Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Lentex S.A. (WSE:LTX) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Lentex

How Much Debt Does Lentex Carry?

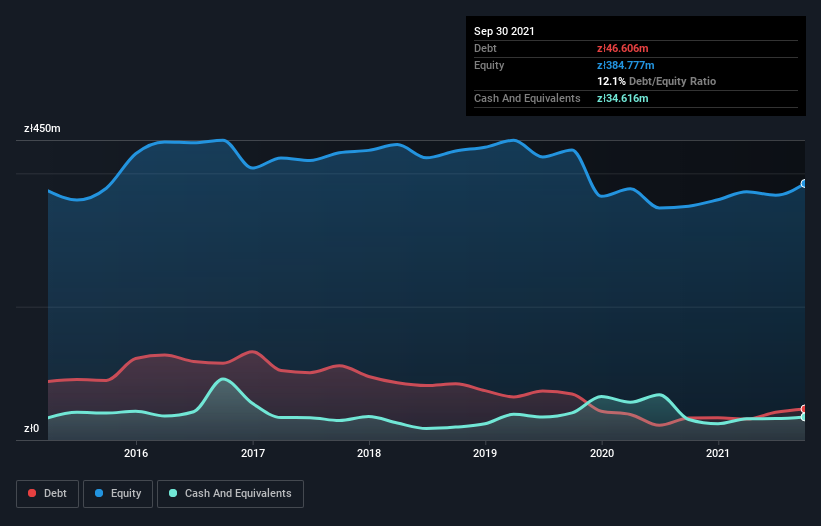

As you can see below, at the end of September 2021, Lentex had zł46.6m of debt, up from zł32.9m a year ago. Click the image for more detail. On the flip side, it has zł34.6m in cash leading to net debt of about zł12.0m.

How Strong Is Lentex's Balance Sheet?

According to the last reported balance sheet, Lentex had liabilities of zł105.0m due within 12 months, and liabilities of zł45.1m due beyond 12 months. Offsetting these obligations, it had cash of zł34.6m as well as receivables valued at zł71.1m due within 12 months. So its liabilities total zł44.4m more than the combination of its cash and short-term receivables.

Since publicly traded Lentex shares are worth a total of zł444.1m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Lentex has a low net debt to EBITDA ratio of only 0.17. And its EBIT easily covers its interest expense, being 63.0 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Another good sign is that Lentex has been able to increase its EBIT by 21% in twelve months, making it easier to pay down debt. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Lentex will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Lentex recorded free cash flow worth 80% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

The good news is that Lentex's demonstrated ability to cover its interest expense with its EBIT delights us like a fluffy puppy does a toddler. And the good news does not stop there, as its conversion of EBIT to free cash flow also supports that impression! Considering this range of factors, it seems to us that Lentex is quite prudent with its debt, and the risks seem well managed. So the balance sheet looks pretty healthy, to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Lentex (1 is potentially serious!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About WSE:LTX

Lentex

Manufactures and sells flexible PVC floor coverings for residential and commercial areas, and sports facilities in Poland and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives