- Poland

- /

- Capital Markets

- /

- WSE:XTB

Here's Why I Think X-Trade Brokers Dom Maklerski (WSE:XTB) Is An Interesting Stock

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In the age of tech-stock blue-sky investing, my choice may seem old fashioned; I still prefer profitable companies like X-Trade Brokers Dom Maklerski (WSE:XTB). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for X-Trade Brokers Dom Maklerski

X-Trade Brokers Dom Maklerski's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). That makes EPS growth an attractive quality for any company. It certainly is nice to see that X-Trade Brokers Dom Maklerski has managed to grow EPS by 30% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

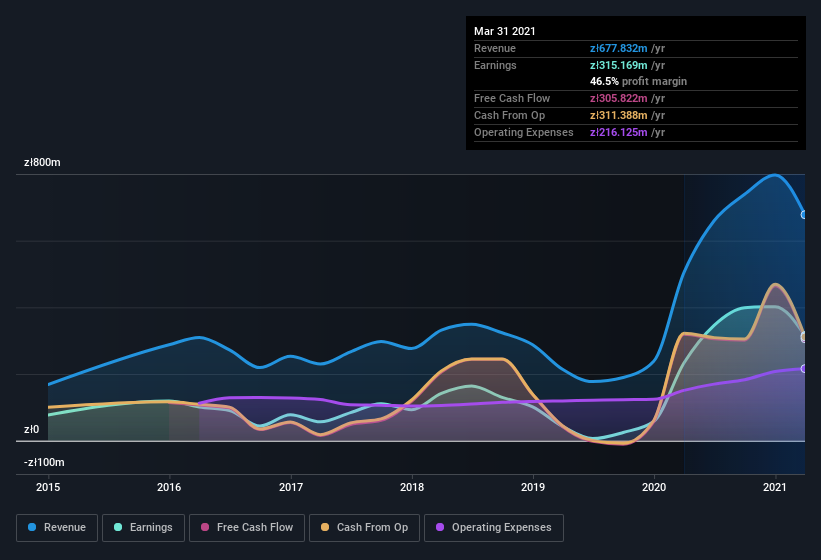

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. I note that X-Trade Brokers Dom Maklerski's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. While we note X-Trade Brokers Dom Maklerski's EBIT margins were flat over the last year, revenue grew by a solid 34% to zł678m. That's a real positive.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are X-Trade Brokers Dom Maklerski Insiders Aligned With All Shareholders?

Personally, I like to see high insider ownership of a company, since it suggests that it will be managed in the interests of shareholders. So we're pleased to report that X-Trade Brokers Dom Maklerski insiders own a meaningful share of the business. Indeed, with a collective holding of 67%, company insiders are in control and have plenty of capital behind the venture. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling zł1.3b. Now that's what I call some serious skin in the game!

Is X-Trade Brokers Dom Maklerski Worth Keeping An Eye On?

You can't deny that X-Trade Brokers Dom Maklerski has grown its earnings per share at a very impressive rate. That's attractive. Further, the high level of insider ownership impresses me, and suggests that I'm not the only one who appreciates the EPS growth. So this is very likely the kind of business that I like to spend time researching, with a view to discerning its true value. However, before you get too excited we've discovered 1 warning sign for X-Trade Brokers Dom Maklerski that you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade X-Trade Brokers Dom Maklerski, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:XTB

XTB

Provides ETF, currency derivatives, commodities, indices, stocks, and bonds brokerage services in Central and Eastern Europe, Western Europe, Latin America, and the Middle East.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives