If You Like EPS Growth Then Check Out Grupa Azoty (WSE:ATT) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Grupa Azoty (WSE:ATT). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for Grupa Azoty

How Fast Is Grupa Azoty Growing Its Earnings Per Share?

In the last three years Grupa Azoty's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Grupa Azoty's EPS shot from zł3.14 to zł5.87, over the last year. Year on year growth of 87% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

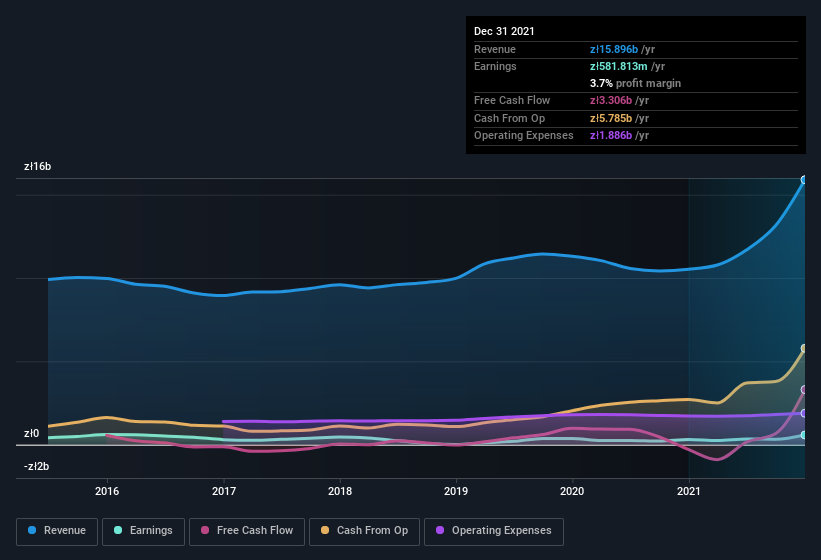

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Grupa Azoty maintained stable EBIT margins over the last year, all while growing revenue 51% to zł16b. That's progress.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Grupa Azoty Insiders Aligned With All Shareholders?

I always like to check up on CEO compensation, because I think that reasonable pay levels, around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalizations between zł1.8b and zł7.2b, like Grupa Azoty, the median CEO pay is around zł2.3m.

The Grupa Azoty CEO received total compensation of only zł68k in the year to . You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. I'd also argue reasonable pay levels attest to good decision making more generally.

Is Grupa Azoty Worth Keeping An Eye On?

Grupa Azoty's earnings have taken off like any random crypto-currency did, back in 2017. With rocketing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. Meanwhile, the very reasonable CEO pay reassures me a little, since it points to an absence profligacy. While I couldn't be sure without a deeper dive, it does seem that Grupa Azoty has the hallmarks of a quality business; and that would make it well worth watching. We should say that we've discovered 3 warning signs for Grupa Azoty that you should be aware of before investing here.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:ATT

Grupa Azoty

Manufactures and sells fertilizers, plastics, and other chemicals in Poland, Germany, South America, Asia, other European Union countries, and internationally.

Undervalued with moderate growth potential.

Market Insights

Community Narratives