Spotlight On European Penny Stocks: Ilkka Oyj And Two More To Consider

Reviewed by Simply Wall St

As European markets experience a mix of relief from the U.S. government reopening and tempered enthusiasm due to cooling sentiment on artificial intelligence, investors are exploring diverse opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those looking beyond the mainstream market players. While the term might seem outdated, these stocks can still offer potential growth and value when backed by strong financial health and clear growth trajectories.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.62 | €1.25B | ✅ 5 ⚠️ 2 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.80 | €85.24M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.965 | €27.15M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €252.7M | ✅ 3 ⚠️ 3 View Analysis > |

| Altri SGPS (ENXTLS:ALTR) | €4.745 | €973.35M | ✅ 3 ⚠️ 2 View Analysis > |

| Libertas 7 (BME:LIB) | €3.18 | €67.45M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.385 | €387.57M | ✅ 4 ⚠️ 1 View Analysis > |

| High (ENXTPA:HCO) | €3.99 | €78.05M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.06 | €284.73M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 278 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ilkka Oyj (HLSE:ILKKA2)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ilkka Oyj, with a market cap of €109.23 million, operates in Finland and internationally through its subsidiaries, offering marketing, technology, and data services.

Operations: Ilkka Oyj does not report specific revenue segments.

Market Cap: €109.23M

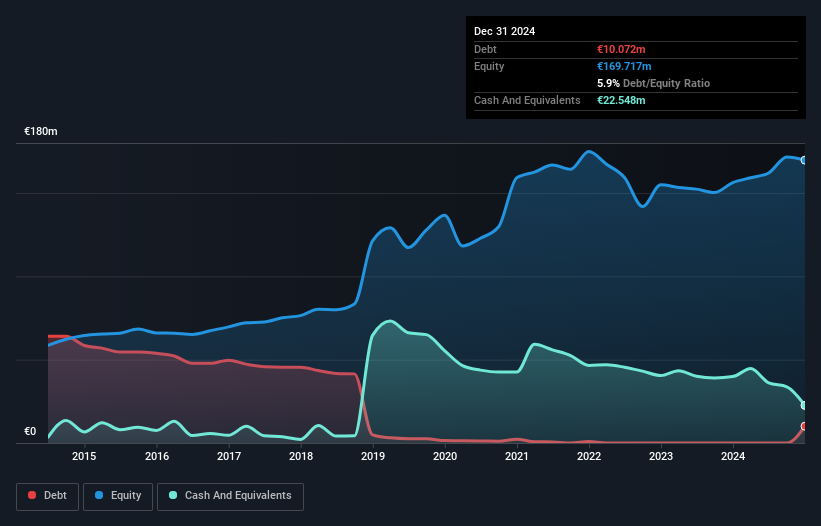

Ilkka Oyj presents a mixed picture for investors interested in penny stocks. The company's market cap is €109.23 million, and it has demonstrated robust earnings growth of 30% over the past year, significantly outperforming the media industry. However, its return on equity remains low at 3%. While Ilkka's short-term assets exceed both short and long-term liabilities, its net profit margins have declined compared to last year. The management team is experienced with an average tenure of 5.3 years, but the company faces challenges with unstable dividends and large one-off items affecting financial results. Recent earnings reports show improved sales and net income figures compared to the previous year.

- Click here to discover the nuances of Ilkka Oyj with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Ilkka Oyj's future.

4MASS Spólka Akcyjna (WSE:4MS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 4Mass Spólka Akcyjna is involved in the manufacture and distribution of make-up products, with a market capitalization of PLN103.25 million.

Operations: The company's revenue is primarily generated from its production and distribution of cosmetic products, amounting to PLN112.61 million.

Market Cap: PLN103.25M

4MASS Spólka Akcyjna offers a nuanced investment case within the penny stock realm, with a market cap of PLN103.25 million and recent half-year revenue of PLN52.97 million. Despite a challenging year-over-year decline in earnings and profit margins, the company maintains high-quality earnings and robust debt management, as its cash exceeds total debt and operating cash flow covers debt significantly. The Price-To-Earnings ratio at 8.2x suggests potential undervaluation compared to the Polish market average. However, negative earnings growth (-27.7%) over the past year poses concerns against its historically strong five-year profit growth trajectory of 45.4% annually.

- Get an in-depth perspective on 4MASS Spólka Akcyjna's performance by reading our balance sheet health report here.

- Gain insights into 4MASS Spólka Akcyjna's past trends and performance with our report on the company's historical track record.

Euro-Tax.pl (WSE:ETX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Euro-Tax.pl S.A., along with its subsidiaries, offers tax refund services in Poland and has a market cap of PLN12.40 million.

Operations: The company generates revenue from its operations in Romania (PLN5.85 million), Bulgaria (PLN4.52 million), Lower Silesia (PLN10.56 million), and Greater Poland (PLN11.20 million).

Market Cap: PLN12.4M

Euro-Tax.pl S.A. presents a mixed picture within the penny stock landscape, with a market cap of PLN12.40 million and diverse revenue streams across Poland and neighboring countries. The company's Return on Equity is outstanding at 40.8%, yet it faces challenges with declining profit margins (0.8% from 8.6%) and negative earnings growth (-91.5%) over the past year, contrasting its five-year earnings growth of 11.5% annually. Debt management is strong, as cash exceeds total debt significantly, but short-term liabilities surpass assets by PLN2M, indicating potential liquidity concerns despite trading below fair value estimates by 34%.

- Click here and access our complete financial health analysis report to understand the dynamics of Euro-Tax.pl.

- Assess Euro-Tax.pl's previous results with our detailed historical performance reports.

Key Takeaways

- Click this link to deep-dive into the 278 companies within our European Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ILKKA2

Ilkka Oyj

Provides marketing, technology, and data services in Finland and internationally.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives