for funding (95%). However, it faces challenges with high non-performing loans at 11.4% and a low allowance for bad loans at just 61%. Recent insider selling raises questions about internal confidence despite its otherwise promising financial metrics.

- Dive into the specifics of TF Bank here with our thorough health report.

Gain insights into TF Bank's historical performance by reviewing our past performance report.

Newag (WSE:NWG)

Simply Wall St Value Rating: ★★★★★★

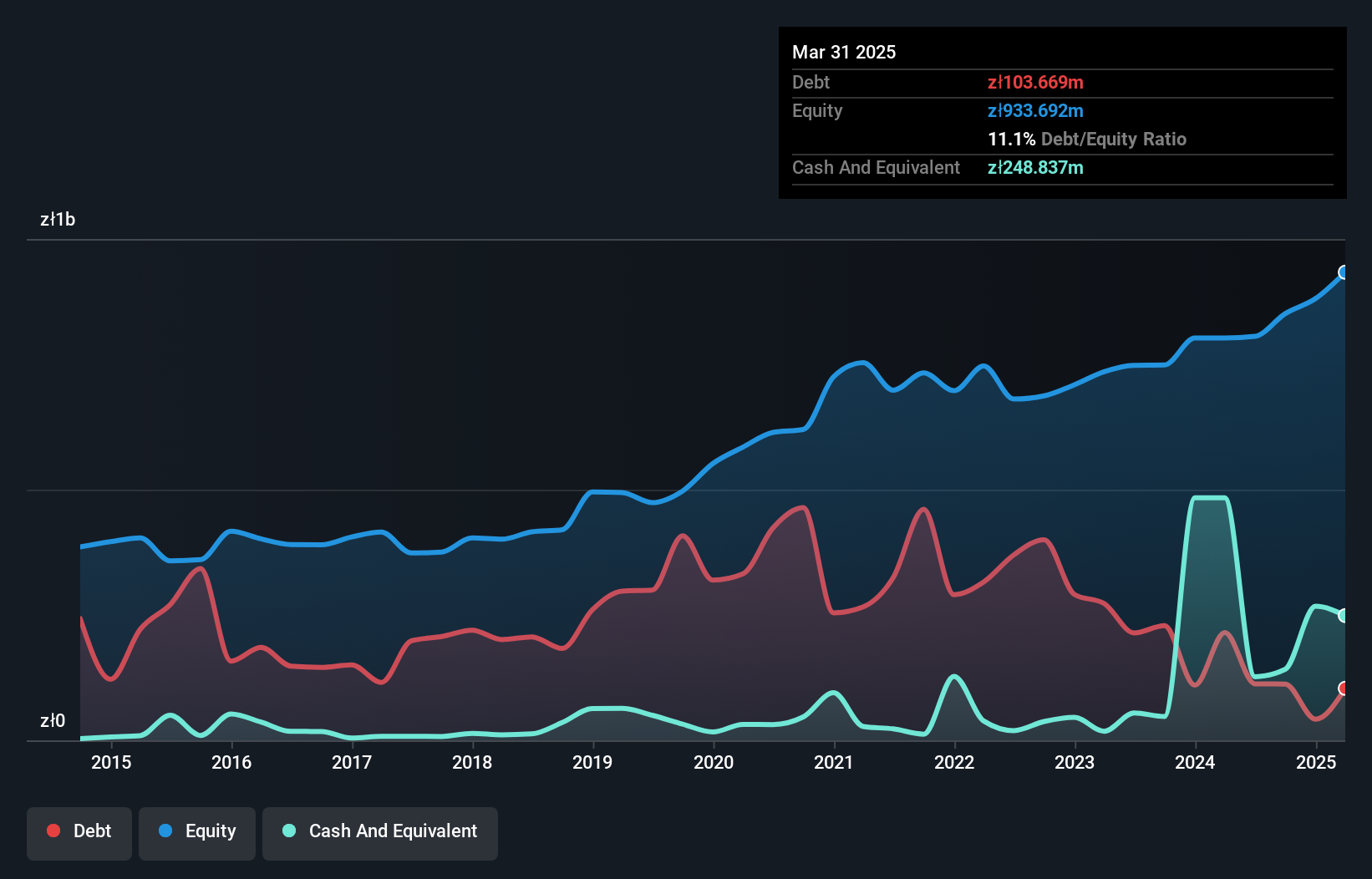

Overview: Newag S.A. focuses on the production and sale of railway locomotives and rolling stocks in Poland, with a market capitalization of PLN1.80 billion.

Operations: Newag S.A. generates revenue primarily from repair services, modernization of rolling stock, and production of rolling stock and control systems, contributing PLN1.77 billion. Activities of financial holdings add PLN85.93 million to its revenue streams.

Newag's recent performance highlights its potential as a promising player in the machinery sector. Sales for Q3 2024 reached PLN 564.97 million, significantly up from PLN 243.32 million last year, while net income rose to PLN 45.14 million from just PLN 0.725 million a year ago, showcasing strong profitability growth with basic earnings per share at PLN 1.01 compared to PLN 0.01 previously. The company's debt-to-equity ratio has impressively reduced from 82% to just over 13% over five years, indicating effective debt management and financial stability, further supported by high-quality earnings and positive free cash flow trends.

Taking Advantage

- Click through to start exploring the rest of the 4630 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newag might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:NWG

Newag

Engages in the production and sale of railway locomotives and rolling stocks in Poland.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives