- Japan

- /

- Food and Staples Retail

- /

- TSE:7451

Discovering January 2025's Hidden Gems with Solid Potential

Reviewed by Simply Wall St

As global markets navigate a landscape of cooling inflation and robust bank earnings, major U.S. stock indices have shown resilience, with value stocks outperforming growth shares amid shifting economic dynamics. In this environment, identifying lesser-known stocks with solid fundamentals and potential for growth can be particularly rewarding for investors seeking opportunities beyond the mainstream market leaders.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Caltagirone (BIT:CALT)

Simply Wall St Value Rating: ★★★★★★

Overview: Caltagirone SpA operates through its subsidiaries in cement manufacturing, media, real estate, and publishing activities with a market capitalization of €824.02 million.

Operations: Caltagirone SpA generates significant revenue primarily from its Cement, Concrete and Aggregates segment, amounting to €1.64 billion, followed by contributions from Other Assets at €244.51 million and Constructions at €186.77 million. The Publishing segment adds €112.65 million, while Management of Properties contributes €35.27 million to the overall revenue mix.

Caltagirone, a promising player in the Basic Materials sector, shows strong financial health with its debt to equity ratio dropping significantly from 35.8% to 9.9% over five years. This reduction suggests prudent financial management and stability. The company outpaces industry peers with a notable earnings growth of 10.5%, compared to the industry's -11.5%. Trading at 90% below its estimated fair value indicates potential undervaluation, offering room for appreciation if market conditions align favorably. With high-quality earnings and positive free cash flow, Caltagirone seems well-positioned for continued success in its field.

- Click here and access our complete health analysis report to understand the dynamics of Caltagirone.

Gain insights into Caltagirone's historical performance by reviewing our past performance report.

Mitsubishi Shokuhin (TSE:7451)

Simply Wall St Value Rating: ★★★★★★

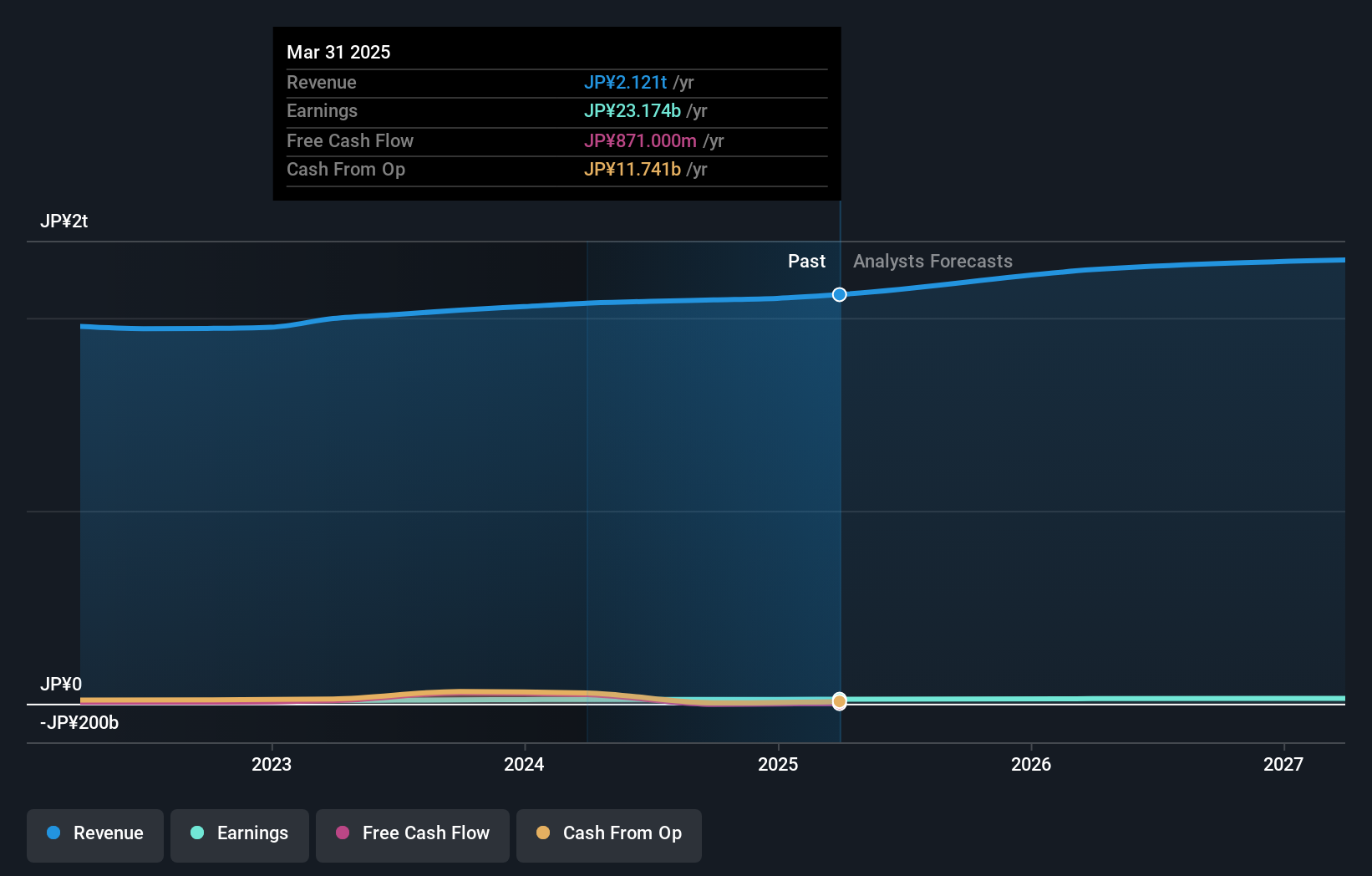

Overview: Mitsubishi Shokuhin Co., Ltd. operates as a wholesaler of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries in Japan and internationally, with a market cap of ¥209.50 billion.

Operations: The company's revenue primarily comes from its wholesale operations in processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries. The market cap is ¥209.50 billion.

Mitsubishi Shokuhin, a promising player in its industry, has been making strides with a forecasted earnings growth of 7.93% annually. The company is trading at 6% below its estimated fair value, indicating potential for investors seeking undervalued opportunities. Over the past year, it outpaced the Consumer Retailing industry with a 13.2% earnings increase and boasts high-quality past earnings. Recent corporate guidance suggests net sales of ¥2.13 trillion and an operating profit of ¥31.5 billion for fiscal year ending March 2025, while dividends have been increased to ¥90 per share from last year's ¥80 per share payout.

- Get an in-depth perspective on Mitsubishi Shokuhin's performance by reading our health report here.

Assess Mitsubishi Shokuhin's past performance with our detailed historical performance reports.

Voxel (WSE:VOX)

Simply Wall St Value Rating: ★★★★★★

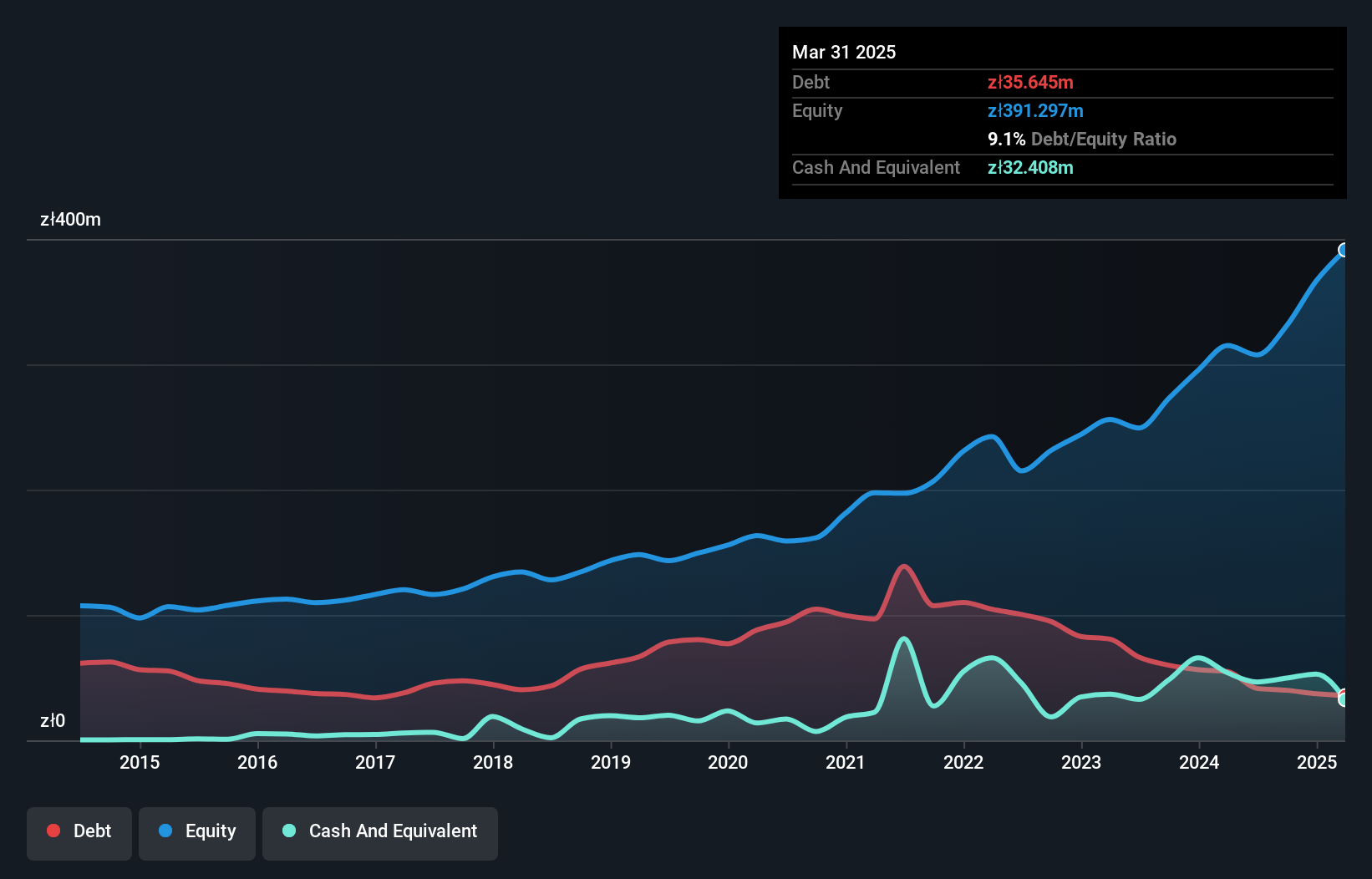

Overview: Voxel S.A. operates a network of diagnostic imaging laboratories in Poland with a market capitalization of PLN 1.44 billion.

Operations: The company generates revenue primarily from its diagnostic imaging services. It has a market capitalization of PLN 1.44 billion, reflecting its position in the Polish healthcare sector.

Voxel, a promising player in the healthcare sector, has shown impressive financial health with its debt to equity ratio dropping from 53.8% to 12.1% over five years, indicating effective debt management. The company's earnings have grown at an annual rate of 24.5%, though slightly trailing the healthcare industry's 26.3%. Recent earnings reports highlight a net income of PLN 25.4 million for Q3, up from PLN 23.14 million last year, with sales reaching PLN 134.52 million compared to PLN 118.29 million previously reported; this suggests solid operational performance and market presence growth despite competitive pressures in the industry.

- Click to explore a detailed breakdown of our findings in Voxel's health report.

Evaluate Voxel's historical performance by accessing our past performance report.

Taking Advantage

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4654 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7451

Mitsubishi Shokuhin

Engages in the wholesale of processed foods, frozen and chilled foods, alcoholic beverages, and confectioneries businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion