- Spain

- /

- Real Estate

- /

- BME:AEDAS

European Dividend Stocks To Consider Now

Reviewed by Simply Wall St

As European markets face significant turbulence due to higher-than-expected U.S. trade tariffs, major indices like the STOXX Europe 600 and Germany's DAX have experienced their steepest declines in years. In such uncertain times, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for investors looking to navigate these volatile conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Julius Bär Gruppe (SWX:BAER) | 5.23% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 5.13% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.72% | ★★★★★★ |

| Mapfre (BME:MAP) | 6.00% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.14% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.74% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 5.43% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.48% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.55% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.74% | ★★★★★★ |

Click here to see the full list of 237 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

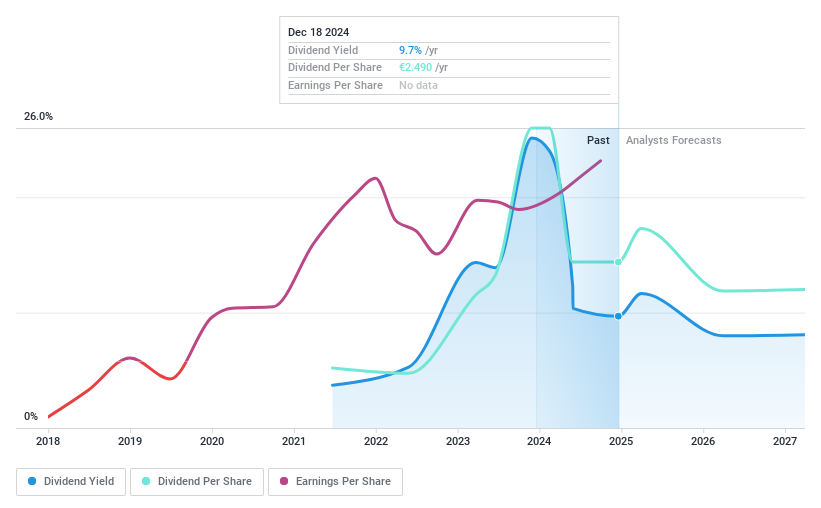

Aedas Homes (BME:AEDAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aedas Homes, S.A. is involved in the development of residential properties in Spain and has a market cap of €1.12 billion.

Operations: Aedas Homes, S.A. generates revenue primarily through its property development segment, which accounts for €1.22 billion.

Dividend Yield: 9.6%

Aedas Homes offers a high dividend yield of 9.6%, placing it in the top 25% of Spanish dividend payers. However, its dividend track record is unstable, with payments being volatile and only four years of history. The dividends are well-covered by earnings and cash flows, with payout ratios at 8% and 37.2%, respectively. Despite trading at a significant discount to fair value, the company faces challenges such as high debt levels and declining earnings forecasts.

- Delve into the full analysis dividend report here for a deeper understanding of Aedas Homes.

- Upon reviewing our latest valuation report, Aedas Homes' share price might be too pessimistic.

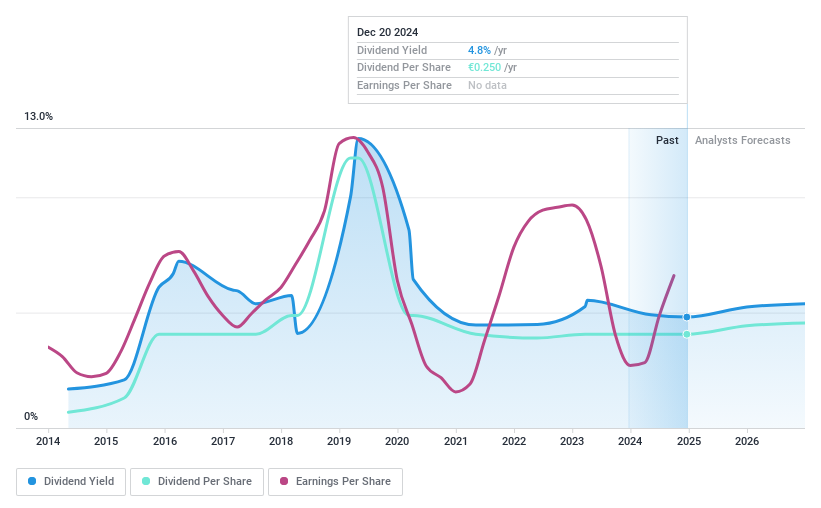

Altri SGPS (ENXTLS:ALTR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Altri SGPS, along with its subsidiaries, is engaged in the production and sale of cellulosic fibers both in Portugal and internationally, with a market cap of €1.22 billion.

Operations: Altri SGPS generates revenue primarily from its segment focused on the production and commercialization of cellulosic fibers, amounting to €837.90 million.

Dividend Yield: 5%

Altri SGPS's dividend yield of 5.03% is below the Portuguese market's top tier, but dividends are well-covered by earnings and cash flow, with payout ratios at 57.4% and 26.7%, respectively. Despite a volatile dividend history over the past decade, recent earnings growth and undervaluation relative to fair value may appeal to investors seeking potential capital appreciation alongside income, though high debt levels remain a concern. Recent full-year revenue reached €855.3 million with net income at €107.2 million.

- Get an in-depth perspective on Altri SGPS' performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Altri SGPS shares in the market.

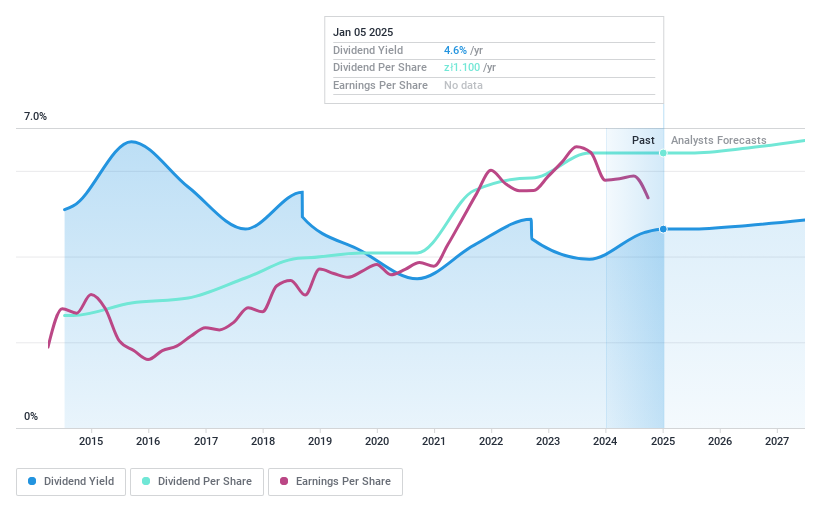

Ambra (WSE:AMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ambra S.A. and its subsidiaries are involved in the manufacture, import, and distribution of grape wines across Poland, the Czech Republic, Slovakia, and Romania with a market cap of PLN540.68 million.

Operations: Ambra S.A.'s revenue segments include PLN685.01 million from Poland, PLN181.41 million from Romania, and PLN83.73 million from the Czech Republic and Slovakia.

Dividend Yield: 5.1%

Ambra's dividend yield of 5.13% is below the top tier in Poland, yet dividends are stable and well-covered by earnings and cash flow, with payout ratios of 48.5% and 40.2%, respectively. Over the past decade, dividends have grown consistently without volatility. Recent earnings reports show improved financial performance, with second-quarter net income rising to PLN 38.63 million from PLN 31.71 million year-on-year, supporting its reliable dividend profile despite forecasted earnings declines.

- Take a closer look at Ambra's potential here in our dividend report.

- Our valuation report unveils the possibility Ambra's shares may be trading at a discount.

Turning Ideas Into Actions

- Take a closer look at our Top European Dividend Stocks list of 237 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Aedas Homes, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:AEDAS

Aedas Homes

Engages in the development of residential properties in Spain.

Undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives