- Romania

- /

- Electric Utilities

- /

- BVB:TEL

Exploring CNTEE Transelectrica And 2 Other Hidden Small Cap Treasures In Europe

Reviewed by Simply Wall St

As European markets face renewed concerns over inflated AI stock valuations and the impact of shifting interest rate expectations, investors are increasingly seeking opportunities in smaller, less conspicuous companies that may offer untapped potential. In this context, identifying a good stock often involves looking beyond headline-grabbing sectors to find companies with solid fundamentals and growth prospects that can withstand broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Evergent Investments | 3.63% | 11.51% | 22.05% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

We'll examine a selection from our screener results.

CNTEE Transelectrica (BVB:TEL)

Simply Wall St Value Rating: ★★★★★★

Overview: CNTEE Transelectrica SA operates as the transmission and system operator for Romania's national power system, with a market capitalization of RON5.30 billion.

Operations: Transelectrica generates revenue primarily through its role as a transmission and system operator for Romania's national power system. The company's financial performance is reflected in its market capitalization of RON5.30 billion.

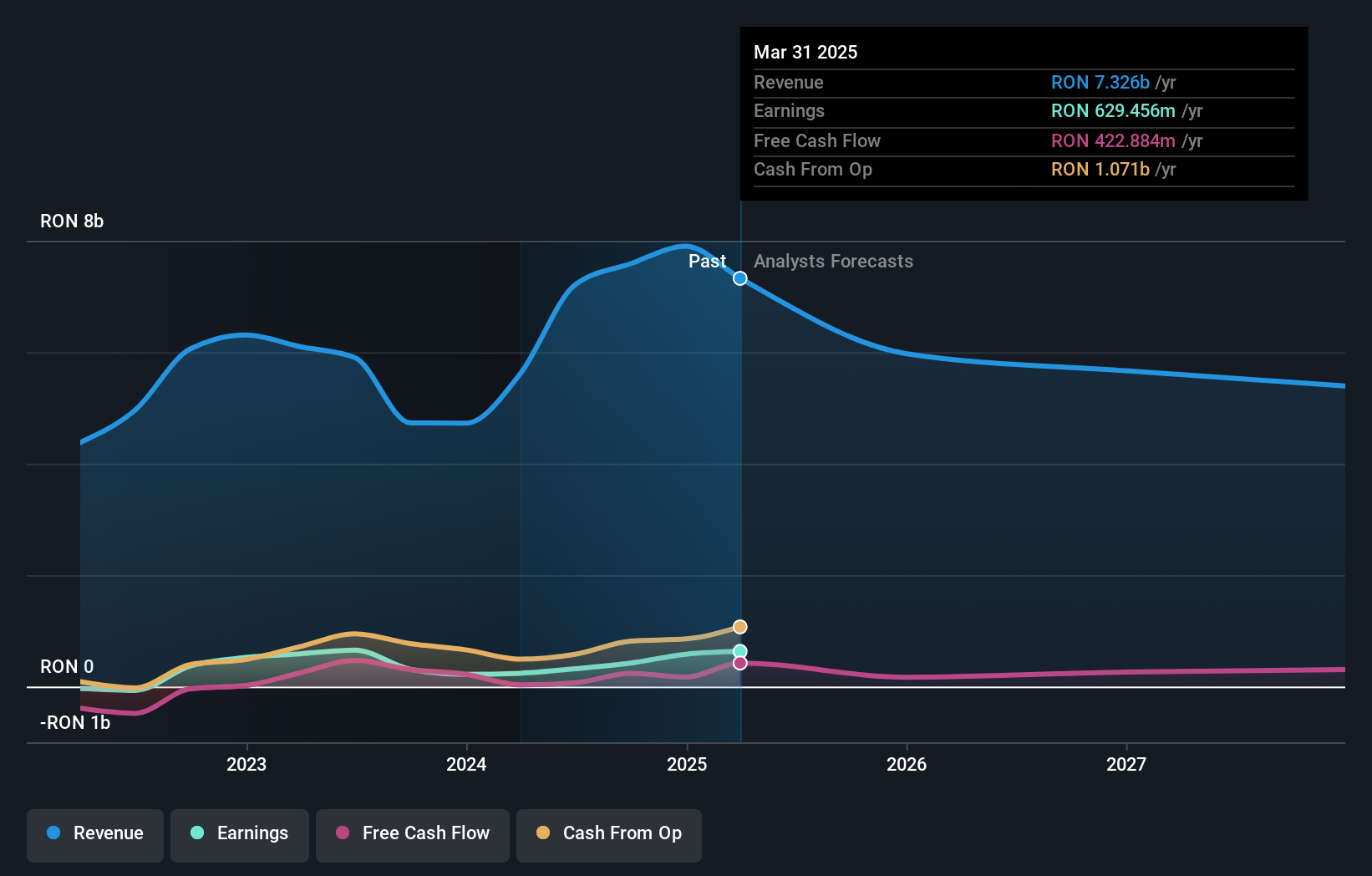

Transelectrica, a notable player in the European energy sector, has seen its debt to equity ratio drop significantly from 3.9 to 0.5 over five years, signaling improved financial stability. Despite a challenging year with earnings growth at -3.2% compared to the industry average of -1.5%, it remains well-positioned with interest payments covered by EBIT at 9.2 times, indicating robust operational efficiency. The company also boasts high-quality past earnings and is trading slightly below its estimated fair value by 1.9%. However, recent earnings reports show reduced sales and net income compared to last year, suggesting potential hurdles ahead.

- Navigate through the intricacies of CNTEE Transelectrica with our comprehensive health report here.

Assess CNTEE Transelectrica's past performance with our detailed historical performance reports.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Storytel AB (publ) is a company that offers streaming services for audiobooks and e-books, with a market capitalization of approximately SEK5.83 billion.

Operations: Storytel generates revenue primarily from its streaming services, which account for SEK3.48 billion, and its publishing segment, contributing SEK1.24 billion. The net profit margin is a key financial indicator to consider when evaluating the company's financial performance over time.

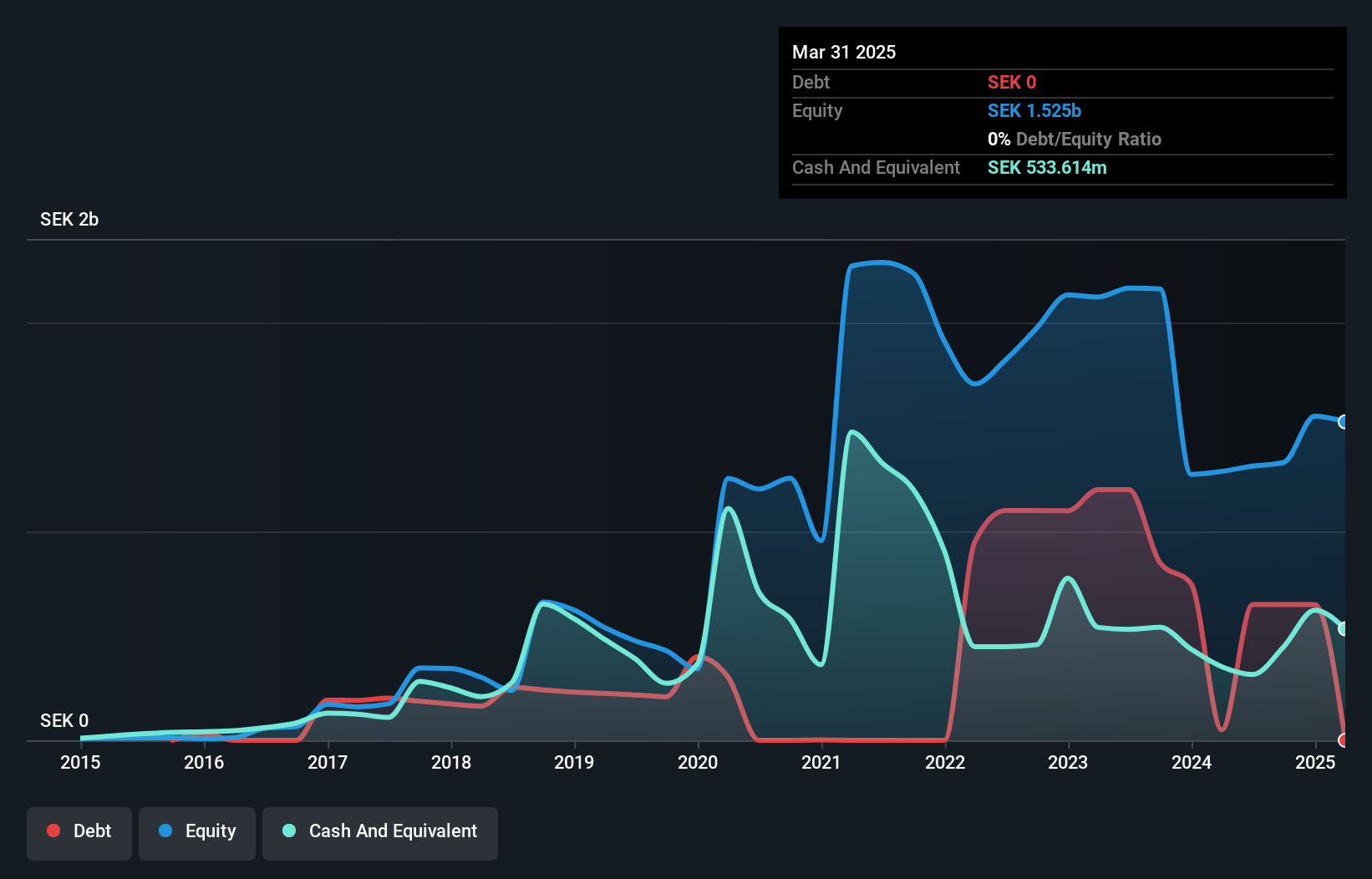

Storytel's recent performance highlights its growing influence in the audiobook and e-book streaming sector, marked by a significant rise in net income to SEK 131 million for Q3 2025, up from SEK 51 million last year. The company's strategic partnerships, like the one with Klarna, are expanding its reach across 14 markets, enhancing subscriber growth and content personalization. Storytel's debt management appears robust with a net debt to equity ratio of just 1.5%, while interest payments are well covered at 21 times by EBIT. Despite challenges such as competition from Spotify and market profitability concerns, Storytel is trading at an attractive valuation of nearly 78% below estimated fair value.

Mennica Polska (WSE:MNC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Mennica Polska S.A. is involved in the manufacture and distribution of minting and engraved medallist products both in Poland and internationally, with a market cap of PLN1.78 billion.

Operations: Mennica Polska's revenue is primarily derived from the production and distribution of minting and engraved medallist products. The company has experienced fluctuations in its net profit margin, which was last recorded at 8.5%.

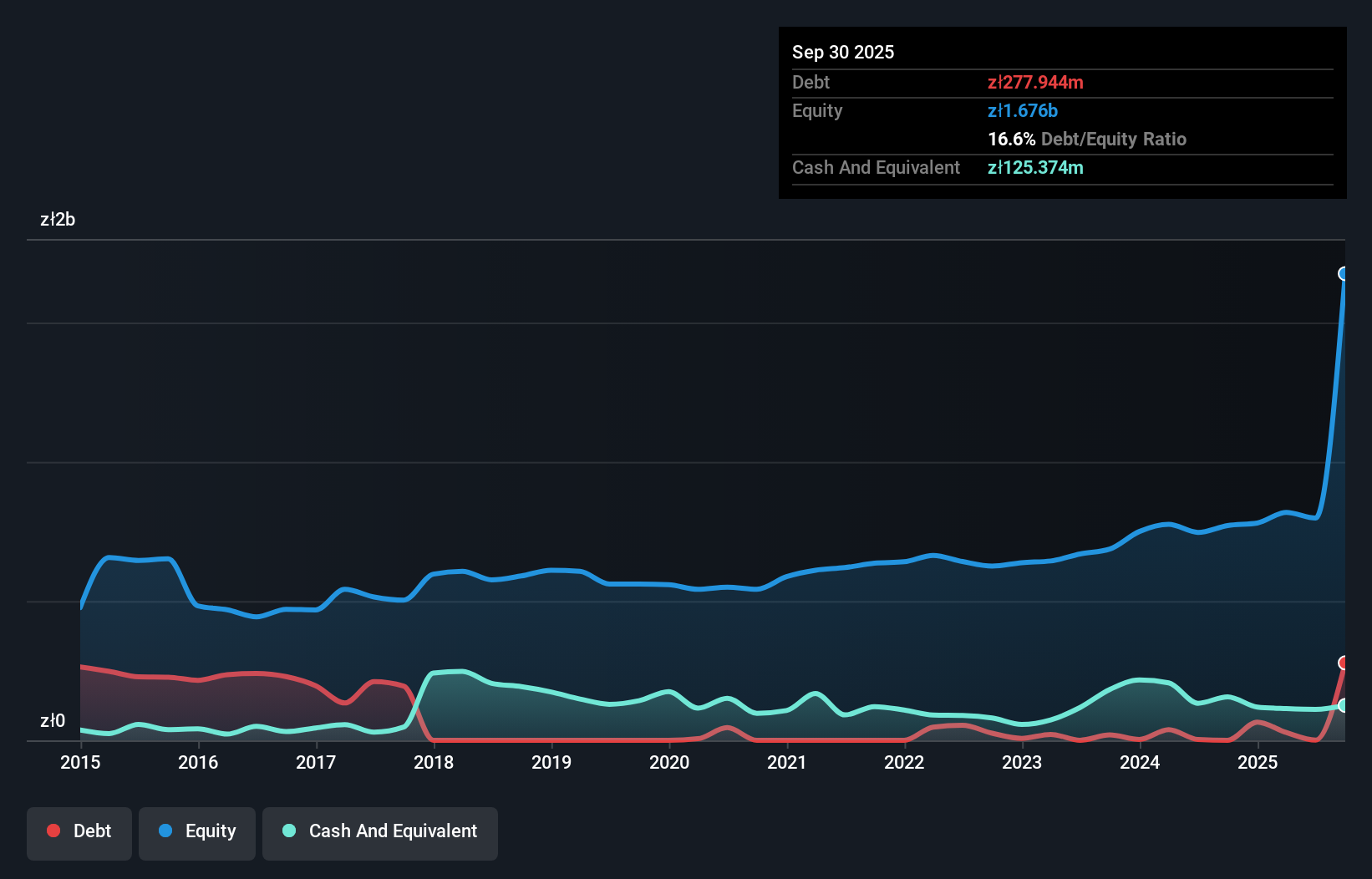

Mennica Polska, a smaller player in its industry, has shown impressive growth with earnings surging by 357% over the past year, outpacing the leisure sector's 1.7%. Trading at 67.8% below its estimated fair value suggests potential undervaluation. Over five years, debt to equity rose from zero to 16.6%, but a net debt to equity ratio of 9.1% remains satisfactory and interest payments are well covered at 7.6 times EBIT. Recent results highlighted robust performance with third-quarter sales reaching PLN420 million and net income soaring to PLN406 million from PLN25 million year-on-year, indicating strong operational momentum.

- Get an in-depth perspective on Mennica Polska's performance by reading our health report here.

Explore historical data to track Mennica Polska's performance over time in our Past section.

Turning Ideas Into Actions

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 311 more companies for you to explore.Click here to unveil our expertly curated list of 314 European Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:TEL

CNTEE Transelectrica

CNTEE Transelectrica SA acts as a transmission and system operator of the national power system.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.