- Poland

- /

- Healthcare Services

- /

- WSE:NEU

Investors Shouldn't Overlook NEUCA's (WSE:NEU) Impressive Returns On Capital

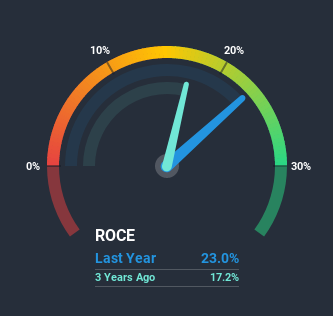

If we want to find a stock that could multiply over the long term, what are the underlying trends we should look for? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So when we looked at the ROCE trend of NEUCA (WSE:NEU) we really liked what we saw.

Return On Capital Employed (ROCE): What is it?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for NEUCA, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.23 = zł238m ÷ (zł3.5b - zł2.4b) (Based on the trailing twelve months to September 2020).

Thus, NEUCA has an ROCE of 23%. That's a fantastic return and not only that, it outpaces the average of 13% earned by companies in a similar industry.

Check out our latest analysis for NEUCA

In the above chart we have measured NEUCA's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free report for NEUCA.

How Are Returns Trending?

The trends we've noticed at NEUCA are quite reassuring. The data shows that returns on capital have increased substantially over the last five years to 23%. Basically the business is earning more per dollar of capital invested and in addition to that, 59% more capital is being employed now too. So we're very much inspired by what we're seeing at NEUCA thanks to its ability to profitably reinvest capital.

On a separate but related note, it's important to know that NEUCA has a current liabilities to total assets ratio of 70%, which we'd consider pretty high. This can bring about some risks because the company is basically operating with a rather large reliance on its suppliers or other sorts of short-term creditors. Ideally we'd like to see this reduce as that would mean fewer obligations bearing risks.

Our Take On NEUCA's ROCE

In summary, it's great to see that NEUCA can compound returns by consistently reinvesting capital at increasing rates of return, because these are some of the key ingredients of those highly sought after multi-baggers. And with the stock having performed exceptionally well over the last five years, these patterns are being accounted for by investors. With that being said, we still think the promising fundamentals mean the company deserves some further due diligence.

On a separate note, we've found 1 warning sign for NEUCA you'll probably want to know about.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

If you decide to trade NEUCA, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade NEUCA, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NEUCA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:NEU

NEUCA

Engages in the wholesale distribution of pharmaceuticals in Poland.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives