The CEO of Eurocash S.A. (WSE:EUR) is Luis Manuel do Amaral, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Eurocash

Comparing Eurocash S.A.'s CEO Compensation With the industry

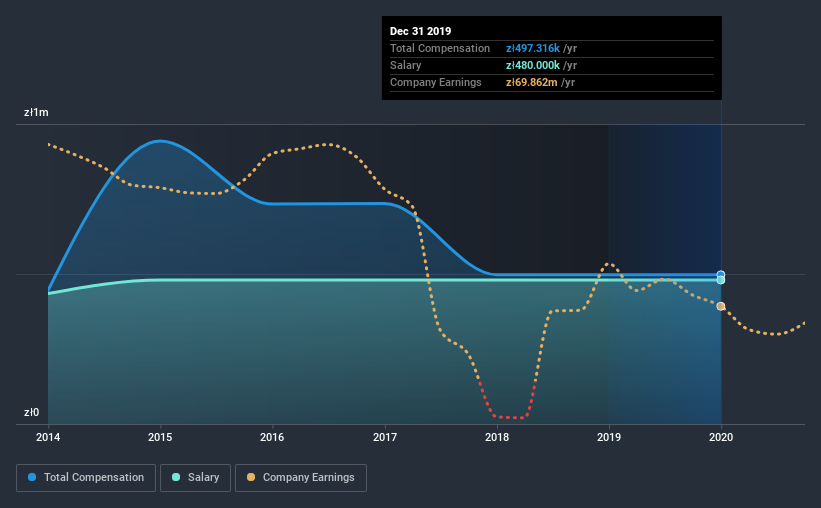

According to our data, Eurocash S.A. has a market capitalization of zł1.9b, and paid its CEO total annual compensation worth zł497k over the year to December 2019. That is, the compensation was roughly the same as last year. Notably, the salary which is zł480.0k, represents most of the total compensation being paid.

On comparing similar companies from the same industry with market caps ranging from zł739m to zł3.0b, we found that the median CEO total compensation was zł3.4m. Accordingly, Eurocash pays its CEO under the industry median. What's more, Luis Manuel do Amaral holds zł831m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | zł480k | zł480k | 97% |

| Other | zł17k | zł17k | 3% |

| Total Compensation | zł497k | zł497k | 100% |

Speaking on an industry level, nearly 39% of total compensation represents salary, while the remainder of 61% is other remuneration. Eurocash is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Eurocash S.A.'s Growth

Over the past three years, Eurocash S.A. has seen its earnings per share (EPS) grow by 30% per year. In the last year, its revenue is up 3.8%.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Eurocash S.A. Been A Good Investment?

Since shareholders would have lost about 44% over three years, some Eurocash S.A. investors would surely be feeling negative emotions. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

Eurocash pays its CEO a majority of compensation through a salary. As previously discussed, Luis Manuel is compensated less than what is normal for CEOs of companies of similar size, and which belong to the same industry. However we must not forget that the EPS growth has been very strong over three years. Considering EPS are on the up, we would say Luis Manuel is compensated fairly. But shareholders will likely want to hold off on any raise for Luis Manuel until investor returns are positive.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 2 warning signs for Eurocash (of which 1 is significant!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Eurocash, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eurocash might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About WSE:EUR

Eurocash

Engages in the wholesale distribution of food and other fast moving consumer goods (FMCG) in Poland.

Undervalued with moderate growth potential.