- Poland

- /

- Diversified Financial

- /

- WSE:NOV

A Piece Of The Puzzle Missing From Novina Spólka Akcyjna's (WSE:NOV) 27% Share Price Climb

The Novina Spólka Akcyjna (WSE:NOV) share price has done very well over the last month, posting an excellent gain of 27%. Looking further back, the 22% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

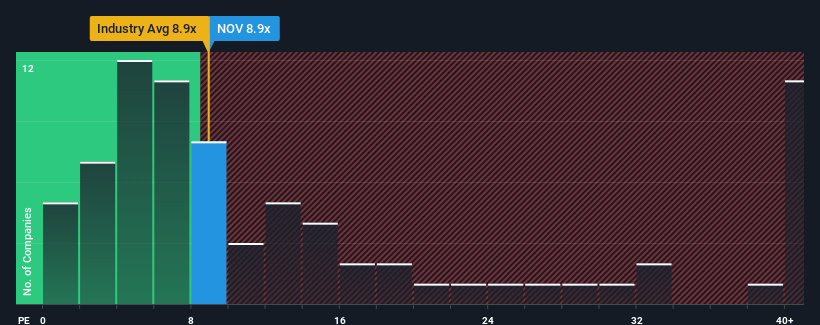

Even after such a large jump in price, given about half the companies in Poland have price-to-earnings ratios (or "P/E's") above 13x, you may still consider Novina Spólka Akcyjna as an attractive investment with its 8.9x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Novina Spólka Akcyjna has been doing a good job lately as it's been growing earnings at a solid pace. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Novina Spólka Akcyjna

What Are Growth Metrics Telling Us About The Low P/E?

Novina Spólka Akcyjna's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 23% last year. Pleasingly, EPS has also lifted 109% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Comparing that to the market, which is only predicted to deliver 11% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised earnings results.

In light of this, it's peculiar that Novina Spólka Akcyjna's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Final Word

Despite Novina Spólka Akcyjna's shares building up a head of steam, its P/E still lags most other companies. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Novina Spólka Akcyjna currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. At least price risks look to be very low if recent medium-term earnings trends continue, but investors seem to think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 5 warning signs for Novina Spólka Akcyjna (3 shouldn't be ignored!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if NOVINA pozyczkihipoteczne.eu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:NOV

NOVINA pozyczkihipoteczne.eu

Provides mortgage secured cash loans for business entities in Poland.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives