- Poland

- /

- Capital Markets

- /

- WSE:XTB

Undiscovered Gems Promising Stocks To Explore In December 2024

Reviewed by Simply Wall St

As global markets navigate a period of cautious optimism, with the Federal Reserve's recent rate cut and mixed economic signals, small-cap stocks have faced particular challenges, evidenced by broad-based declines in smaller-cap indexes. Despite this backdrop of volatility and uncertainty, discerning investors may find opportunities in lesser-known stocks that exhibit strong fundamentals and resilience to broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bahnhof | NA | 8.70% | 14.93% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| ABG Sundal Collier Holding | 18.07% | 0.55% | -4.76% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Nederman Holding | 73.66% | 10.94% | 15.88% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Lavipharm | 39.21% | 9.47% | -15.70% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

CropEnergies (HMSE:CE2)

Simply Wall St Value Rating: ★★★★★★

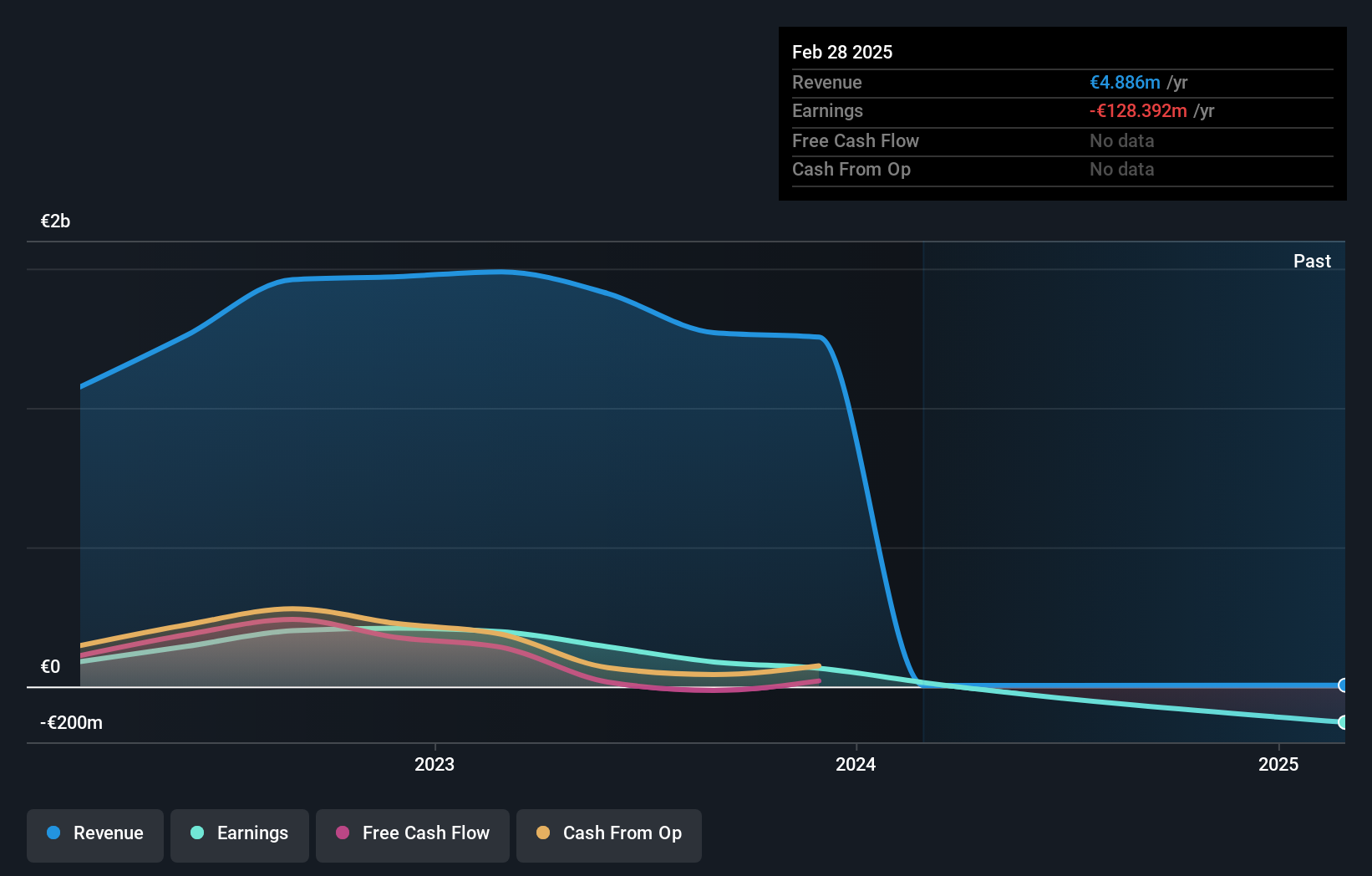

Overview: CropEnergies AG is a company that manufactures and distributes bioethanol and other biofuels from agricultural raw materials, operating both in Germany and internationally, with a market capitalization of €1.18 billion.

Operations: CropEnergies generates revenue primarily from the sale of bioethanol, amounting to €3.82 billion. The company's financial performance can be analyzed through its net profit margin, which provides insights into profitability trends over time.

Navigating the landscape of niche industries, CropEnergies stands out with its debt-free status and high-quality past earnings, offering a solid foundation despite recent challenges. The company reported negative earnings growth of -92.8% over the past year, contrasting sharply with the Oil and Gas industry average of -28.6%. With revenue at €4M, it seems that CropEnergies is grappling to find meaningful traction in its sector. The lack of sufficient recent financial data adds an element of uncertainty, yet its historical leverage-free operations suggest resilience amidst fluctuating market conditions.

- Dive into the specifics of CropEnergies here with our thorough health report.

Assess CropEnergies' past performance with our detailed historical performance reports.

MPC Container Ships (OB:MPCC)

Simply Wall St Value Rating: ★★★★★★

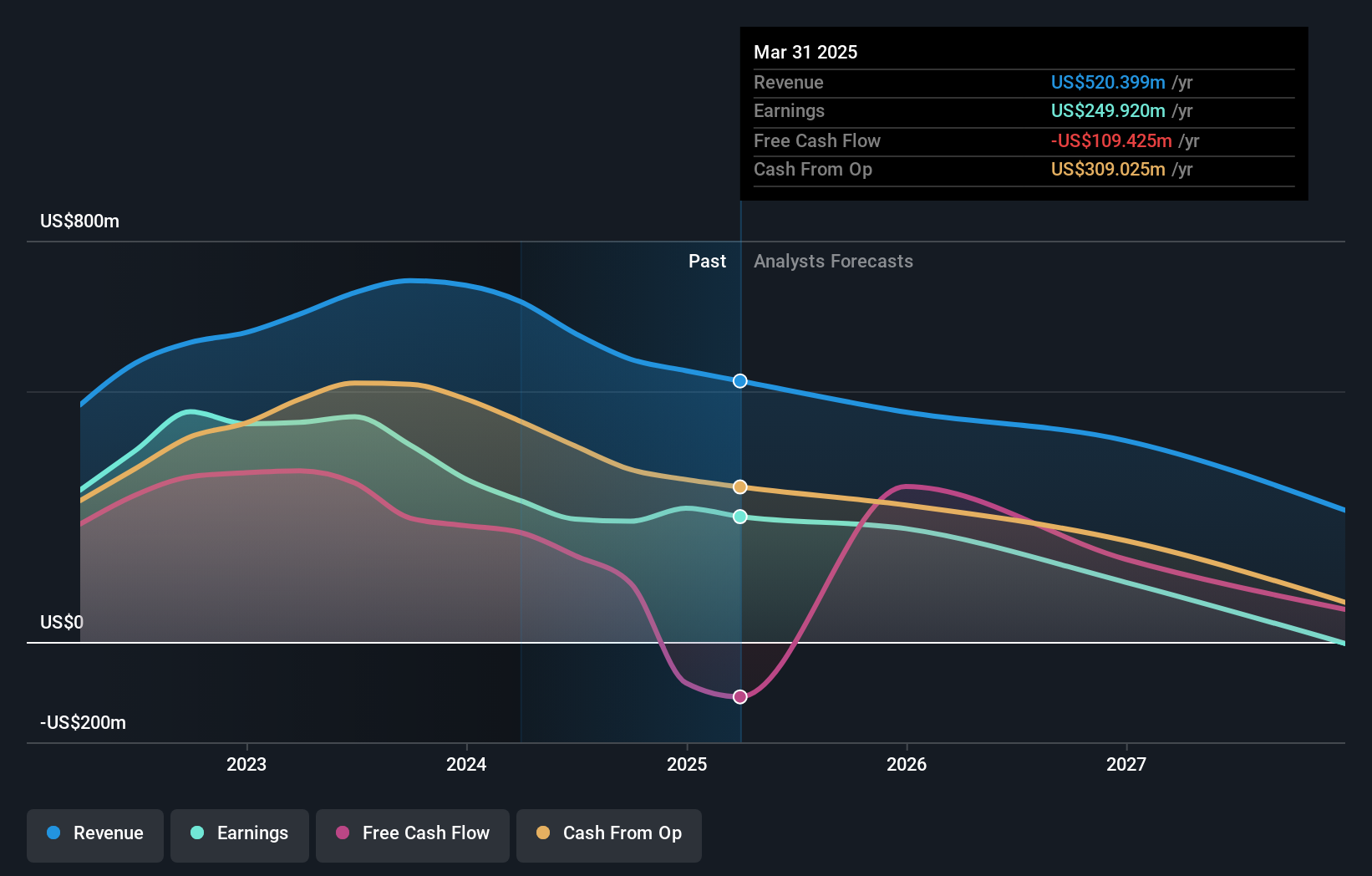

Overview: MPC Container Ships ASA owns and operates a portfolio of container vessels with a market cap of NOK9.08 billion.

Operations: The company generates revenue primarily from its container shipping segment, amounting to $563.74 million. With a market capitalization of NOK9.08 billion, it focuses on optimizing its fleet operations to drive financial performance.

MPCC, a player in the shipping sector, is navigating through some choppy waters with its earnings taking a hit of 38.7% over the past year, contrasting sharply with the industry average growth of 31.1%. Despite this setback, MPCC's debt management shines as it reduced its debt to equity ratio from 64.5% to 25.3% in five years and maintains satisfactory coverage on interest payments with EBIT at 27.8x coverage. Trading at an attractive valuation of approximately 75% below estimated fair value, MPCC continues to reward shareholders with dividends despite a dip in sales and net income compared to last year.

- Click here to discover the nuances of MPC Container Ships with our detailed analytical health report.

Understand MPC Container Ships' track record by examining our Past report.

XTB (WSE:XTB)

Simply Wall St Value Rating: ★★★★☆☆

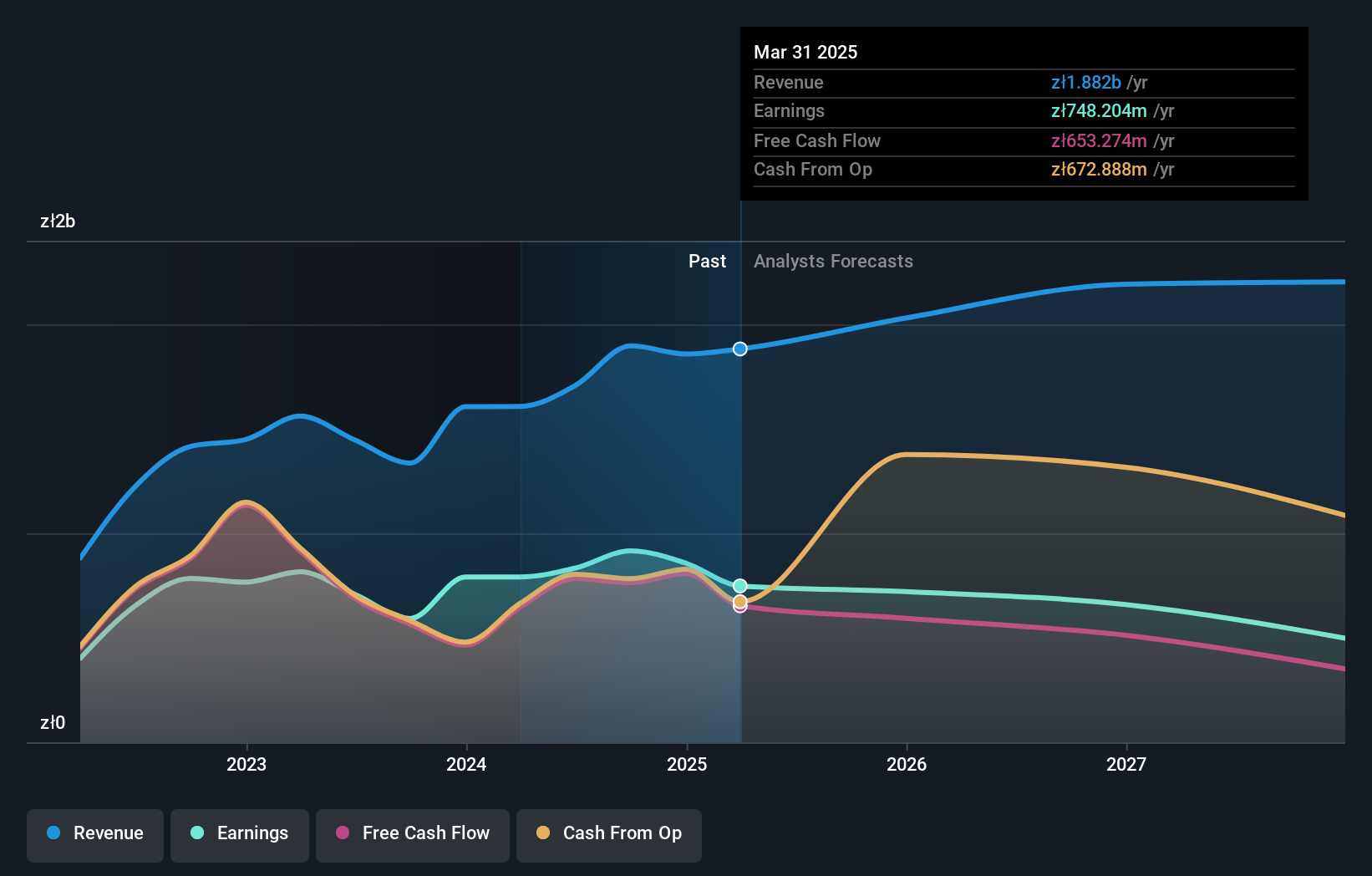

Overview: XTB S.A. operates as a brokerage firm offering ETF, currency derivatives, commodities, indices, stocks, and bonds services across Central and Eastern Europe, Western Europe, Latin America, and the Middle East with a market cap of PLN8.18 billion.

Operations: XTB's revenue primarily comes from retail operations, generating PLN1.70 billion, while institutional operations contribute PLN10.16 million.

XTB has demonstrated impressive financial performance, with a notable earnings growth of 54.6% over the past year, outpacing the Capital Markets industry's 8.6%. Despite an increase in its debt-to-equity ratio from 4.4% to 6.7% over five years, XTB holds more cash than total debt, indicating a strong balance sheet position. The company reported a net income of PLN 203.83 million for Q3 2024, up from PLN 121.13 million the previous year, showcasing robust profitability backed by high-quality earnings and positive free cash flow trends. However, future earnings are expected to decrease by an average of 4.2% annually over three years despite trading at nearly 40% below estimated fair value compared to peers and industry standards.

- Take a closer look at XTB's potential here in our health report.

Gain insights into XTB's past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 4621 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:XTB

XTB

Provides ETF, currency derivatives, commodities, indices, stocks, and bonds brokerage services in Central and Eastern Europe, Western Europe, Latin America, and the Middle East.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives