- Poland

- /

- Capital Markets

- /

- WSE:IPE

North Energy And 2 Other European Penny Stocks To Consider

Reviewed by Simply Wall St

The European market has recently experienced a positive shift, with major stock indexes such as the STOXX Europe 600 Index and Germany’s DAX showing significant gains as concerns over tariffs eased. Despite the vintage feel of the term "penny stocks," these smaller or newer companies remain relevant investment opportunities, especially when they are supported by strong financials. In this article, we explore three European penny stocks that stand out for their financial robustness and potential for long-term growth, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Transferator (NGM:TRAN A) | SEK2.66 | SEK263.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.48 | SEK211.72M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.66 | PLN124.05M | ✅ 4 ⚠️ 2 View Analysis > |

| AMSC (OB:AMSC) | NOK1.538 | NOK110.53M | ✅ 2 ⚠️ 5 View Analysis > |

| Cellularline (BIT:CELL) | €2.58 | €54.42M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.995 | €33.32M | ✅ 3 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.67 | €17.46M | ✅ 2 ⚠️ 3 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.01 | €22.01M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.13 | €294.08M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 433 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

North Energy (OB:NORTH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: North Energy ASA is an industrial investment company that owns, manages, and finances activities in the energy and other industries in Norway, with a market cap of NOK303.68 million.

Operations: The company generates revenue from investment activities, amounting to NOK0.09 million.

Market Cap: NOK303.68M

North Energy ASA, an industrial investment company in Norway, is pre-revenue with earnings driven by investment activities. The company has demonstrated significant earnings growth of 136% over the past year and maintains a strong financial position with no debt and short-term assets exceeding liabilities. Despite its low revenue of NOK0.09 million, North Energy's net profit margins have improved, and it recently approved a cash dividend of NOK0.15 per share for 2024. However, its dividend sustainability is questionable due to limited free cash flows. The management team has an average tenure of 3.3 years, indicating seasoned leadership.

- Unlock comprehensive insights into our analysis of North Energy stock in this financial health report.

- Examine North Energy's past performance report to understand how it has performed in prior years.

IPOPEMA Securities (WSE:IPE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: IPOPEMA Securities S.A. operates in Poland, offering brokerage, equity research, and investment banking services with a market cap of PLN94.00 million.

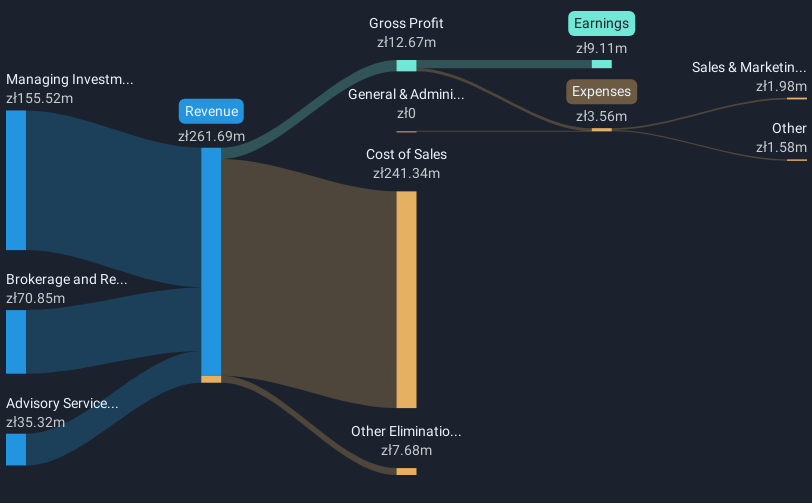

Operations: IPOPEMA Securities generates revenue through three main segments: Advisory Services (PLN35.32 million), Brokerage and Related Services (PLN70.85 million), and Managing Investment Funds and Portfolios of Brokerage Financial Instruments (PLN155.52 million).

Market Cap: PLN94M

IPOPEMA Securities S.A., operating in Poland, has a market cap of PLN94 million and generates revenue through advisory services, brokerage, and managing investment funds. Despite a seasoned management team with an average tenure of 20.2 years and strong liquidity with short-term assets exceeding liabilities, the company faces challenges. Earnings have declined by 2.3% annually over five years, with net profit margins dropping from 5.7% to 3.6%. Recent earnings showed a decrease in net income to PLN9.11 million from PLN18.18 million the previous year, impacted by large one-off items affecting financial results.

- Jump into the full analysis health report here for a deeper understanding of IPOPEMA Securities.

- Explore historical data to track IPOPEMA Securities' performance over time in our past results report.

tmc Content Group (XTRA:ERO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: tmc Content Group AG is a media company operating in Germany and Austria with a market capitalization of €6.48 million.

Operations: tmc Content Group AG does not report any specific revenue segments.

Market Cap: €6.48M

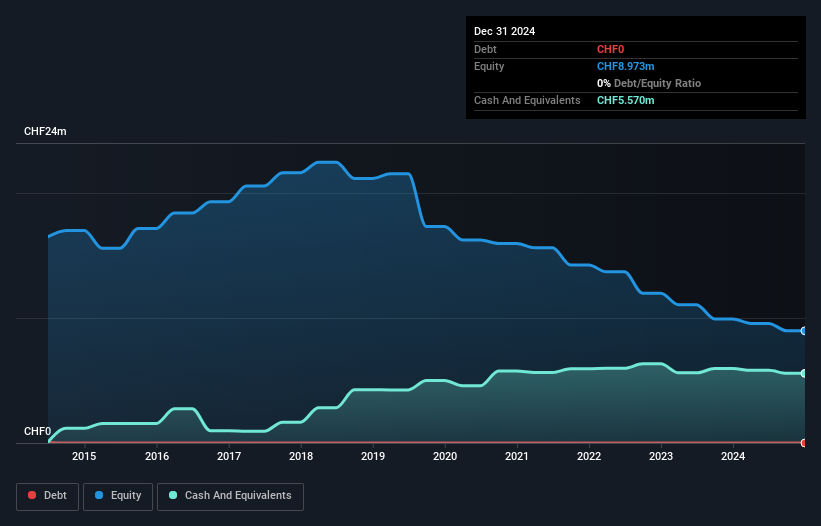

tmc Content Group AG, with a market cap of €6.48 million, operates in Germany and Austria and is currently pre-revenue. The company reported a net loss of CHF 0.88 million for the full year ended December 31, 2024, an improvement from the previous year's CHF 2.3 million loss. Despite high volatility compared to most German stocks, tmc Content Group's short-term assets significantly exceed both its long-term and short-term liabilities, providing financial stability without debt concerns. While unprofitable, it has reduced losses over five years by 18.2% annually and maintains a cash runway exceeding three years based on current free cash flow levels.

- Click here to discover the nuances of tmc Content Group with our detailed analytical financial health report.

- Understand tmc Content Group's track record by examining our performance history report.

Next Steps

- Investigate our full lineup of 433 European Penny Stocks right here.

- Interested In Other Possibilities? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade IPOPEMA Securities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:IPE

IPOPEMA Securities

Provides brokerage, equity research, and investment banking services in Poland.

Excellent balance sheet moderate and pays a dividend.

Market Insights

Community Narratives