- Poland

- /

- Diversified Financial

- /

- WSE:NOV

With EPS Growth And More, NOVINA pozyczkihipoteczne.eu (WSE:NOV) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like NOVINA pozyczkihipoteczne.eu (WSE:NOV), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for NOVINA pozyczkihipoteczne.eu

How Quickly Is NOVINA pozyczkihipoteczne.eu Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. NOVINA pozyczkihipoteczne.eu's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 52%. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

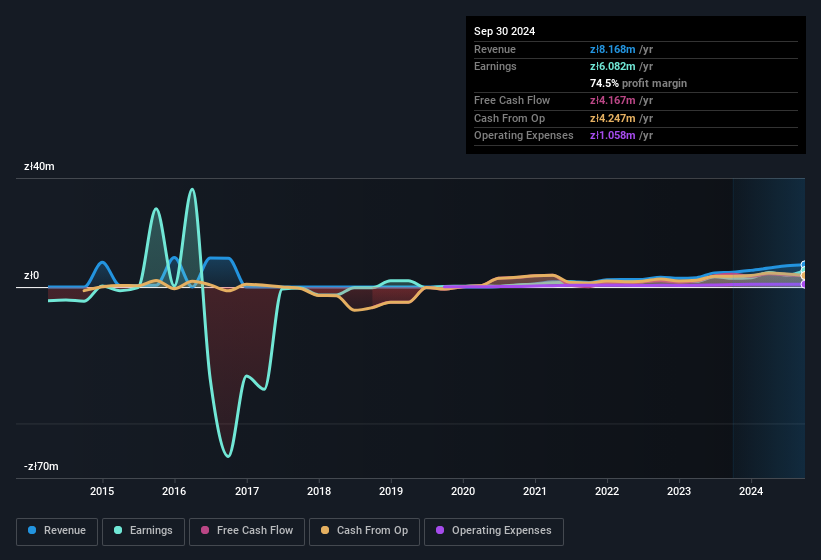

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, NOVINA pozyczkihipoteczne.eu's EBIT margins fell over the last year, but on the other hand, revenue grew. So if EBIT margins can stabilize, this top-line growth should pay off for shareholders.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Since NOVINA pozyczkihipoteczne.eu is no giant, with a market capitalisation of zł40m, you should definitely check its cash and debt before getting too excited about its prospects.

Are NOVINA pozyczkihipoteczne.eu Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that NOVINA pozyczkihipoteczne.eu insiders own a significant number of shares certainly is appealing. Actually, with 46% of the company to their names, insiders are profoundly invested in the business. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Of course, NOVINA pozyczkihipoteczne.eu is a very small company, with a market cap of only zł40m. So this large proportion of shares owned by insiders only amounts to zł18m. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does NOVINA pozyczkihipoteczne.eu Deserve A Spot On Your Watchlist?

NOVINA pozyczkihipoteczne.eu's earnings per share growth have been climbing higher at an appreciable rate. This level of EPS growth does wonders for attracting investment, and the large insider investment in the company is just the cherry on top. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, NOVINA pozyczkihipoteczne.eu is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. We should say that we've discovered 3 warning signs for NOVINA pozyczkihipoteczne.eu (1 is a bit concerning!) that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in PL with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if NOVINA pozyczkihipoteczne.eu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:NOV

NOVINA pozyczkihipoteczne.eu

Provides mortgage secured cash loans for business entities in Poland.

Outstanding track record with excellent balance sheet.

Market Insights

Community Narratives