- Germany

- /

- Oil and Gas

- /

- XTRA:ETG

Exploring Three Undiscovered Gems For Potential Portfolio Growth

Reviewed by Simply Wall St

In the current global market landscape, uncertainty over the incoming U.S. administration's policies has led to fluctuations in key indices, with the S&P 500 and Nasdaq Composite experiencing notable declines. Amidst this backdrop of policy-driven volatility and shifting economic indicators, investors are increasingly on the lookout for stocks that can offer potential growth opportunities while navigating these complex conditions. When seeking undiscovered gems for portfolio growth, it's essential to focus on companies with strong fundamentals and resilience in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SALUS Ljubljana d. d | NA | 13.11% | 9.95% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Etihad Atheeb Telecommunication | 12.19% | 30.82% | 63.88% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| S J Logistics (India) | 34.96% | 59.89% | 51.25% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

PSG Corporation (SET:PSG)

Simply Wall St Value Rating: ★★★★★★

Overview: PSG Corporation Public Company Limited, along with its subsidiary PSGC (Lao) Sole Company Limited, operates in turnkey engineering, procurement, and construction (EPC) as well as large-scale construction projects in Thailand and Laos, with a market cap of THB32.50 billion.

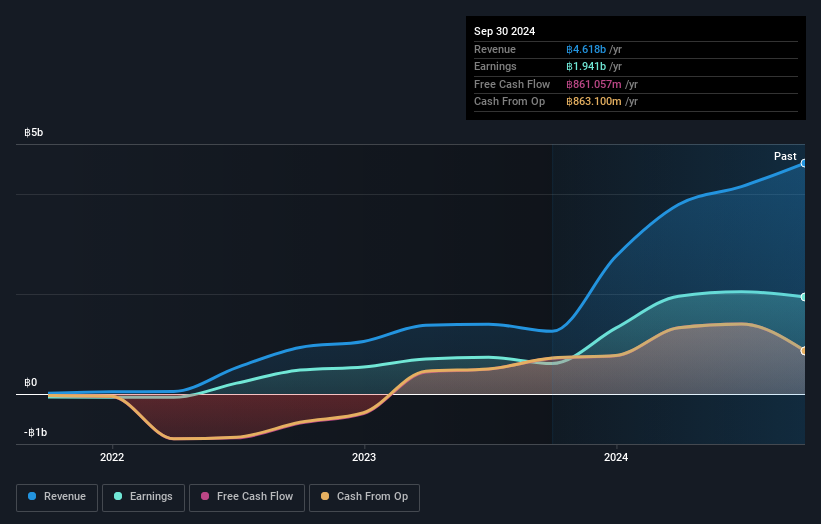

Operations: PSG generates revenue primarily from plant and building construction, totaling THB4.62 billion.

PSG Corporation, a nimble player in the construction sector, has shown impressive earnings growth of 217.9% over the past year, outpacing its industry's -17.7%. Despite a volatile share price recently, PSG remains debt-free with no debt compared to five years ago when its debt-to-equity ratio stood at 4.3%. The company reported third-quarter sales of THB 726 million and revenue of THB 730.37 million, though net income fell to THB 12.79 million from THB 116.72 million a year earlier. With positive free cash flow and high-quality non-cash earnings, PSG offers intriguing potential amidst market fluctuations.

- Navigate through the intricacies of PSG Corporation with our comprehensive health report here.

Explore historical data to track PSG Corporation's performance over time in our Past section.

Voxel (WSE:VOX)

Simply Wall St Value Rating: ★★★★★★

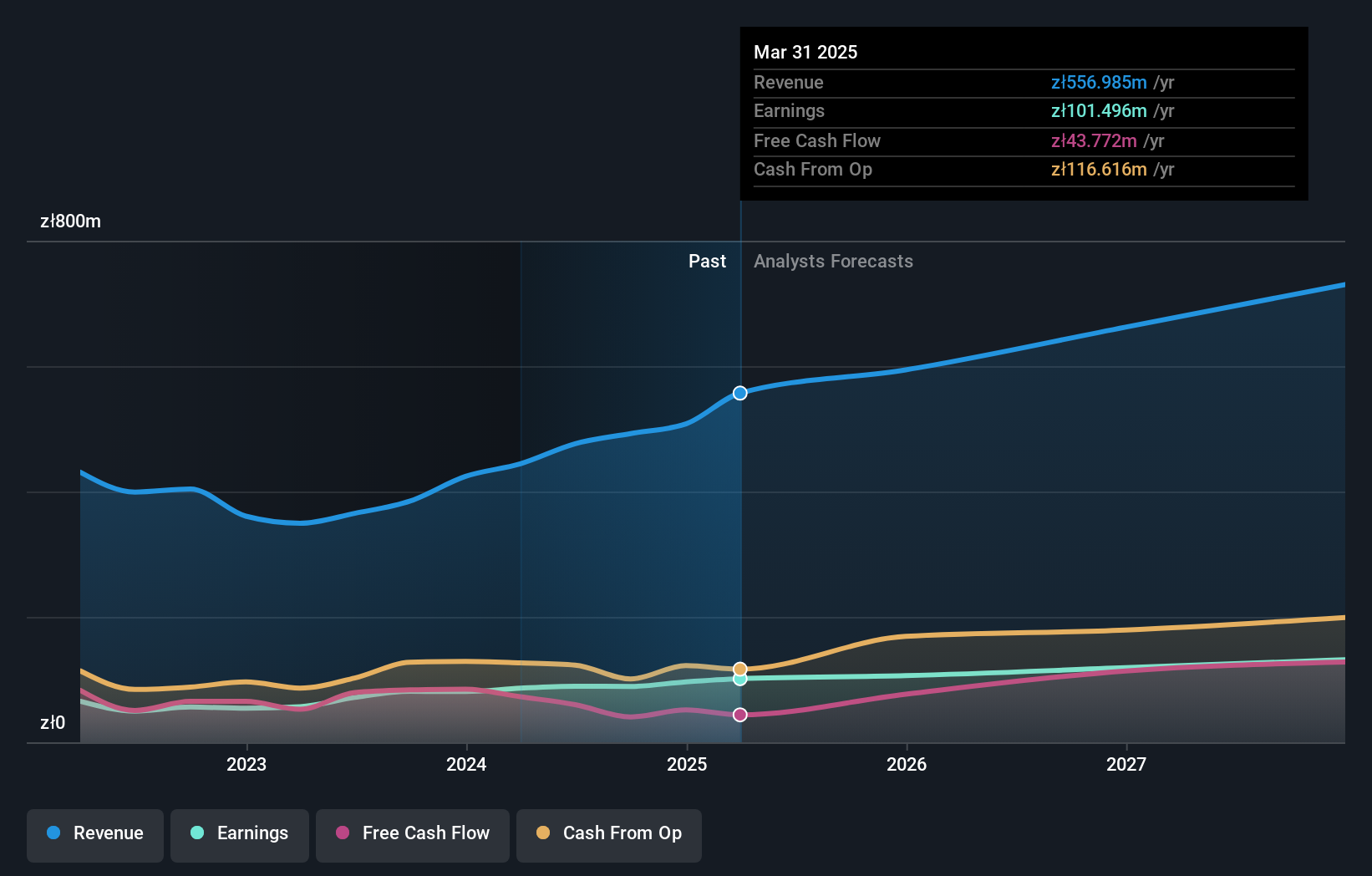

Overview: Voxel S.A. operates a network of diagnostic imaging laboratories in Poland with a market cap of PLN 1.28 billion.

Operations: The company derives its revenue primarily from diagnostic imaging services. It has reported a net profit margin of 12% in the most recent financial period.

Voxel's financials reflect a robust trajectory, with earnings growing 24.7% annually over the past five years, although recent growth of 45.1% didn't surpass the healthcare sector's pace. Trading at 46.5% below its estimated fair value, Voxel seems undervalued. The company's debt-to-equity ratio impressively decreased from 54.7% to 13.5%, showcasing effective debt management while maintaining more cash than total debt obligations, ensuring stability in volatile times. Recent inclusion in the S&P Global BMI Index highlights its rising prominence, and second-quarter sales surged to PLN 123.95 million from PLN 91.97 million year-on-year, boosting net income to PLN 22.56 million from PLN 17.02 million previously.

- Delve into the full analysis health report here for a deeper understanding of Voxel.

Evaluate Voxel's historical performance by accessing our past performance report.

EnviTec Biogas (XTRA:ETG)

Simply Wall St Value Rating: ★★★★★☆

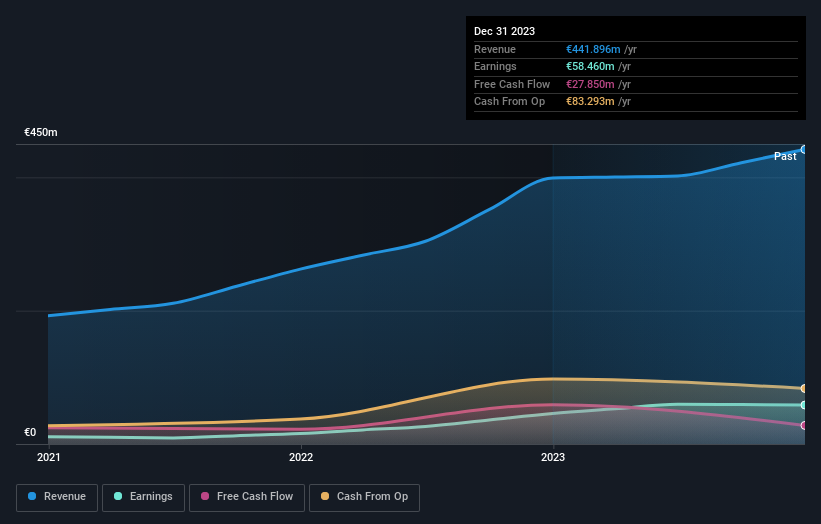

Overview: EnviTec Biogas AG is engaged in the manufacturing and operation of biogas and biomethane plants across various countries including Germany, Italy, Great Britain, the Czech Republic, France, Denmark, the United States, China, Greece, and Estonia with a market capitalization of €460.35 million.

Operations: EnviTec Biogas generates revenue primarily from the manufacturing and operation of biogas and biomethane plants. The company has a market capitalization of €460.35 million.

EnviTec Biogas, a relatively small player in the energy sector, is trading at 54.8% below its estimated fair value, suggesting potential undervaluation. Despite high-quality earnings and satisfactory interest coverage, the company faces challenges with a net debt to equity ratio rising from 36.3% to 48.5% over five years and negative earnings growth of -16.5% last year compared to industry averages. Recent half-year results show sales increased to €190 million from €153 million previously; however, revenue dipped slightly to €181 million while net income fell to €22 million from €31 million year-on-year, indicating mixed financial performance amidst industry pressures.

- Click to explore a detailed breakdown of our findings in EnviTec Biogas' health report.

Examine EnviTec Biogas' past performance report to understand how it has performed in the past.

Key Takeaways

- Access the full spectrum of 4638 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EnviTec Biogas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ETG

EnviTec Biogas

Manufactures and operates biogas and biomethane plants in Germany, Italy, Great Britain, the Czechia Republic, France, Denmark, the United States, China, Greece, Estonia, and internationally.

Excellent balance sheet average dividend payer.