- Switzerland

- /

- Insurance

- /

- SWX:VAHN

European Dividend Stocks To Consider

Reviewed by Simply Wall St

As the European markets navigate mixed performances, with the STOXX Europe 600 Index recently pulling back after hitting a fresh high, investors are keeping a close eye on interest rate decisions and economic growth indicators. In this context, dividend stocks can offer a stable income stream and potential for long-term appreciation, making them an attractive option for those seeking to balance risk and return in their portfolios.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.69% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.28% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.83% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.42% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.00% | ★★★★★★ |

| Evolution (OM:EVO) | 4.94% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.21% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.69% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.77% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Manitou BF (ENXTPA:MTU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Manitou BF SA, along with its subsidiaries, develops, manufactures, and distributes equipment and services across various regions including France, Southern Europe, Northern Europe, the Americas, Asia, the Pacific, Africa, and the Middle East; it has a market cap of approximately €679.63 million.

Operations: Manitou BF SA generates its revenue primarily from its Products Division, which accounts for €2.11 billion, and its Services & Solutions (S&S) Division, contributing €416.52 million.

Dividend Yield: 7.0%

Manitou BF's dividend yield of 7.04% places it among the top 25% in France, though its payments have been volatile over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios of 65.9% and 37.2%, respectively. However, recent guidance indicates a revenue decline for 2025 and shrinking profit margins from last year. The stock trades at a favorable P/E ratio of 9.3x compared to the French market average of 16.1x.

- Navigate through the intricacies of Manitou BF with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Manitou BF's share price might be too pessimistic.

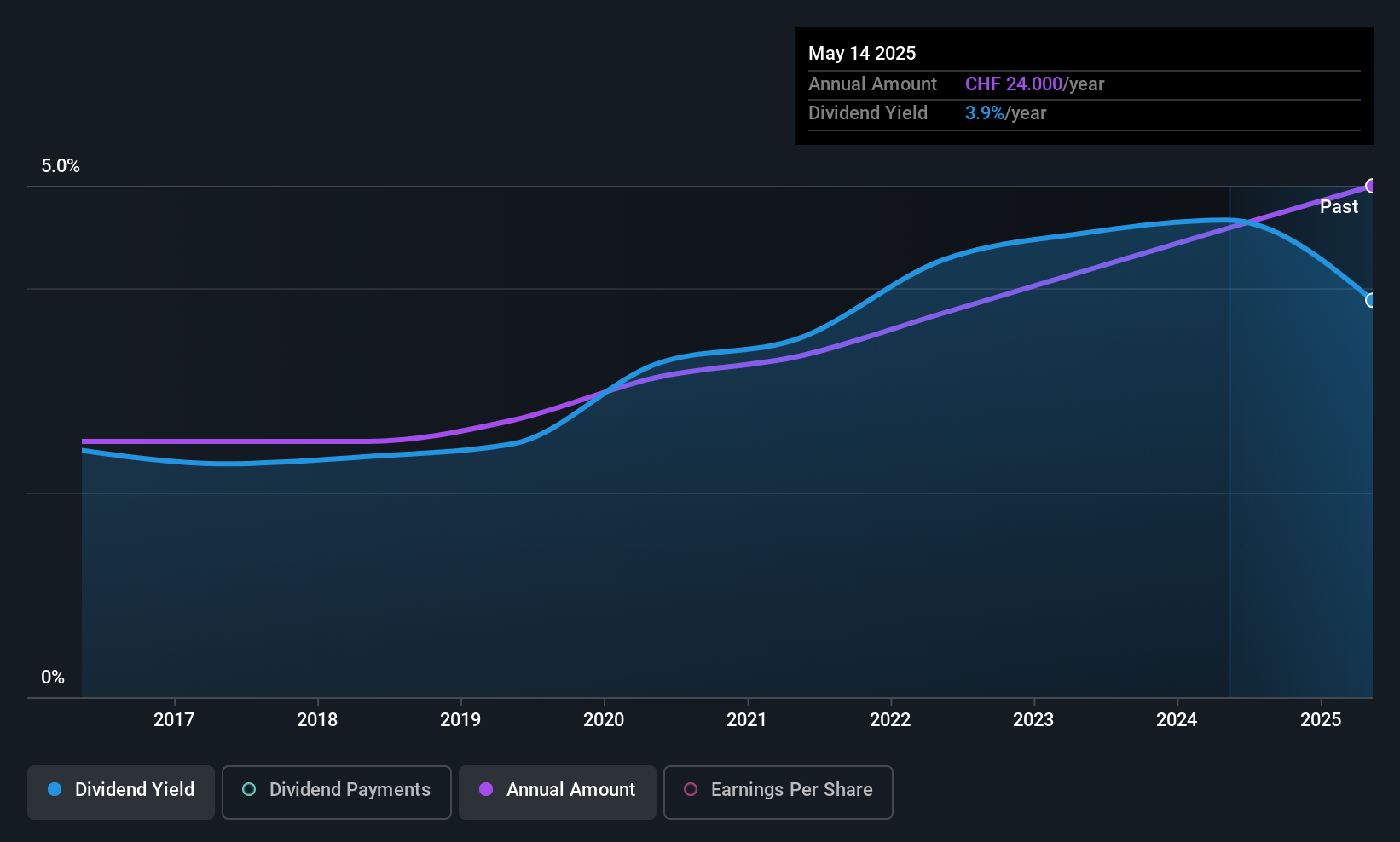

Vaudoise Assurances Holding (SWX:VAHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vaudoise Assurances Holding SA offers insurance products and services mainly in Switzerland, with a market capitalization of CHF1.85 billion.

Operations: Vaudoise Assurances Holding SA generates its revenue through various insurance products and services primarily within Switzerland.

Dividend Yield: 3.8%

Vaudoise Assurances Holding's dividend yield of 3.76% is slightly below the top 25% in Switzerland but has been stable and growing over the past decade. Despite a low payout ratio of 46.5%, dividends are not covered by free cash flows, raising sustainability concerns. Recent inclusion in the S&P Global BMI Index may enhance visibility, while net income for H1 2025 increased to CHF 84.09 million from CHF 81.17 million year-on-year, indicating steady earnings growth.

- Get an in-depth perspective on Vaudoise Assurances Holding's performance by reading our dividend report here.

- According our valuation report, there's an indication that Vaudoise Assurances Holding's share price might be on the cheaper side.

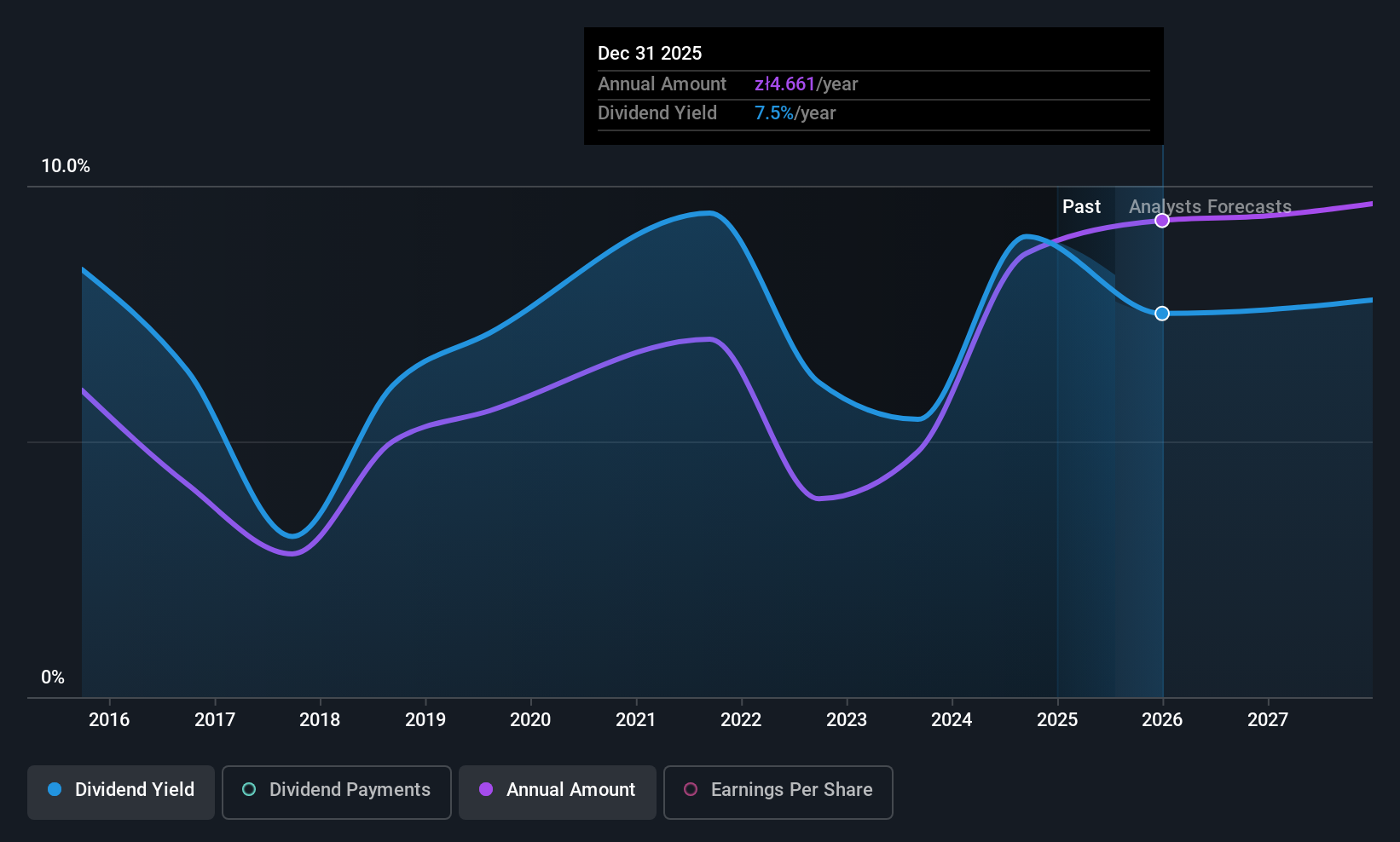

Powszechny Zaklad Ubezpieczen (WSE:PZU)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Powszechny Zaklad Ubezpieczen SA offers life and non-life insurance products and services in Poland, the Baltic States, and Ukraine, with a market cap of PLN52.67 billion.

Operations: Powszechny Zaklad Ubezpieczen SA's revenue segments include Mass Insurance (PLN16.13 billion), Banking Activities (PLN42.39 billion), Corporate Insurance (PLN5.45 billion), Group and Individually Continued Insurance (PLN11.91 billion), Baltic Countries (PLN3.50 billion), Investments (PLN844 million), Individual Protective Insurance (PLN1.55 billion), Pensions (PLN373 million), Ukraine operations (PLN281 million) and Life Investment Insurance (PLN109 million).

Dividend Yield: 7.3%

Powszechny Zaklad Ubezpieczen's dividend yield is in the top 25% of Polish dividend payers, supported by a reasonable payout ratio of 63% and a low cash payout ratio of 14.6%, ensuring coverage by both earnings and cash flows. Despite past volatility in dividends, recent earnings growth—net income for H1 2025 rose to PLN 3.23 billion from PLN 2.45 billion year-on-year—suggests potential for stability. The stock trades significantly below estimated fair value, offering attractive entry points for investors seeking dividends.

- Take a closer look at Powszechny Zaklad Ubezpieczen's potential here in our dividend report.

- Our valuation report here indicates Powszechny Zaklad Ubezpieczen may be undervalued.

Key Takeaways

- Embark on your investment journey to our 228 Top European Dividend Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VAHN

Vaudoise Assurances Holding

Provides insurance products and services primarily in Switzerland.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives