- Sweden

- /

- Entertainment

- /

- OM:FLEXM

Flexion Mobile Leads Our Top 3 European Penny Stock Picks

Reviewed by Simply Wall St

The European market has experienced mixed movements recently, with the pan-European STOXX Europe 600 Index seeing a modest rise of 0.37%, influenced by dovish signals from U.S. Federal Reserve Chair Jerome Powell and easing U.S.-China trade tensions. In this context, investors might find value in exploring penny stocks—an investment area that, despite its somewhat outdated label, remains pertinent for those interested in smaller or newer companies. These stocks can offer surprising value and growth potential when backed by strong financials, as we explore three European penny stocks that exhibit promising financial strength and potential for long-term success.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| DigiTouch (BIT:DGT) | €1.985 | €27.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €231.7M | ✅ 2 ⚠️ 2 View Analysis > |

| Hove (CPSE:HOVE) | DKK4.68 | DKK118.33M | ✅ 2 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €4.81 | €39M | ✅ 3 ⚠️ 3 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.977 | €78.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Faes Farma (BME:FAE) | €4.525 | €1.41B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0798 | €8.44M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.924 | €30.94M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 275 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Flexion Mobile (OM:FLEXM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Flexion Mobile Plc operates a game distribution platform for developers worldwide and has a market cap of SEK170.04 million.

Operations: The company generates revenue through its game distribution segment, amounting to £74.61 million.

Market Cap: SEK170.04M

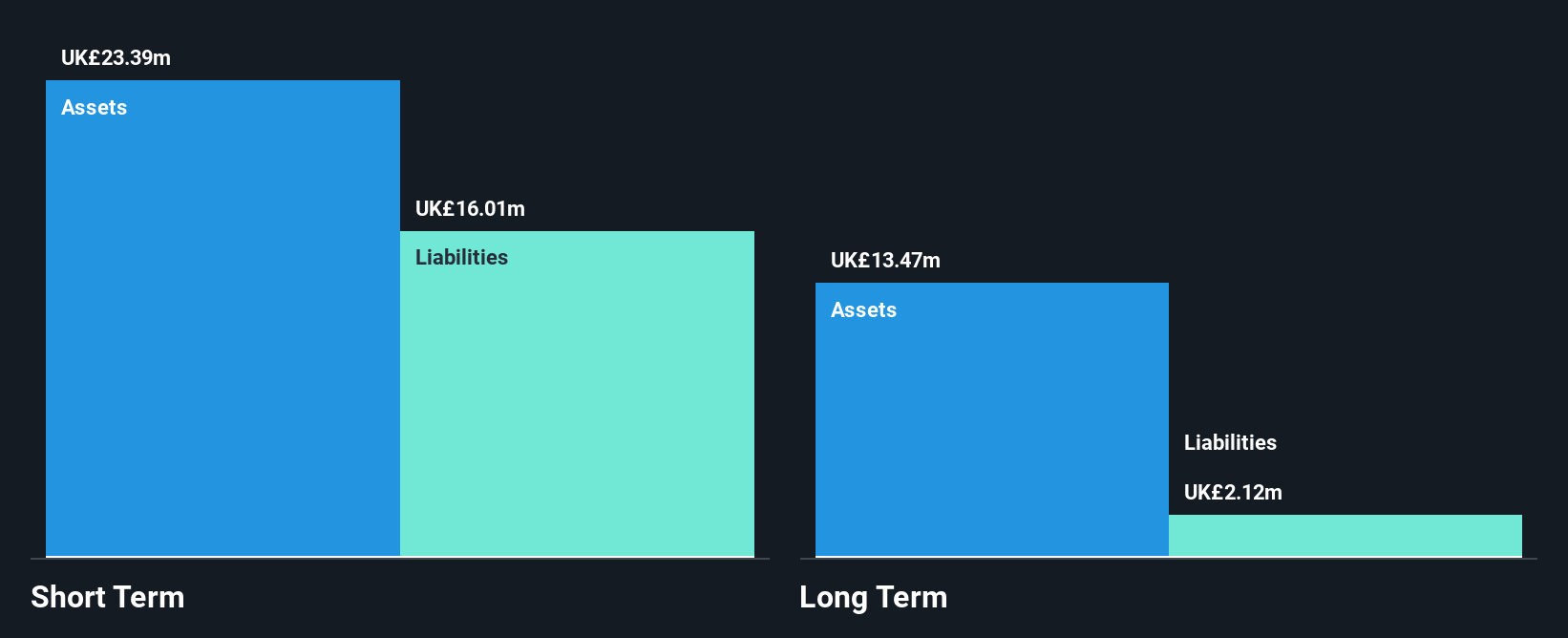

Flexion Mobile Plc, with a market cap of SEK170.04 million, operates in the game distribution space and recently reported sales of £34.98 million for the first half of 2025. Despite being unprofitable and having a negative return on equity, Flexion remains debt-free and has short-term assets exceeding both its short- and long-term liabilities. The company's strategic partnerships with Xsolla and Microfun enhance its distribution capabilities in alternative markets, potentially boosting revenue by 10% compared to traditional platforms like Google Play. While volatility remains high, Flexion's experienced management could navigate these challenges effectively.

- Dive into the specifics of Flexion Mobile here with our thorough balance sheet health report.

- Evaluate Flexion Mobile's prospects by accessing our earnings growth report.

Hemp & Health (WSE:HMP)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hemp & Health S.A. is focused on cultivating, processing, and distributing medical cannabis, with a market cap of PLN16.94 million.

Operations: The company generates revenue from Management Consulting Services, amounting to PLN0.16 million.

Market Cap: PLN16.94M

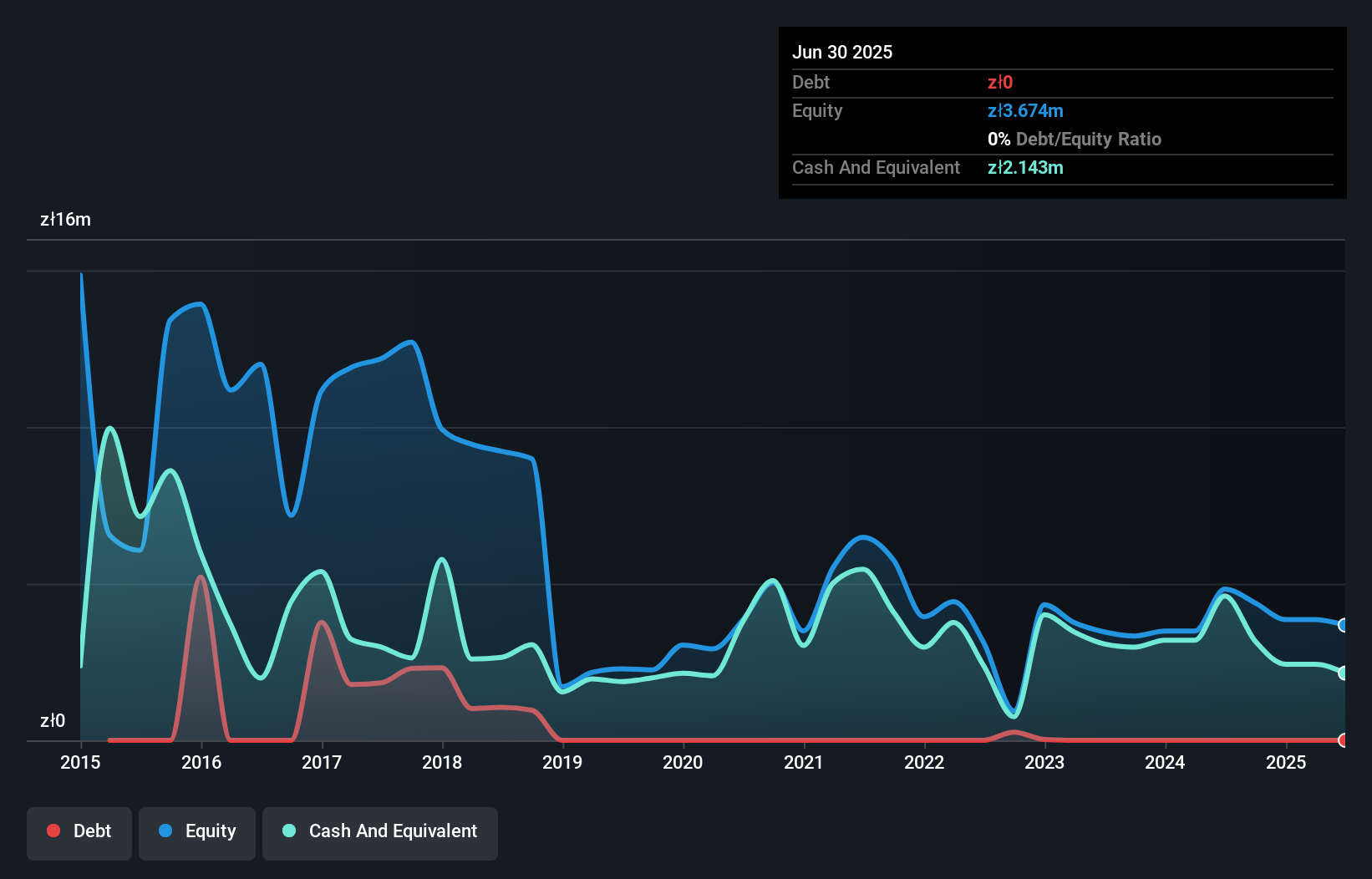

Hemp & Health S.A., with a market cap of PLN16.94 million, is pre-revenue and unprofitable, having reported a net loss of PLN0.78 million for the first half of 2025 despite slight revenue growth to PLN0.098 million. The company is debt-free but faces financial constraints with less than a year of cash runway if current cash flow trends persist. Its short-term assets comfortably cover liabilities, and shareholders have not faced significant dilution recently. The board's experience averages 4.5 years, although management tenure data remains unclear, contributing to uncertainty in strategic execution amidst stable volatility levels.

- Take a closer look at Hemp & Health's potential here in our financial health report.

- Learn about Hemp & Health's historical performance here.

Planoptik (XTRA:P4O)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Planoptik AG manufactures and sells structured wafers in Germany with a market cap of €20.33 million.

Operations: The company's revenue is primarily generated from its Glass & Clay Products segment, amounting to €11.94 million.

Market Cap: €20.33M

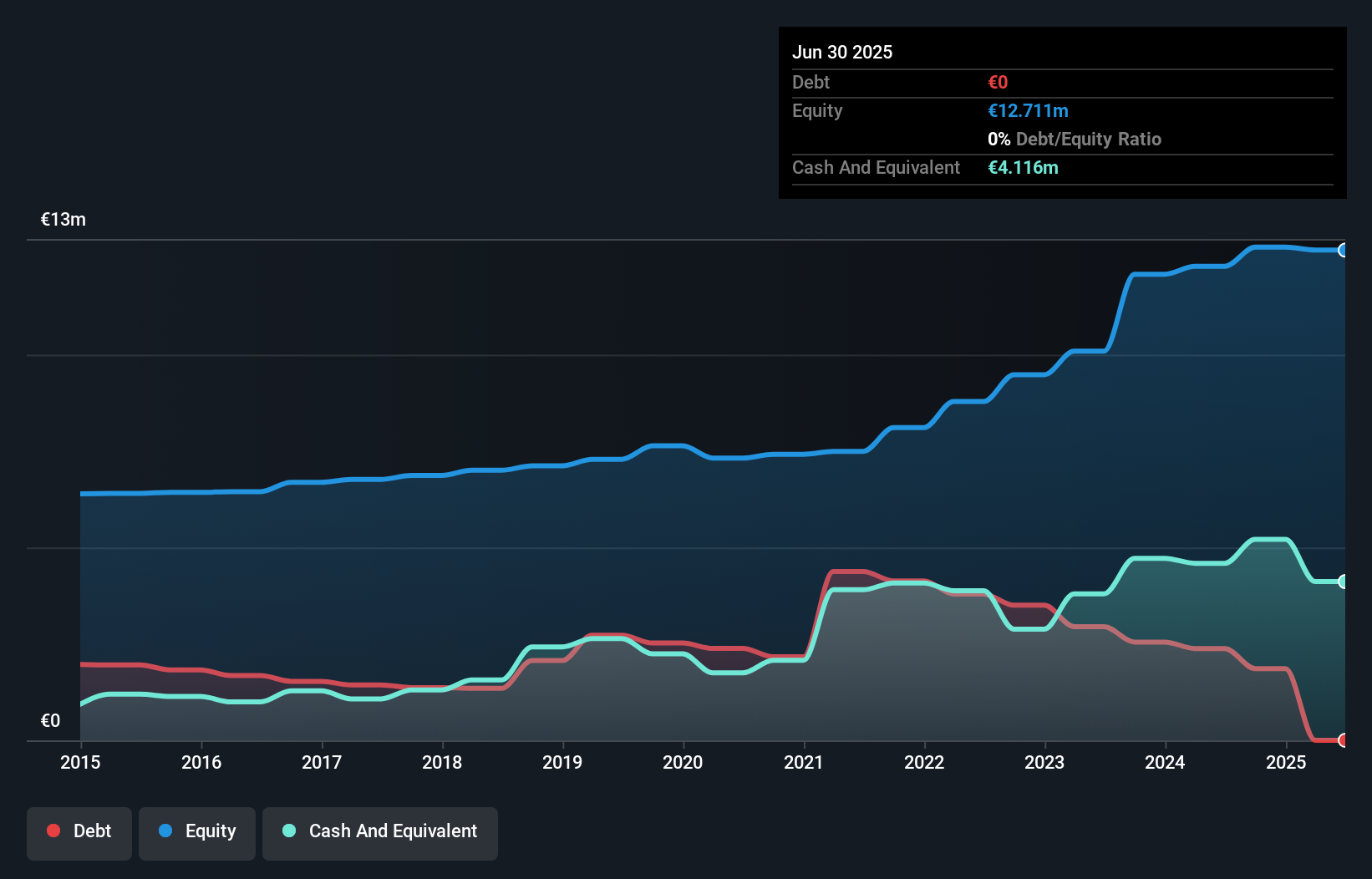

Planoptik AG, with a market cap of €20.33 million, primarily generates revenue from its Glass & Clay Products segment, totaling €11.94 million annually. Despite stable weekly volatility and being debt-free, the company reported a net loss of €0.04 million for the first half of 2025 compared to a profit last year. Its return on equity is low at 3.6%, and recent earnings growth has been negative despite significant past growth over five years. Short-term assets exceed liabilities comfortably; however, declining profit margins indicate challenges in maintaining profitability amid reaffirmed guidance for increased future sales and earnings.

- Click here to discover the nuances of Planoptik with our detailed analytical financial health report.

- Review our historical performance report to gain insights into Planoptik's track record.

Key Takeaways

- Get an in-depth perspective on all 275 European Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:FLEXM

Flexion Mobile

Operates game distribution platform for game developers worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives