Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Agroliga Group Plc (WSE:AGL) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Agroliga Group

What Is Agroliga Group's Debt?

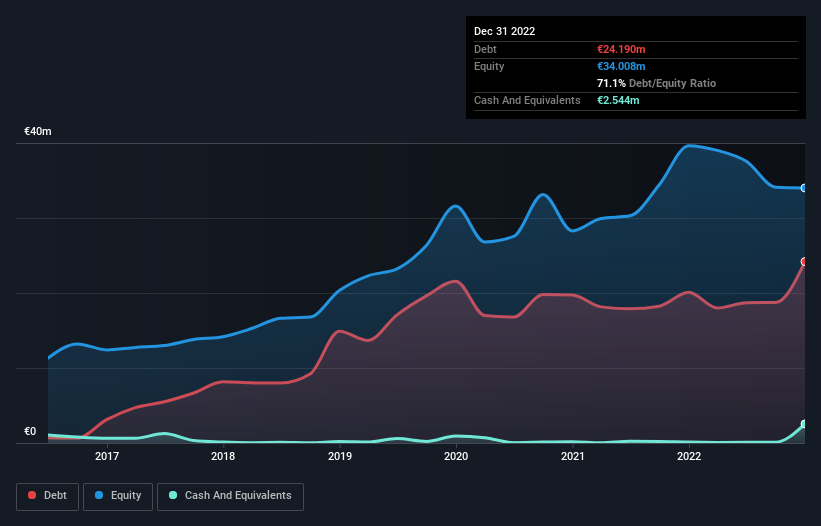

The image below, which you can click on for greater detail, shows that at December 2022 Agroliga Group had debt of €24.2m, up from €20.1m in one year. On the flip side, it has €2.54m in cash leading to net debt of about €21.6m.

How Strong Is Agroliga Group's Balance Sheet?

The latest balance sheet data shows that Agroliga Group had liabilities of €29.6m due within a year, and liabilities of €6.82m falling due after that. Offsetting these obligations, it had cash of €2.54m as well as receivables valued at €14.1m due within 12 months. So its liabilities total €19.8m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the €7.82m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Agroliga Group would likely require a major re-capitalisation if it had to pay its creditors today.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Agroliga Group's debt is 3.3 times its EBITDA, and its EBIT cover its interest expense 3.2 times over. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. The good news is that Agroliga Group improved its EBIT by 4.5% over the last twelve months, thus gradually reducing its debt levels relative to its earnings. When analysing debt levels, the balance sheet is the obvious place to start. But it is Agroliga Group's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent three years, Agroliga Group recorded free cash flow of 33% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say Agroliga Group's level of total liabilities was disappointing. Having said that, its ability to grow its EBIT isn't such a worry. We're quite clear that we consider Agroliga Group to be really rather risky, as a result of its balance sheet health. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Agroliga Group (including 2 which are significant) .

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:AGL

Agroliga Group

Produces and sells vegetable oils, cereals, meat products, and dairy breeding herds in Ukraine.

Excellent balance sheet moderate.